Scalper1 News

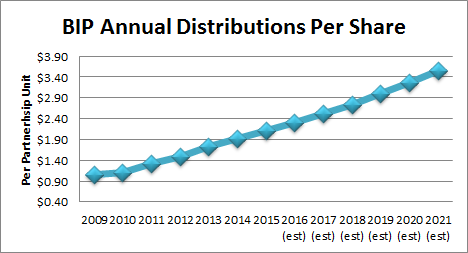

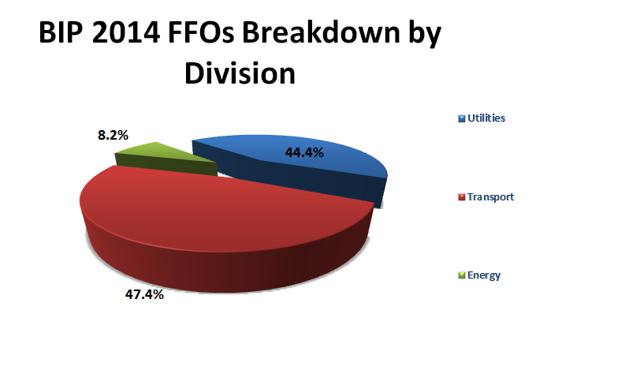

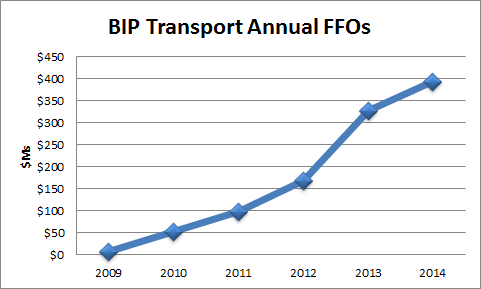

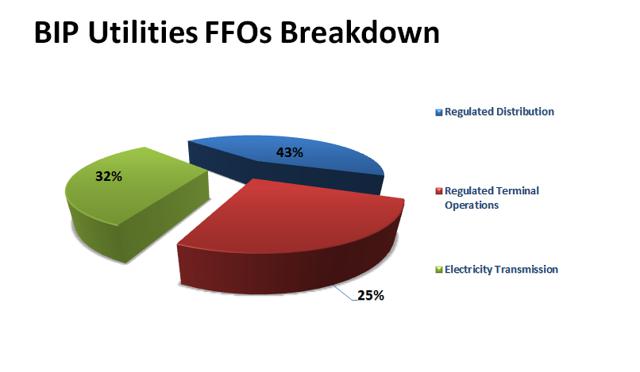

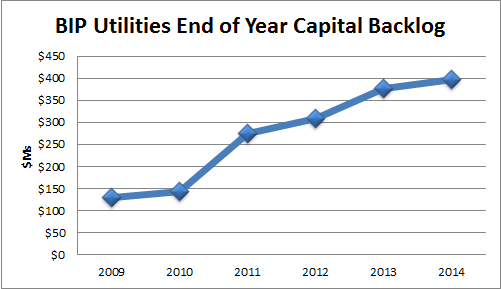

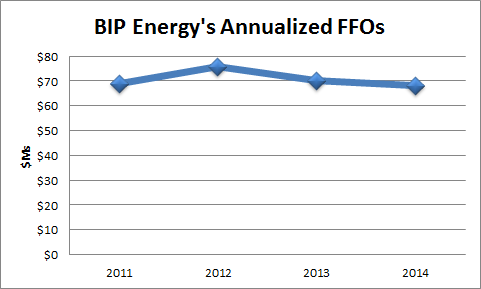

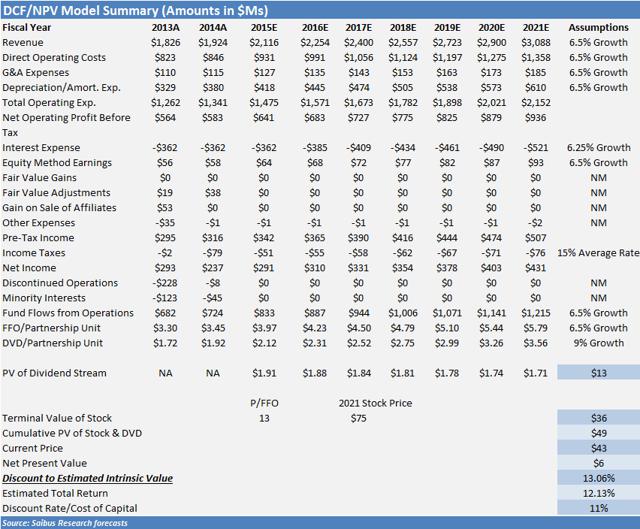

Summary BIP recently increased its dividend by 10% and now sports a 5% dividend yield. We believe BIP’s long-term dividend growth rate is 9%, up from 7% in our previous report. BIP’s shares are still 13% below its fair intrinsic value and we expect its intrinsic value to steadily increase as BIP steadily grows its FFOs per share. BIP’s disciplined approach to investing and its ability to continually identify new investment opportunities. We expect 15% FFO/share growth in 2015 and at least 6.5% growth thereafter. Brookfield Infrastructure Partners (NYSE: BIP ) recently announced it increased its dividend distribution by 10%. Although it was lower than our previous single year dividend growth in 2015, it was higher than our previous 7% estimated long-term dividend growth rate. BIP’s dividend increased by 13% annually since its 2008 IPO and BIP expects its long-run dividend growth rate will be 5%-9%. We believe that future dividend growth will be closer to the higher end of its forecasted range as it offers strong, steadily growing cash flow funds from its operations, which enables BIP to provide investors with strong dividend yields and dividend growth. BIP offers investors a 5% dividend yield and we believe its share price is 13% undervalued relative to its fair intrinsic value. For these reasons, we reiterate investors accumulate shares in BIP, especially income-oriented investors as BIP continues its consistent performance . Source: BIP’s Investor Relations and Our Estimates Companywide Highlights: BIP’s Q4 2014 FFOs/unit was $.86, slightly missing analyst expectations for the fourth time in the last 5 quarters but increasing by 3.6% versus Q4 2013. Key drivers of this performance were as follows Incremental contributions from the mid-August close of its investment in Vale’s cargo transportation division VLI, Improved volumes at its UK ports and Australian railroads, Soft volume demand from its North American energy transmission businesses due to mild weather and The absence of incremental contributions from its former Australasian regulated distribution operations, which BIP sold last November. Source: BIP’s Q4 2014 Report Business Segment Highlights: BIP Transport saw a 20% increase in its FFO’s for 2014 versus 2013 primarily driven by contributions from the additional investment in BIP’s Brazilian toll road in Q3 2013 as well as increased volume from its ports division and a partial quarter’s contribution from its investment in Vale’s cargo transportation VLI. Not only is this a high-quality asset, but Vale provided BIP with a minimum return mechanism to ensure that a minimum return is achieved over a period of up to six years from closing. As the Brazilian economy is facing some negative headwinds , this minimizes the risk of BIP failing to generate a positive return from its investment in VLI. Highlights from BIP Transport’s business units were as follows: BIP Transport’s Ports business enjoyed 21.4% FFO growth due to improved volumes from its UK port operations and incremental contribution from its newly acquired North American container port acquired during the year. BIP Transport’s Railroad business’s FFOs increased by $14M year-over-year (7.5%) because of a partial year’s incremental contribution from its Q3 2014 investment in Vale’s cargo transportation division as well as increased harvest grain volumes from its Australian railroad operations. BIP Transport’s Toll Road business saw its