Scalper1 News

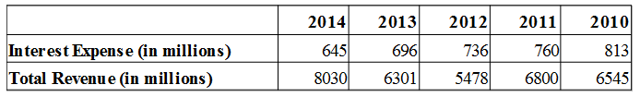

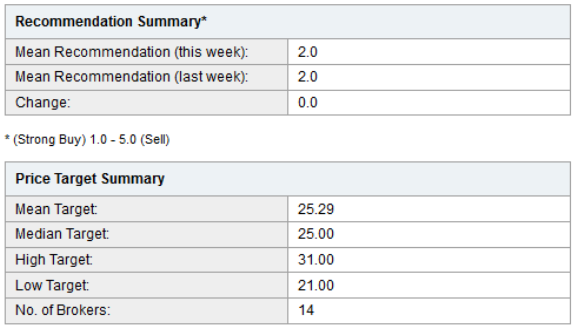

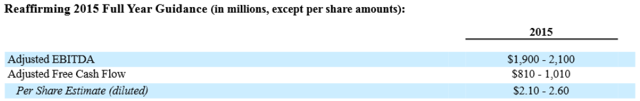

Summary Operates diversified, modern natural gas-fired power plants. Company pays no dividend yield, only share repurchases. Management exercises prudent control of debt and input costs. Calpine Corp. (NYSE: CPN ) has a portfolio (including partnership interest) of over 88 power plants generating in excess of 26,000 megawatts of power in North America, primarily in California, Texas, and the Eastern seaboard. As an added benefit, these are modern, clean energy plants using natural gas and geothermal to produce power, resulting in lower carbon emissions – 95% of the company’s power generation was done with natural gas. This marks it as an industry leader going forward as natural gas is expected to be a leading generator of power in the United States in the coming years, as coal continues its decline and natural gas is discovered in shale plays. While the company consumed 793 billion cubic feet of natural gas in 2014 (10% of all natural gas used for power generation), the EIA estimates the US has over 350 trillion cubic feet of proven natural gas reserves at the end of 2013. Prior Bankruptcy, Current Cost Control In 2005, Calpine filed for bankruptcy protection in one of the largest bankruptcies in US history as natural gas prices had soared, a new glut of competing power plants came online, and the company’s debt load of $22B became unmanageable due to poor structure. Calpine’s prior leadership team was poor and mismanaged the company in its debt and hedging practices. The company emerged from bankruptcy to begin trading again in 2008. I think it is important to note that the market today is much different than it was then – Calpine’s current outstanding debt is half of what it was, has been financed at lower interest rates, and the natural gas market has fundamentally changed. (click to enlarge) As noted, the company has done a great job in recent years of paying down and refinancing debt. Total interest expense has fallen from $813M in 2010 to $645M in 2014, a decrease of 20%, as total revenue has grown 22% in that same time frame. Long-Term Outlook, Coal to Gas Switching Depending on the fluctuating spot prices of coal and natural gas, power plants using one or the other frequently set the price of wholesale energy. Most often in the past decade, but as natural gas prices have fallen it has become more commonplace that natural gas sets the price. When this switching occurs, demand and total generation volumes increase for Calpine. If you look back to 2012 when this occurred often, you’ll find elevated levels of operating income. Forward markets for natural gas prices suggest this may happen again in 2015. Fundamentally, in the intermediate/long term, coal to gas switching may become even more prevalent as environmental regulations and political pressures force coal-fired power generation to reduce levels of pollutants like sulfur dioxide and nitrogen monoxide through expensive retrofits. Costs will increase for these market participants and natural gas power plants may overtake coal as the primary form of energy generation in the United States. Wait, No Dividend? Utilities are known for and sought out by income investors for the income that their dividend payouts provide. Retail investors frequently screen stocks by dividend yield and history to choose stocks. CPN does not pay one – but not for lack of profitability or cash flow. Thad Hill, CEO, stated in the Q4 2014 Earnings Release , 2014 wrapped up in a fine year for Calpine, we are proud to report adjusted EBITDA of $1.949 billion, adjusted free cash flow of $830 million and adjusted free cash flow per share of $2.03. So what gives? CPN provides returns to shareholders in the form of share buybacks solely. Thad Hill further states, Finally, we have continued to return money to our shareholders by completing $277 million of buyback since the last quarterly call in November. As our stock price moved down with the recent commodity price sell off, we took advantage of it and stepped up our share repurchase program. Since beginning the program in 2011, we have repurchased approximately 25% of our outstanding shares for $2.4 billion. $1.1B of those share repurchases have been done in the last year. Operating using a model of only share repurchases gives management added flexibility in deploying capital. Who better to know when the shares are undervalued than management? Or when that capital may best be used to fund a timely acquisition that has a greater expected NPV than through shareholder returns? Ownership/Short Interest CPN also has high institutional ownership (95%). This ratio is one of the highest I could find among utilities – only El Paso Electric (NYSE: EE ) and ITC Holdings (NYSE: ITC ) have higher rates, at 98.9% and 95.1%, respectively. Institutional ownership here is key – considering the vast amount of resources, talent, and research that these institutions provide their researchers, their investment decisions generally carry great weight with retail investors. In this case, retail investors have not followed, most likely due to the earlier highlighted issues of the lack of a dividend and prior bankruptcy. Analysts have a similar opinion to institutions. 