Scalper1 News

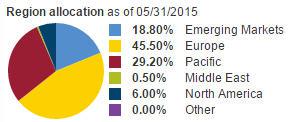

Summary Every ETF investor needs to consider what holdings will form the very core of their portfolio. For the portion relating to foreign stocks, the Vanguard FTSE All-World ex-US ETF is a compelling choice. Also discussed are reasons every investor should consider holding foreign stocks in their portfolio, along with links to additional background reading for those who desire such. For my first articles for Seeking Alpha, I decided to start simple: tackling the question of building a solid core portfolio using ETFs offered by Vanguard Funds. I started with domestic stocks featuring the Vanguard Total Stock Market ETF (NYSEARCA: VTI ), followed by domestic bonds featuring the Vanguard Total Bond Market ETF (NYSEARCA: BND ). As can quickly be discerned, however, both of the above options relate to U.S.-centric investments. For their portfolio to be complete, investors should also seriously consider going beyond the borders of the U.S. and into the world of foreign equities. For your first venture into this brave world, the Vanguard FTSE All-World ex-US ETF (NYSEARCA: VEU ) makes an excellent choice. Why Foreign? Why Now? For an overview of the risks and benefits of investing in foreign stocks, I offer this article from my personal blog. It offers a relatively brief, yet comprehensive overview, supported by links to further reading if desired. Essentially, what you will read there is that foreign stocks offer two potential benefits, growth and diversification . Hopefully, this material will answer that first question, Why Foreign? But what about that second question, Why Now? I hope to write about the concept of rebalancing one’s portfolio in a future article. But for now, let me just say that a key to good portfolio management is to “sell high and buy low;” in other words, to take a certain portion of your investments out of asset classes that have outperformed and put them to work in asset classes that have underperformed. With that in mind, have a look at the graph below. It compares Vanguard’s VTI (Domestic Stocks) with the ETF featured in this article, VEU, since VEU’s inception on March 2, 2007: VEU data by YCharts Do you notice anything interesting about that chart? I thought you might. After a period of relatively similar performance between roughly 2007 and 2012, U.S. stocks have outperformed their foreign brethren by a fairly significant margin. Further, foreign stocks have been roughly flat over the roughly 8-year span covered by the chart, while U.S. stocks have risen almost 60%. Let me be clear, there have doubtless been good reasons for this. While the U.S. economy has struggled, in particular since 2008, other countries have done even worse. Further, I am in no way predicting that foreign stocks will outperform their U.S. brethren moving forward. I don’t have a crystal ball. However, based on an analysis similar to this that I performed approximately two months ago, I decided to lower my personal weighting in U.S. stocks by 2.5% and shift those funds to foreign stocks. Certainly, this is no dramatic move. I simply decided that I wished to take a little from the asset class that had experienced significant gains and move it to the class that had been flat. With that big picture background, let’s now turn to the composition of VEU, as well as the expense ratio. Composition VEU is named well (Vanguard FTSE All-World ex-US ) because, as it happens, that is the name of the index it tracks. As such, VEU offers incredibly broad and diversified foreign exposure. As of the latest factsheet , we find that VEU actually contains a slightly greater number of securities than the index, 2,492 vs. 2,377. Let’s look a little closer. First, here is the fund’s geographic allocation: As you can see, the fund leans heavily toward developed markets such as Europe and the Pacific (Asia). At the same time, it offers reasonable exposure to emerging markets; those whose economies are not as fully developed and therefore offer greater potential for growth, albeit with a greater level of risk. If you back out the 18.8% in emerging markets, you quickly realize that 81.2% of the fund is invested in what are generally considered developed markets. Diving in a little more specifically, here are the Top 10 countries represented in the fund. If you add up the numbers, you will see that these countries comprise 73.4% of the total. Of these, China is the only country included in the Vanguard FTSE Emerging Markets ETF (NYSEARCA: VWO ). Let’s now take a look at one last perspective, the Top 10 holdings: To give you some small sense of the sorts of companies that constitute the largest portions of the fund, here are extremely brief synopses of the Top two; Nestle SA ( OTCPK:NSRGY ) and Novartis AG (NYSE: NVS ): Nestle SA – Nestle is the largest food company in the world , measured