FFOs increase because of additional investment in its Brazilian toll roads completed in Q3 2013. On a “same-store basis”, toll revenues increased by 8% year-over-year due to tariff increases and higher volumes on Chilean roads. Source: BIP’s 2009-14 Annual Reports BIP Utilities saw a 2.65% decrease in its 2014 FFOs versus 2013 on a reported basis but increased 12% on an adjusted comparable continuing operations basis. The decrease in reported FFOs was primarily attributable to the sale of its Australasian regulated distribution operations on November 30, 2013. Excluding the impact of the sale, the segment’s FFOs increased by $39M versus the prior year as of the result of improved performance at BIP’s UK regulated distribution business. Source: BIP’s Financial Reports, Supplemental Reports BIP Utilities’ maintenance capital expenditures in 2014 were $14M and were $27M less than YTD 2013. BIP Utilities’ Regulated Terminal grew by 2.2% as negative movements in foreign exchange offset incremental pro forma operating income growth due to additions to its rate base. BIP Utilities’ Electricity Transmission business increased its FFOs by 7.4% due to inflation indexation, commissioning of projects into rate base and lower operating costs, partially offset by impact of foreign exchange. BIP Utilities’ Regulated Distribution’s adjusted FFOs from continuing operations grew by 22.5% as its United Kingdom regulated distribution operations benefited from a higher rate base, inflation indexation, lower costs and higher customer connections revenue. Source: BIP’s 2009-14 Annual Reports BIP Energy’s FFOs decreased by $2M year-over-year as incremental contribution from the acquisitions district energy businesses during the last 12 months was not enough to offset lower transportation volumes at its Energy Transmission, Distribution & Storage Business. BIP North American gas transmission business continues to see headwinds from the weak natural gas market, which resulted in a $275M asset impairment charge in 2013. Although BIP Energy’s performance has been flat since 2011, at least its capital expenditure backlog more than doubled during the year, which signals potential future growth. Other sources of potential future growth for BIP Energy include the closing of three previously announced acquisitions including gas storage businesses in California and Texas and a district energy system in Seattle. BIP also acquired a district energy business in Australia recently and is closing the acquisition of another one as well. Source: BIP’s 2011-14 Annual Reports BIP’s Corporate and Administrative segment’s FFO decreased by $12M (13%) in the year as increased interest and distribution income and reduced financing costs were offset by the absence of BIP Timber’s results as BIP sold BIP Timber in H1 2013 and higher management fees paid to Brookfield Asset Management. Corporate highlights include the following: BIP’s previously announced acquisition of a 23% interest in the French communications tower infrastructure firm TDF is expected to close in March 2015. BIP Corporate refinanced $4B of its debt in 2014 in order to capitalize on the historically low interest rate environment. BIP’s weighted average cost of debt is 5.9% and the average maturity profile is over 10 years, with minimal maturities over the next 5 years. BIP identified $1B in non-core assets that it seeks to sell in order to redeploy towards areas of growth and core operations, on top of its $1B capital-recycling program in 2013. BIP finished the year with $2.1B worth of total liquidity through its cash and available credit facilities. BIP has a BBB+ credit rating and it expects strong demand for its future offering $300M-$500M corporate debentures, which it seeks to