Scalper1 News

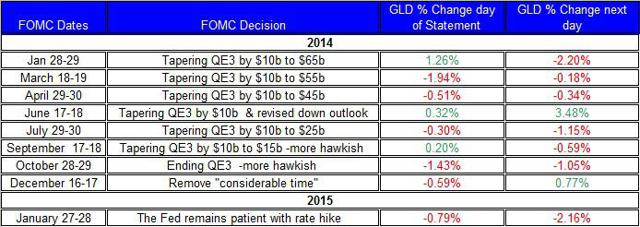

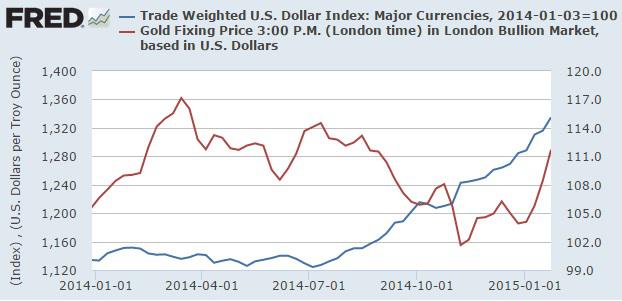

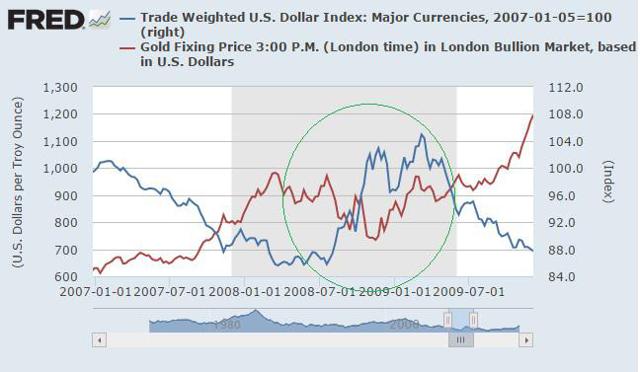

Summary The FOMC is still likely to raise rates in the coming months, but the global economic slowdown could still keep up GLD. I reexamine the relation between GLD and the U.S. dollar. The upcoming non-farm payroll report could bring GLD further down. The FOMC’s recent meeting was concluded with no changes to policy. The statement presented modest changes to the wording. For now, the market still estimates a rate hike in the middle of year. Following this news, the price of the SPDR Gold Trust (NYSEARCA: GLD ) fell down albeit it’s still up for the year. Let’s review the latest from the FOMC, the upcoming reports to be released this week, and reexamine the relation between the U.S. dollar and gold in light of the global economic slowdown. Last week’s main event was the FOMC meeting , in which the FOMC tried not to “rock the boat” and provided little changes in the wording in the statement. Nonetheless, following the release of the FOMC statement, the price of GLD took another tumble. (click to enlarge) Source of data taken from FOMC’s site and Bloomberg The statement still suggested that FOMC remains bullish on the U.S. economy, which isn’t a good sign for keeping rates low for a long time. The recent release of the U.S. GDP , in which the GDP growth rate for the fourth quarter was only 2.6%, market expectations were at 3% and in the third quarter the GDP grew by 5% may have contributed to the rally of GLD on Friday. A closer look at this report, however, reveals a more complex picture: real personal consumption grew by 4.3%; conversely, government spending tumbled down by 7.5%; private inventories added 0.8 percentage points to the growth rate. So even though government spending dropped, the GDP grew by 2.6% – mostly due to higher personal consumption and gain in inventories. All in all, this wasn’t a bad result and could tie up the FOMC’s bullish sentiment with respect to the progress of the U.S. economy. The upcoming non-farm payroll report could provide another indication for the progress of the U.S. labor market. Current estimates are for a gain of 231,000 jobs in January. A much higher gain in number of jobs could result in another fall in the price of GLD. (click to enlarge) Source of data taken from the U.S. Bureau of Labor Statistics and Google Finance Moreover, if the labor market keeps showing signs of recovery over the coming months, then this will bring the FOMC one step closer towards hitting the rate hike button. The debate over the next rate hike is likely to pick up in the coming months as we will get closer to the June meeting. Some still suspect the FOMC could back down from its current direction of raising rates in the coming months. But the FOMC doesn’t tend to make such a deviation from its direction unless the economic climate when it comes to inflation and labor warrants such a change. On both counts, the FOMC continues to voice little concern and to change market expectations with a sudden announcement, while has been done in the past, seems less likely considering the conditions only continue -albeit slowly – to improve. Despite the recent fall in the price of GLD, gold holdings in GLD keep picking up, and as of last week, reached over 758 tonnes of gold – this is a 6.5% gain since the end of 2014. This is also the highest level of gold hoards for the ETF since October 2014. This means, the recent fall in the price of GLD didn’t hold back investors from investing in the ETF. Another point to consider is the ongoing rise in the U.S. dollar, which coincides with the rally of gold prices. The chart below shows the relation between the U.S. dollar and gold prices during 2014-2015. Source of chart taken from FRED The relation between the U.S. dollar and GLD should be, as expected, negative; i.e. when the U.S. dollar appreciates against major currencies, the price of GLD tends to come down. This wasn’t the case, however, in recent weeks, as indicated in the chart above. Since the beginning of the year, both GLD and the U.S. dollar appreciated. But this type of positive relation was also the case back in 2008. (click to enlarge) Source of chart taken from FRED Back then, the U.S. economy, as well as other leading economies, was in a recession. This time, however, the U.S. economy is performing well while other economies show a slowdown in growth. In both times, the demand for gold picked up when the economic climate was uncertain and the global economy wasn’t doing so well. In times of uncertainty, the U.S. dollar tends to rise, U.S. treasury yields fall and gold prices rise. The main difference is that the U.S. economy, this time, is doing much better, and thus the U.S. dollar is likely to keep appreciating. Therefore, the ongoing appreciation of the U.S. dollar is likely to eventually catch up with the price of GLD and curb down its rally. For now, it seems that even if the FOMC were to raise rates in June by 0.25%, it won’t bring down the ongoing fall in the U.S. treasury yields and, consequently, the recovery of GLD. After all, the concerns over the global economy continue to offset the impact of the potential rise in the Fed’s rate on gold. In times of uncertainty, the U.S. dollar and GLD rally. But it also means that the recent rally of GLD could slow down on account of a stronger U.S. dollar. For more see: 3 