Deere & Company (DE) is sounding optimistic as its non-agriculture business appears to be rebounding. This Zacks Rank #1 (Strong Buy) raised guidance for 2017.

For 175 years, Deere has manufactured agriculture, construction and forestry equipment. Headquartered in Illinois, it now has worldwide operations.

Another Beat in Fiscal Q1

On Feb 17, Deere reported its fiscal first quarter 2017 results and beat the Zacks Consensus Estimate again. It reported $ 0.61 versus the consensus of $ 0.50.

Despite the weakness in the agriculture sector, the company hasn’t missed on earnings since 2013. That’s an impressive streak.

Sales in the quarter fell 1%, while equipment net sales in the US and Canada decreased 8%. Outside of the US, net sales rose 11%, with a favorable currency-translation effect of 1%.

The company’s been cutting costs aggressively during this agriculture downturn and that will make for a lean, mean fighting machine once agriculture’s fortunes rise.

Outlook for 2017 Improving in Construction and Forestry

Everyone knows the pain in the agriculture sector. Low crop prices mean less income for farmers so there are less equipment sales.

For 2017, Deere forecasts agriculture and turf equipment sales to rise by about 3%. Industry sales for agriculture equipment in the US and Canada are forecast to be down 5% to 10% for the year as crop prices remain weak.

But many in the industry believe that 2017 could be the bottom of the weak agriculture cycle.

Construction & Forestry is where the optimism reigns. Deere sees worldwide sales up about 7%, reflecting moderate economic growth worldwide.

Earnings Estimates on the Rise

Deere raised its full year forecast moderately, which resulted in the analysts doing the same.

Suddenly, things don’t look so dire at the equipment makers.

4 estimates were raised for 2017 which pushed up the Zacks Consensus Estimate to $ 4.67 from $ 4.40 just 7 days ago.

But even with the optimism, it’s important to look at what has happened to Deere’s earnings over the last 5 years. This looks like it could be the bottoming though.

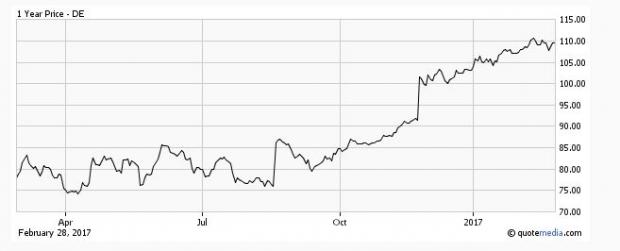

Is the Deere Rally Overdone?

Since the Nov 9 election, shares of Deere, along with the other construction stocks, have soared.

Deere now trades with a forward P/E of 23. That’s certainly not cheap.

Investors do get a dividend, paying 2.2%.

For investors looking for a play on the rebound in the agriculture sector, plus a play on the possible infrastructure build-out in the United States, Deere might be one to keep on the short list.

Want to see all of today’s Strong Buys?

Today’s Bull of the Day is just one of 220 Zacks Rank #1 stocks. Right now the full, up-to-the-minute list is available to you free of charge. There is no better place to start your own stock search. Plus you can access the full list of Zacks Strong Sells and a lot more of our private research.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deere & Company (DE): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International