bring to market in H1 2015. BIP’s opportunities for investment Government Privatizations-In Australian alone, BIP identified $50B worth of potential privatizations by the federal and state governments there Brazilian Construction Companies-BIP recognizes that many Brazilian construction companies are facing financial challenges and may seek to part with high-quality infrastructure related assets in order to shore up liquidity. Corporate deleveraging and carve-outs-BIP had success in acquiring utility assets from capital constrained European companies and is now Maturing Infrastructure Funds- Many investment funds raised between 2005 and 2008 are approaching the expiry of their funds. BIP has started to see the first wave of divestitures from this ownership group. Lastly, BIP focuses on investing capital to meet its long-term return targets of 12%-15% and will not reduce its return thresholds to make it easier to acquire assets Conclusion: In conclusion, investors looking for high yields and non-equity correlation should consider accumulating a position in BIP due to its portfolio of unique, hard-to-replicate assets. BIP provided unit-holders with strong returns from capital appreciation and partnership unit distributions since it went public in 2008. BIP offers a 5% dividend yield and its unit price is within 13% of its fair intrinsic value. We expect BIP’s FFOs to increase by at least 6.5% annually over the next seven years and its dividend distributions to increase by at least 9%. We can see why over 50% of BIP’s shares are held by leading asset managers such as Brookfield Asset Management, Legg Mason, BAMCO, Principal Global Investors and Scotia Bank’s asset management divisions. For these reasons, we believe investors should realize that BIP is a great alternative to the S&P 500 and traditional utilities as represented by the XLU and take advantage of market weaknesses to strategically accumulate units of BIP. Source: FactSet Marquee and our Estimates Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary BIP recently increased its dividend by 10% and now sports a 5% dividend yield. We believe BIP’s long-term dividend growth rate is 9%, up from 7% in our previous report. BIP’s shares are still 13% below its fair intrinsic value and we expect its intrinsic value to steadily increase as BIP steadily grows its FFOs per share. BIP’s disciplined approach to investing and its ability to continually identify new investment opportunities. We expect 15% FFO/share growth in 2015 and at least 6.5% growth thereafter. Brookfield Infrastructure Partners (NYSE: BIP ) recently announced it increased its dividend distribution by 10%. Although it was lower than our previous single year dividend growth in 2015, it was higher than our previous 7% estimated long-term dividend growth rate. BIP’s dividend increased by 13% annually since its 2008 IPO and BIP expects its long-run dividend growth rate will be 5%-9%. We believe that future dividend growth will be closer to the higher end of its forecasted range as it offers strong, steadily growing cash flow funds from its operations, which enables BIP to provide investors with strong dividend yields and dividend growth. BIP offers investors a 5% dividend yield and we believe its share price is 13% undervalued relative to its fair intrinsic value. For these reasons, we reiterate investors accumulate shares in BIP, especially income-oriented investors as BIP continues its consistent performance . Source: BIP’s Investor Relations and Our Estimates Companywide Highlights: BIP’s Q4 2014 FFOs/unit was $.86, slightly missing analyst expectations for the fourth time in the last 5 quarters but increasing by 3.6% versus Q4 2013. Key drivers of this performance were as follows Incremental