Questions About Gold Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The FOMC is still likely to raise rates in the coming months, but the global economic slowdown could still keep up GLD. I reexamine the relation between GLD and the U.S. dollar. The upcoming non-farm payroll report could bring GLD further down. The FOMC’s recent meeting was concluded with no changes to policy. The statement presented modest changes to the wording. For now, the market still estimates a rate hike in the middle of year. Following this news, the price of the SPDR Gold Trust (NYSEARCA: GLD ) fell down albeit it’s still up for the year. Let’s review the latest from the FOMC, the upcoming reports to be released this week, and reexamine the relation between the U.S. dollar and gold in light of the global economic slowdown. Last week’s main event was the FOMC meeting , in which the FOMC tried not to “rock the boat” and provided little changes in the wording in the statement. Nonetheless, following the release of the FOMC statement, the price of GLD took another tumble. (click to enlarge) Source of data taken from FOMC’s site and Bloomberg The statement still suggested that FOMC remains bullish on the U.S. economy, which isn’t a good sign for keeping rates low for a long time. The recent release of the U.S. GDP , in which the GDP growth rate for the fourth quarter was only 2.6%, market expectations were at 3% and in the third quarter the GDP grew by 5% may have contributed to the rally of GLD on Friday. A closer look at this report, however, reveals a more complex picture: real personal consumption grew by 4.3%; conversely, government spending tumbled down by 7.5%; private inventories added 0.8 percentage points to the growth rate. So even though government spending dropped, the GDP grew by 2.6% – mostly due to higher personal consumption and gain in inventories. All in all, this wasn’t a bad result and could tie up the FOMC’s bullish sentiment with respect to the progress of the U.S. economy. The upcoming non-farm payroll report could provide another indication for the progress of the U.S. labor market. Current estimates are for a gain of 231,000 jobs in January. A much higher gain in number of jobs could result in another fall in the price of GLD. (click to enlarge) Source of data taken from the U.S. Bureau of Labor Statistics and Google Finance Moreover, if the labor market keeps showing signs of recovery over the coming months, then this will bring the FOMC one step closer towards hitting the rate hike button. The debate over the next rate hike is likely to pick up in the coming months as we will get closer to the June meeting. Some still suspect the FOMC could back down from its current direction of raising rates in the coming months. But the FOMC doesn’t tend to make such a deviation from its direction unless the economic climate when it comes to inflation and labor warrants such a change. On both counts, the FOMC continues to voice little concern and to change market expectations with a sudden announcement, while has been done in the past, seems less likely considering the conditions only continue -albeit slowly – to improve. Despite the recent fall in the price of GLD, gold holdings in GLD keep picking up, and as of last week, reached over 758 tonnes of gold – this is a 6.5% gain since the end of 2014. This is also the highest level of gold hoards for the ETF since October 2014. This means, the recent fall in the price of GLD didn’t hold back investors from investing in the ETF. Another point to consider is the ongoing rise in the U.S. dollar, which coincides with the rally of gold prices. The chart below shows the relation between the U.S. dollar and gold prices during 2014-2015. Source of chart taken from FRED The relation between the U.S. dollar and GLD should be, as expected, negative; i.e. when the U.S. dollar appreciates against major currencies, the price of GLD tends to come down. This wasn’t the case, however, in recent weeks, as indicated in the chart above. Since the beginning of the year, both GLD and the U.S. dollar appreciated. But this type of positive relation was also the case back in 2008. (click to enlarge) Source of chart taken from FRED Back then, the U.S. economy, as well as other leading economies, was in a recession. This time, however, the U.S. economy is performing well while other economies show a slowdown in growth. In both times, the demand for gold picked up when the economic climate was uncertain and the global economy wasn’t doing so well. In times of uncertainty, the U.S. dollar tends to rise, U.S. treasury yields fall and gold prices rise. The main difference is that the U.S. economy, this time, is doing much better, and thus the U.S. dollar is likely to keep appreciating. Therefore, the ongoing appreciation of the U.S. dollar is likely to eventually catch up with the price of GLD and curb down its rally. For now, it seems that even if the FOMC were to raise rates in June by 0.25%, it won’t bring down the ongoing fall in the U.S. treasury yields and, consequently, the recovery of GLD. After all, the concerns over the global economy continue to offset the impact of the potential rise in the Fed’s rate on gold. In times of uncertainty, the U.S. dollar and GLD rally. But it also means that the recent rally of GLD could slow down on account of a stronger U.S. dollar. For more see: 3 Questions About Gold Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News