75% of analysts rate the stock a strong buy/buy, with none rating it as underperform/sell. The average target price is $25.00 – nearly 20% upside from current prices. *Sourced from Yahoo! Finance Short interest in CPN (4% shares held short) is within the top quintile of utilities. Its short interest is similar to utilities that have no free cash flow or those with higher P/E ratios and lower growth prospects. Having no dividend is a double edged sword – no short wants to get stuck covering a dividend over ex-date, so short interest in the sector is usually mild even when the sector trades overvalued. The company’s lack of a dividend yield gives shorts the advantage of not being forced to cover at high prices before ex-date or feeling the sting of that negative dividend payment hit their account. 2015 Guidance (click to enlarge) The company guides $2.10-$2.60 a share in free cash flow/share – 3.5% increase over 2014 on the low end and 28% on the high end. This is forecast to be a record year in cash flow availability for the company, with plenty of available cash for repurchases and acquisitions. As of the February earnings release, the company had already repurchased $125M in shares in 2015 – on pace for another year of over $1B in repurchases – which would retire 12% of the float at the current share price. As the current share price sits below the average share price of repurchases in 2014, so I expect these buybacks to continue as management continues to believe current prices are an excellent investment opportunity. Conclusion A purchase in Calpine is a purchase of a company with a historical stigma and no steady income stream to shareholders. But it is also a purchase in a company that analysts and institutions have committed big to and one that is set to benefit strongly from a coming shift in energy production from coal to natural gas on the heels of the American resurgence of power in oil and natural gas production. I see fair value today at $26.00/share – more than 20% upside from current prices. Disclosure: The author is long CPN. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Operates diversified, modern natural gas-fired power plants. Company pays no dividend yield, only share repurchases. Management exercises prudent control of debt and input costs. Calpine Corp. (NYSE: CPN ) has a portfolio (including partnership interest) of over 88 power plants generating in excess of 26,000 megawatts of power in North America, primarily in California, Texas, and the Eastern seaboard. As an added benefit, these are modern, clean energy plants using natural gas and geothermal to produce power, resulting in lower carbon emissions – 95% of the company’s power generation was done with natural gas. This marks it as an industry leader going forward as natural gas is expected to be a leading generator of power in the United States in the coming years, as coal continues its decline and natural gas is discovered in shale plays. While the company consumed 793 billion cubic feet of natural gas in 2014 (10% of all natural gas used for power generation), the EIA estimates the US has over 350 trillion cubic feet of proven natural gas reserves at the end of 2013. Prior Bankruptcy, Current Cost Control In 2005, Calpine filed for bankruptcy protection in one of the largest bankruptcies in US history as natural gas prices had soared, a new glut of competing power plants came online, and the company’s debt load of $22B became unmanageable due to poor structure. Calpine’s prior leadership team was poor and mismanaged the company in its debt and hedging practices. The company emerged from bankruptcy to begin trading again in 2008. I think it is important to note that the market today is much different than it was then – Calpine’s current outstanding debt is half of what it was, has been financed at lower interest rates, and the natural gas market has fundamentally changed. (click to enlarge) As noted, the company has done a great job in recent years of paying down and refinancing debt. Total interest expense has fallen from $813M in 2010 to $645M in 2014, a decrease of 20%, as total revenue has grown 22% in that same time frame. Long-Term Outlook, Coal to Gas Switching Depending on the fluctuating spot prices of coal and natural gas, power plants using one or the other frequently set the price of wholesale energy. Most often in the past decade, but as natural gas prices have fallen it has become more commonplace that natural gas sets the price. When this switching