contributions from the mid-August close of its investment in Vale’s cargo transportation division VLI, Improved volumes at its UK ports and Australian railroads, Soft volume demand from its North American energy transmission businesses due to mild weather and The absence of incremental contributions from its former Australasian regulated distribution operations, which BIP sold last November. Source: BIP’s Q4 2014 Report Business Segment Highlights: BIP Transport saw a 20% increase in its FFO’s for 2014 versus 2013 primarily driven by contributions from the additional investment in BIP’s Brazilian toll road in Q3 2013 as well as increased volume from its ports division and a partial quarter’s contribution from its investment in Vale’s cargo transportation VLI. Not only is this a high-quality asset, but Vale provided BIP with a minimum return mechanism to ensure that a minimum return is achieved over a period of up to six years from closing. As the Brazilian economy is facing some negative headwinds , this minimizes the risk of BIP failing to generate a positive return from its investment in VLI. Highlights from BIP Transport’s business units were as follows: BIP Transport’s Ports business enjoyed 21.4% FFO growth due to improved volumes from its UK port operations and incremental contribution from its newly acquired North American container port acquired during the year. BIP Transport’s Railroad business’s FFOs increased by $14M year-over-year (7.5%) because of a partial year’s incremental contribution from its Q3 2014 investment in Vale’s cargo transportation division as well as increased harvest grain volumes from its Australian railroad operations. BIP Transport’s Toll Road business saw its FFOs increase because of additional investment in its Brazilian toll roads completed in Q3 2013. On a “same-store basis”, toll revenues increased by 8% year-over-year due to tariff increases and higher volumes on Chilean roads. Source: BIP’s 2009-14 Annual Reports BIP Utilities saw a 2.65% decrease in its 2014 FFOs versus 2013 on a reported basis but increased 12% on an adjusted comparable continuing operations basis. The decrease in reported FFOs was primarily attributable to the sale of its Australasian regulated distribution operations on November 30, 2013. Excluding the impact of the sale, the segment’s FFOs increased by $39M versus the prior year as of the result of improved performance at BIP’s UK regulated distribution business. Source: BIP’s Financial Reports, Supplemental Reports BIP Utilities’ maintenance capital expenditures in 2014 were $14M and were $27M less than YTD 2013. BIP Utilities’ Regulated Terminal grew by 2.2% as negative movements in foreign exchange offset incremental pro forma operating income growth due to additions to its rate base. BIP Utilities’ Electricity Transmission business increased its FFOs by 7.4% due to inflation indexation, commissioning of projects into rate base and lower operating costs, partially offset by impact of foreign exchange. BIP Utilities’ Regulated Distribution’s adjusted FFOs from continuing operations grew by 22.5% as its United Kingdom regulated distribution operations benefited from a higher rate base, inflation indexation, lower costs and higher customer connections revenue. Source: BIP’s 2009-14 Annual Reports BIP Energy’s FFOs decreased by $2M year-over-year as incremental contribution from the acquisitions district energy businesses during the last 12 months was not enough to offset lower transportation volumes at its Energy Transmission, Distribution & Storage Business. BIP North American gas transmission business continues to see headwinds from the weak natural gas market, which resulted in a $275M asset impairment charge in 2013. Although BIP