by revenues. Encompassing baby food, bottled water, coffee & tea, dairy products, frozen food, pet food, snacks and more. The list of brands is made up of legendary names that you will instantly recognize, and Wikipedia states that 29 of these brands each have annual sales of over $1 billion. The company operates in 197 countries, with factories in 86 countries. Novartis AG – Novartis is the largest pharmaceutical company in the world , measured by revenues. According to its latest annual report , Novartis’ products are available in more than 180 countries worldwide. Its pharmaceuticals arm has 135 projects in development, its subsidiary Alcon is the #1 eye care company worldwide, and its subsidiary Sandoz is the #2 global provider of generic medicines. Looked at from any of these vantage points, I submit that VEU is a wonderful core holding for the foreign, or international, component of your portfolio. Costs and Expenses At 0.14%, VEU’s expense ratio is somewhat higher than that of either VTI or BND, the other two ETFs I have featured. And yet, it too is one of the lowest in the industry. Bear in mind, this is an ETF that is dealing with assets all over the world, across different stock exchanges and the like. To that, of course, you have to add your trading commissions. Vanguard offers its own ETFs commission-free, and TD Ameritrade offers a decent selection of commission-free Vanguard ETFs. Suitability As a core holding, VEU is suitable for all portfolios. While I do believe that all investors should hold at least some portion of their portfolio in foreign stocks, I understand that you must do so at a level at which you are comfortable. Alternatives Another ETF worth considering, particularly if your brokerage offers it commission-free, is the iShares Core MCSI Total International Stock ETF (NYSEARCA: IXUS ). It too sports a very competitive 0.14% expense ratio, and covers basically the same range of countries, including emerging markets, as does VEU. The ETF’s size, as well as its average trading volume, is substantially smaller than VEU, but I do not believe this should be any impediment. As a Fidelity client, I use VEU for my core position and IXUS, which I can trade commission-free, for small incremental investments and/or to adjust portfolio weightings. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I am/we are long BND, IXUS, VEU, VTI, VWO. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal. Scalper1 News

Summary Every ETF investor needs to consider what holdings will form the very core of their portfolio. For the portion relating to foreign stocks, the Vanguard FTSE All-World ex-US ETF is a compelling choice. Also discussed are reasons every investor should consider holding foreign stocks in their portfolio, along with links to additional background reading for those who desire such. For my first articles for Seeking Alpha, I decided to start simple: tackling the question of building a solid core portfolio using ETFs offered by Vanguard Funds. I started with domestic stocks featuring the Vanguard Total Stock Market ETF (NYSEARCA: VTI ), followed by domestic bonds featuring the Vanguard Total Bond Market ETF (NYSEARCA: BND ). As can quickly be discerned, however, both of the above options relate to U.S.-centric investments. For their portfolio to be complete, investors should also seriously consider going beyond the borders of the U.S. and into the world of foreign equities. For your first venture into this brave world, the Vanguard FTSE All-World ex-US ETF (NYSEARCA: VEU ) makes an excellent choice. Why Foreign? Why Now? For an overview of the risks and benefits of investing in foreign stocks, I offer this article from my personal blog. It offers a relatively brief, yet comprehensive overview, supported by links to further reading if desired. Essentially, what you will read there is that foreign stocks offer two potential benefits, growth and diversification . Hopefully, this material will answer that first question, Why Foreign? But what about that second question, Why Now? I hope to write about the concept of rebalancing one’s portfolio in a future article. But for now, let me just say that a key to good portfolio management is to “sell high and buy low;” in other words, to take a certain portion of your investments out of asset classes that have outperformed and put them to work in asset classes that have underperformed. With that in mind, have a look at the graph below. It compares Vanguard’s VTI (Domestic Stocks) with the ETF featured in this article, VEU, since VEU’s inception on March 2, 2007: VEU data by YCharts Do you notice anything interesting about that chart? I thought you might. After a period of relatively similar performance between roughly 2007 and 2012, U.S. stocks have outperformed their foreign brethren by a fairly significant margin. Further, foreign stocks have