occurs, demand and total generation volumes increase for Calpine. If you look back to 2012 when this occurred often, you’ll find elevated levels of operating income. Forward markets for natural gas prices suggest this may happen again in 2015. Fundamentally, in the intermediate/long term, coal to gas switching may become even more prevalent as environmental regulations and political pressures force coal-fired power generation to reduce levels of pollutants like sulfur dioxide and nitrogen monoxide through expensive retrofits. Costs will increase for these market participants and natural gas power plants may overtake coal as the primary form of energy generation in the United States. Wait, No Dividend? Utilities are known for and sought out by income investors for the income that their dividend payouts provide. Retail investors frequently screen stocks by dividend yield and history to choose stocks. CPN does not pay one – but not for lack of profitability or cash flow. Thad Hill, CEO, stated in the Q4 2014 Earnings Release , 2014 wrapped up in a fine year for Calpine, we are proud to report adjusted EBITDA of $1.949 billion, adjusted free cash flow of $830 million and adjusted free cash flow per share of $2.03. So what gives? CPN provides returns to shareholders in the form of share buybacks solely. Thad Hill further states, Finally, we have continued to return money to our shareholders by completing $277 million of buyback since the last quarterly call in November. As our stock price moved down with the recent commodity price sell off, we took advantage of it and stepped up our share repurchase program. Since beginning the program in 2011, we have repurchased approximately 25% of our outstanding shares for $2.4 billion. $1.1B of those share repurchases have been done in the last year. Operating using a model of only share repurchases gives management added flexibility in deploying capital. Who better to know when the shares are undervalued than management? Or when that capital may best be used to fund a timely acquisition that has a greater expected NPV than through shareholder returns? Ownership/Short Interest CPN also has high institutional ownership (95%). This ratio is one of the highest I could find among utilities – only El Paso Electric (NYSE: EE ) and ITC Holdings (NYSE: ITC ) have higher rates, at 98.9% and 95.1%, respectively. Institutional ownership here is key – considering the vast amount of resources, talent, and research that these institutions provide their researchers, their investment decisions generally carry great weight with retail investors. In this case, retail investors have not followed, most likely due to the earlier highlighted issues of the lack of a dividend and prior bankruptcy. Analysts have a similar opinion to institutions. 75% of analysts rate the stock a strong buy/buy, with none rating it as underperform/sell. The average target price is $25.00 – nearly 20% upside from current prices. *Sourced from Yahoo! Finance Short interest in CPN (4% shares held short) is within the top quintile of utilities. Its short interest is similar to utilities that have no free cash flow or those with higher P/E ratios and lower growth prospects. Having no dividend is a double edged sword – no short wants to get stuck covering a dividend over ex-date, so short interest in the sector is usually mild even when the sector trades overvalued. The company’s lack of a dividend yield gives shorts the advantage of not being forced to cover at high prices before ex-date or feeling the sting of that negative dividend payment hit their account. 2015 Guidance (click to enlarge) The company guides $2.10-$2.60 a share in free cash flow/share – 3.5% increase over 2014 on the low end and 28% on the high end. This is forecast to be a record year in cash flow availability for the company, with plenty of available cash for repurchases and acquisitions. As of the February earnings release, the company had already repurchased $125M in shares in 2015 – on pace for another year of over $1B in repurchases – which would retire 12% of the float at the current share price. As the current share price sits below the average share price of repurchases in 2014, so I expect these buybacks to continue as management continues to believe current prices are an excellent investment opportunity. Conclusion A purchase in Calpine is a purchase of a company with a historical stigma and no steady income stream to shareholders. But it is also a purchase in a company that analysts and institutions have committed big to and one that is set to benefit strongly from a coming shift in energy production from coal to natural gas on the heels of the American resurgence of power in oil and natural gas production. I see fair value today at $26.00/share – more than 20% upside from current prices. Disclosure: The author is long CPN. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News