Scalper1 News

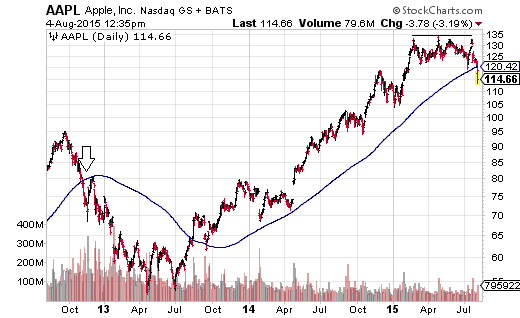

The last time Apple pulled back 10%-plus from its peak and fell below its 200-day trendline, the stock went on to lose 33% from that moment forward. In a market where the median U.S. stock sports its highest P/E and P/S ratios ever, Apple is a relative “bargain.” However, I am not particularly interested in writing about the merits of Apple as a buying opportunity. I am far more intrigued by discussing the hypocrisy of the buy-n-hold community. One of the media’s biggest financial stories this week involves the curious fall of Apple (NASDAQ: AAPL ). Specifically, the largest company in the world by market capitalization has entered correction territory – a 10%-plus fall from a high-water mark. Not surprisingly, few analysts have soured on shares of the culture changer. Even fewer are discussing the technical resistance near $133 per share let alone the drop below a 200-day moving average. The last time Apple pulled back 10%-plus from its peak and fell below its 200-day trendline, the stock went on to lose 33% from that moment forward. Obviously, history rarely repeats itself in identical fashion. What’s more, in a market where the median U.S. stock sports its highest P/E and P/S ratios ever, Apple is a relative “bargain.” Heck, Apple even offers an attractive dividend that you wouldn’t be able to count on from most companies in the white hot biotech space. On the other hand, I am not particularly interested in writing about the merits of Apple as a buying opportunity. On the contrary. I am far more intrigued by discussing the hypocrisy of the buy-n-hold community. In particular, “don’t try to time the market” pretenders are the first in line to discuss the benefits of buying Apple as it trades at a 10% price discount from its highs. If you’re a buyer of stock at a particular time at a specific price, you are timing the market. If you rebalance when you perceive your allocation is out of whack, you are a market timer as well. You are selling some assets at one price and buying other assets at another price. There’s also the hold-n-hope claim that one sticks to his/her asset allocation mix through thin and thick. If that is so, then where does the 60%-40% stock-bond asset allocator suddenly have more cash to buy more Apple shares? Retirees with rollovers sure wouldn’t have it from work income. Even for the buy-n-hold asset allocator who claims he would use the income from dividends and interest or “work” to buy more Apple is being disingenuous. If you have no intention of timing the market, all of the monies would be reinvested immediately; you would not be waiting for an opportunity. The whole idea of a buying opportunity is, by definition, a market timing endeavor. And yet, people only scream bloody murder about market timing when someone suggests selling assets . It does not matter if you adhere to fundamental rules (e.g., extreme overvaluation versus undervaluation) and technical trends (e.g., deteriorating breadth/market internals versus improving breadth/market internals). When the stock market is on a six-year bull run, anything that resembles risk reduction is regularly panned. My tactical asset allocation strategy for reducing exposure to riskier assets involves reducing (not eliminating) exposure to riskier assets when valuations are hitting extremes, technical internals are deteriorating and economic indicators are weakening. When valuations are fair, internals are improving and economic signs are strengthening, we raise exposure to riskier assets back to a client’s target mix. Market timing? Sure, in the same way that opportunistic rebalancing activity and opportunistic efforts to buy quality stocks like Apple at lower prices fit the bill. Indeed, the staunchest advocates of buying-n-holding, including the wonderfully talented Warren Buffett, have a plan for when and what to buy and when and what to sell. Mr. Buffett’s decision to sell all of his Exxon Mobil (NYSE: XOM ) shares in the wintertime demonstrated that there are opportunities to reduce perceived risks, just as others may view the acquisition of more Apple shares today as sensible risk. Just be honest, Mr. Buy-the-Apple-Dip Advocate. Your attempt to acquire shares of Apple at a 10% price discount today is an effort to time the market for when to acquire more of the stock. And more power to you! However, let’s imagine that I dared to opine that overall risks in the stock market are exorbitantly high. And that I put forward a notion that if Apple represented 15% of a portfolio, perhaps one might wish to reduce the exposure to 7.5%. (Remember, I am asking one to imagine this proposition.) Immediately, there would be calls for my “market timing” head. The mere suggestion of selling or rebalancing based on fundamental, economic and technical analysis would be deemed blasphemous. Not surprisingly, the loudest screams about the evils of market timing come during the height of bull market euphoria. Ironically, near the lowest ebb of bear market distress – whether it is with individual shares of Apple (10/2012-7/2013) or with broad market benchmarks like the S&P 500 (e.g., 2000-2002, 2007-2009, etc.), those screams turn to whimpers. The facts that I have been presenting for several months still remain. The U.S. economy has been showing signs of strain, regularly missing expectations and estimates. Corporate revenue has now declined year-over-year for two consecutive quarters, pushing valuations on stocks to higher extremes. Meanwhile, market breadth has shown no signs of recovering since May, when the S&P 500 Bullish Percentage Index straddled 75% (today closer to 50%) and the NYSE Advance Decline (A/D) Line hit its last peak. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