been roughly flat over the roughly 8-year span covered by the chart, while U.S. stocks have risen almost 60%. Let me be clear, there have doubtless been good reasons for this. While the U.S. economy has struggled, in particular since 2008, other countries have done even worse. Further, I am in no way predicting that foreign stocks will outperform their U.S. brethren moving forward. I don’t have a crystal ball. However, based on an analysis similar to this that I performed approximately two months ago, I decided to lower my personal weighting in U.S. stocks by 2.5% and shift those funds to foreign stocks. Certainly, this is no dramatic move. I simply decided that I wished to take a little from the asset class that had experienced significant gains and move it to the class that had been flat. With that big picture background, let’s now turn to the composition of VEU, as well as the expense ratio. Composition VEU is named well (Vanguard FTSE All-World ex-US ) because, as it happens, that is the name of the index it tracks. As such, VEU offers incredibly broad and diversified foreign exposure. As of the latest factsheet , we find that VEU actually contains a slightly greater number of securities than the index, 2,492 vs. 2,377. Let’s look a little closer. First, here is the fund’s geographic allocation: As you can see, the fund leans heavily toward developed markets such as Europe and the Pacific (Asia). At the same time, it offers reasonable exposure to emerging markets; those whose economies are not as fully developed and therefore offer greater potential for growth, albeit with a greater level of risk. If you back out the 18.8% in emerging markets, you quickly realize that 81.2% of the fund is invested in what are generally considered developed markets. Diving in a little more specifically, here are the Top 10 countries represented in the fund. If you add up the numbers, you will see that these countries comprise 73.4% of the total. Of these, China is the only country included in the Vanguard FTSE Emerging Markets ETF (NYSEARCA: VWO ). Let’s now take a look at one last perspective, the Top 10 holdings: To give you some small sense of the sorts of companies that constitute the largest portions of the fund, here are extremely brief synopses of the Top two; Nestle SA ( OTCPK:NSRGY ) and Novartis AG (NYSE: NVS ): Nestle SA – Nestle is the largest food company in the world , measured by revenues. Encompassing baby food, bottled water, coffee & tea, dairy products, frozen food, pet food, snacks and more. The list of brands is made up of legendary names that you will instantly recognize, and Wikipedia states that 29 of these brands each have annual sales of over $1 billion. The company operates in 197 countries, with factories in 86 countries. Novartis AG – Novartis is the largest pharmaceutical company in the world , measured by revenues. According to its latest annual report , Novartis’ products are available in more than 180 countries worldwide. Its pharmaceuticals arm has 135 projects in development, its subsidiary Alcon is the #1 eye care company worldwide, and its subsidiary Sandoz is the #2 global provider of generic medicines. Looked at from any of these vantage points, I submit that VEU is a wonderful core holding for the foreign, or international, component of your portfolio. Costs and Expenses At 0.14%, VEU’s expense ratio is somewhat higher than that of either VTI or BND, the other two ETFs I have featured. And yet, it too is one of the lowest in the industry. Bear in mind, this is an ETF that is dealing with assets all over the world, across different stock exchanges and the like. To that, of course, you have to add your trading commissions. Vanguard offers its own ETFs commission-free, and TD Ameritrade offers a decent selection of commission-free Vanguard ETFs. Suitability As a core holding, VEU is suitable for all portfolios. While I do believe that all investors should hold at least some portion of their portfolio in foreign stocks, I understand that you must do so at a level at which you are comfortable. Alternatives Another ETF worth considering, particularly if your brokerage offers it commission-free, is the iShares Core MCSI Total International Stock ETF (NYSEARCA: IXUS ). It too sports a very competitive 0.14% expense ratio, and covers basically the same range of countries, including emerging markets, as does VEU. The ETF’s size, as well as its average trading volume, is substantially smaller than VEU, but I do not believe this should be any impediment. As a Fidelity client, I use VEU for my core position and IXUS, which I can trade commission-free, for small incremental investments and/or to adjust portfolio weightings. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I am/we are long BND, IXUS, VEU, VTI, VWO. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal. Scalper1 News

Scalper1 News