Energy’s performance has been flat since 2011, at least its capital expenditure backlog more than doubled during the year, which signals potential future growth. Other sources of potential future growth for BIP Energy include the closing of three previously announced acquisitions including gas storage businesses in California and Texas and a district energy system in Seattle. BIP also acquired a district energy business in Australia recently and is closing the acquisition of another one as well. Source: BIP’s 2011-14 Annual Reports BIP’s Corporate and Administrative segment’s FFO decreased by $12M (13%) in the year as increased interest and distribution income and reduced financing costs were offset by the absence of BIP Timber’s results as BIP sold BIP Timber in H1 2013 and higher management fees paid to Brookfield Asset Management. Corporate highlights include the following: BIP’s previously announced acquisition of a 23% interest in the French communications tower infrastructure firm TDF is expected to close in March 2015. BIP Corporate refinanced $4B of its debt in 2014 in order to capitalize on the historically low interest rate environment. BIP’s weighted average cost of debt is 5.9% and the average maturity profile is over 10 years, with minimal maturities over the next 5 years. BIP identified $1B in non-core assets that it seeks to sell in order to redeploy towards areas of growth and core operations, on top of its $1B capital-recycling program in 2013. BIP finished the year with $2.1B worth of total liquidity through its cash and available credit facilities. BIP has a BBB+ credit rating and it expects strong demand for its future offering $300M-$500M corporate debentures, which it seeks to bring to market in H1 2015. BIP’s opportunities for investment Government Privatizations-In Australian alone, BIP identified $50B worth of potential privatizations by the federal and state governments there Brazilian Construction Companies-BIP recognizes that many Brazilian construction companies are facing financial challenges and may seek to part with high-quality infrastructure related assets in order to shore up liquidity. Corporate deleveraging and carve-outs-BIP had success in acquiring utility assets from capital constrained European companies and is now Maturing Infrastructure Funds- Many investment funds raised between 2005 and 2008 are approaching the expiry of their funds. BIP has started to see the first wave of divestitures from this ownership group. Lastly, BIP focuses on investing capital to meet its long-term return targets of 12%-15% and will not reduce its return thresholds to make it easier to acquire assets Conclusion: In conclusion, investors looking for high yields and non-equity correlation should consider accumulating a position in BIP due to its portfolio of unique, hard-to-replicate assets. BIP provided unit-holders with strong returns from capital appreciation and partnership unit distributions since it went public in 2008. BIP offers a 5% dividend yield and its unit price is within 13% of its fair intrinsic value. We expect BIP’s FFOs to increase by at least 6.5% annually over the next seven years and its dividend distributions to increase by at least 9%. We can see why over 50% of BIP’s shares are held by leading asset managers such as Brookfield Asset Management, Legg Mason, BAMCO, Principal Global Investors and Scotia Bank’s asset management divisions. For these reasons, we believe investors should realize that BIP is a great alternative to the S&P 500 and traditional utilities as represented by the XLU and take advantage of market weaknesses to strategically accumulate units of BIP. Source: FactSet Marquee and our Estimates Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News