The last time Apple pulled back 10%-plus from its peak and fell below its 200-day trendline, the stock went on to lose 33% from that moment forward. In a market where the median U.S. stock sports its highest P/E and P/S ratios ever, Apple is a relative “bargain.” However, I am not particularly interested in writing about the merits of Apple as a buying opportunity. I am far more intrigued by discussing the hypocrisy of the buy-n-hold community. One of the media’s biggest financial stories this week involves the curious fall of Apple (NASDAQ: AAPL ). Specifically, the largest company in the world by market capitalization has entered correction territory – a 10%-plus fall from a high-water mark. Not surprisingly, few analysts have soured on shares of the culture changer. Even fewer are discussing the technical resistance near $133 per share let alone the drop below a 200-day moving average. The last time Apple pulled back 10%-plus from its peak and fell below its 200-day trendline, the stock went on to lose 33% from that moment forward. Obviously, history rarely repeats itself in identical fashion. What’s more, in a market where the median U.S. stock sports its highest P/E and P/S ratios ever, Apple is a relative “bargain.” Heck, Apple even offers an attractive dividend that you wouldn’t be able to count on from most companies in the white hot biotech space. On the other hand, I am not particularly interested in writing about the merits of Apple as a buying opportunity. On the contrary. I am far more intrigued by discussing the hypocrisy of the buy-n-hold community. In particular, “don’t try to time the market” pretenders are the first in line to discuss the benefits of buying Apple as it trades at a 10% price discount from its highs. If you’re a buyer of stock at a particular time at a specific price, you are timing the market. If you rebalance when you perceive your allocation is out of whack, you are a market timer as well. You are selling some assets at one price and buying other assets at another price. There’s also the hold-n-hope claim that one sticks to his/her asset allocation mix through thin and thick. If that is so, then where does the 60%-40% stock-bond asset allocator suddenly have more cash to buy more Apple shares? Retirees with rollovers sure wouldn’t have it from work income. Even for the buy-n-hold asset allocator who claims he would use the income from dividends and interest or “work” to buy more Apple is being disingenuous. If you have no intention of timing the market, all of the monies would be reinvested immediately; you would not be waiting for an opportunity. The whole idea of a buying opportunity is, by definition, a market timing endeavor. And yet, people only scream bloody murder about market timing when someone suggests selling assets . It does not matter if you adhere to fundamental rules (e.g., extreme overvaluation versus undervaluation) and technical trends (e.g., deteriorating breadth/market internals versus improving breadth/market internals). When the stock market is on a six-year bull run, anything that resembles risk reduction is regularly panned. My tactical asset allocation strategy for reducing exposure to riskier assets involves reducing (not eliminating) exposure to riskier assets when valuations are hitting extremes, technical internals are deteriorating and economic indicators are weakening. When valuations are fair, internals are improving and economic signs are strengthening, we raise exposure to riskier assets back to a client’s target mix. Market timing? Sure, in the same way that opportunistic rebalancing activity and opportunistic efforts to buy quality stocks like Apple at lower prices fit the bill. Indeed, the staunchest advocates of buying-n-holding, including the wonderfully talented Warren Buffett, have a plan for when and what to buy and when and what to sell. Mr. Buffett’s decision to sell all of his Exxon Mobil (NYSE: XOM ) shares in the wintertime demonstrated that there are opportunities to reduce perceived risks, just as others may view the acquisition of more Apple shares today as sensible risk. Just be honest, Mr. Buy-the-Apple-Dip Advocate. Your attempt to acquire shares of Apple at a 10% price discount today is an effort to time the market for when to acquire more of the stock. And more power to you! However, let’s imagine that I dared to opine that overall risks in the stock market are exorbitantly high. And that I put forward a notion that if Apple represented 15% of a portfolio, perhaps one might wish to reduce the exposure to 7.5%. (Remember, I am asking one to imagine this proposition.) Immediately, there would be calls for my “market timing” head. The mere suggestion of selling or rebalancing based on fundamental, economic and technical analysis would be deemed blasphemous. Not surprisingly, the loudest screams about the evils of market timing come during the height of bull market euphoria. Ironically, near the lowest ebb of bear market distress – whether it is with individual shares of Apple (10/2012-7/2013) or with broad market benchmarks like the S&P 500 (e.g., 2000-2002, 2007-2009, etc.), those screams turn to whimpers. The facts that I have been presenting for several months still remain. The U.S. economy has been showing signs of strain, regularly missing expectations and estimates. Corporate revenue has now declined year-over-year for two consecutive quarters, pushing valuations on stocks to higher extremes. Meanwhile, market breadth has shown no signs of recovering since May, when the S&P 500 Bullish Percentage Index straddled 75% (today closer to 50%) and the NYSE Advance Decline (A/D) Line hit its last peak. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

Scalper1 News