Scalper1 News

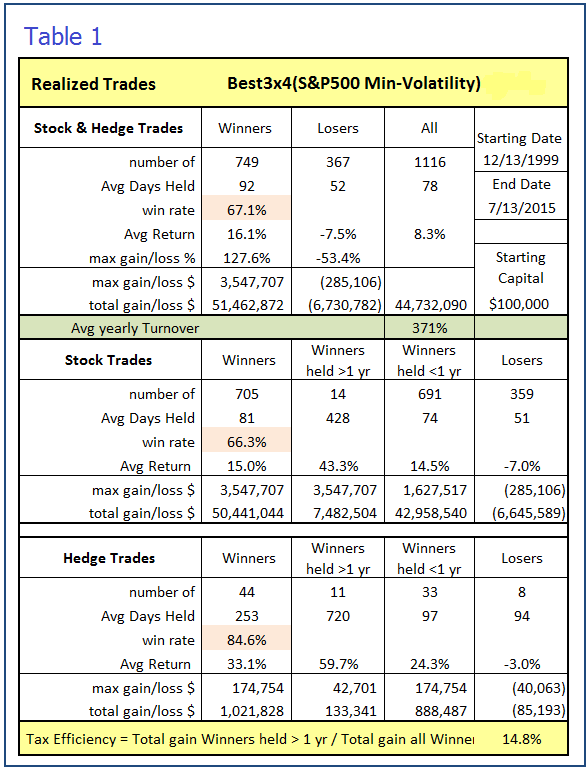

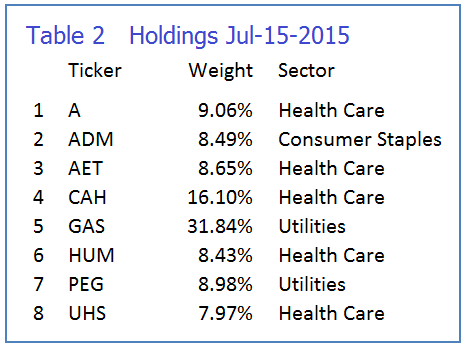

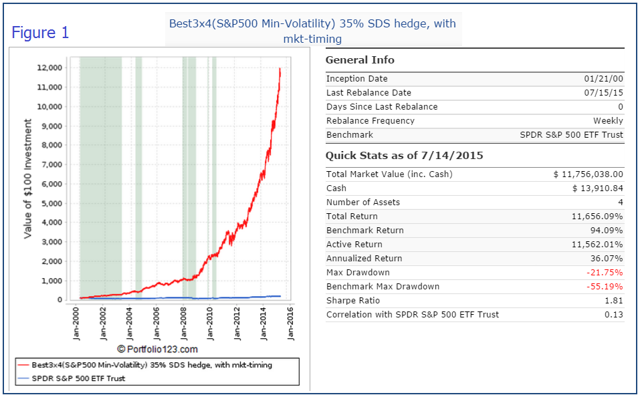

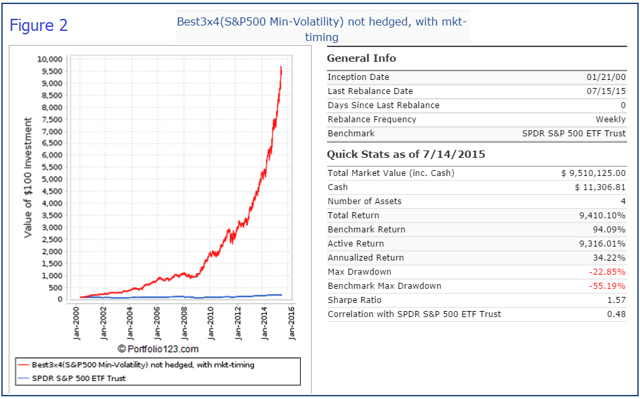

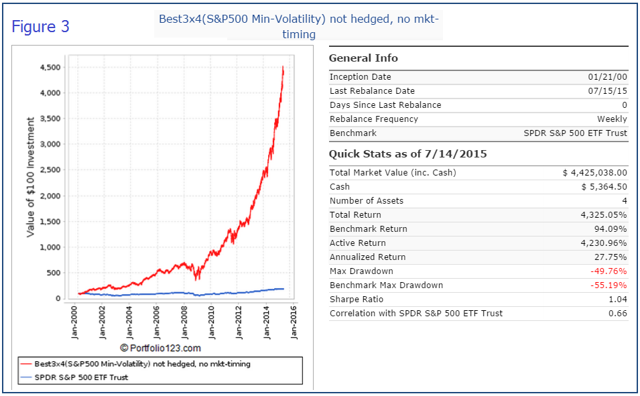

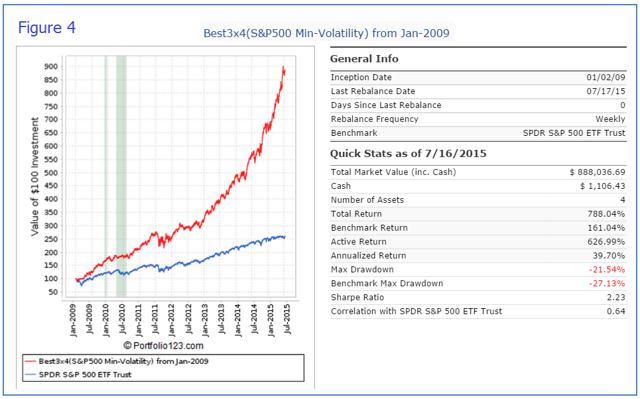

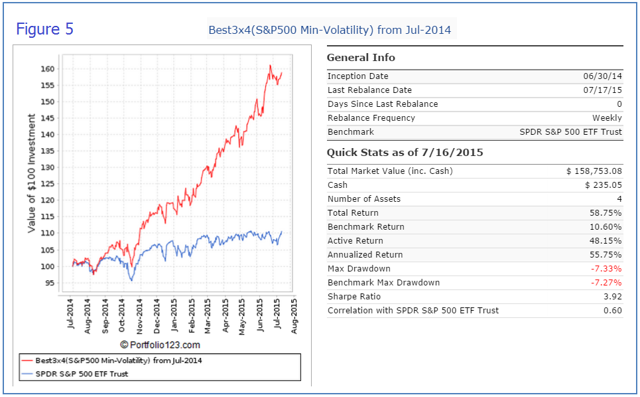

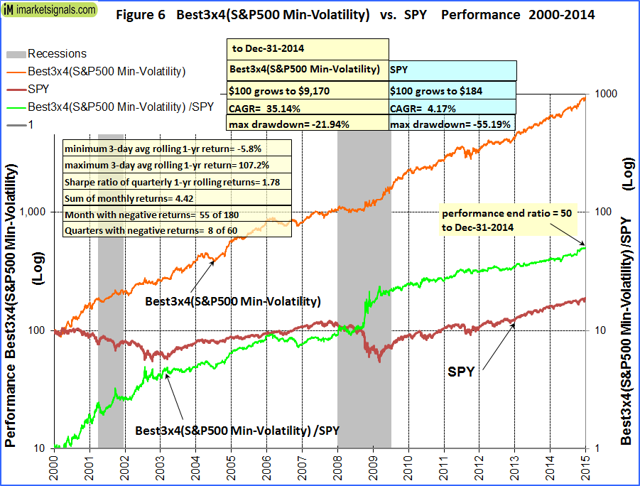

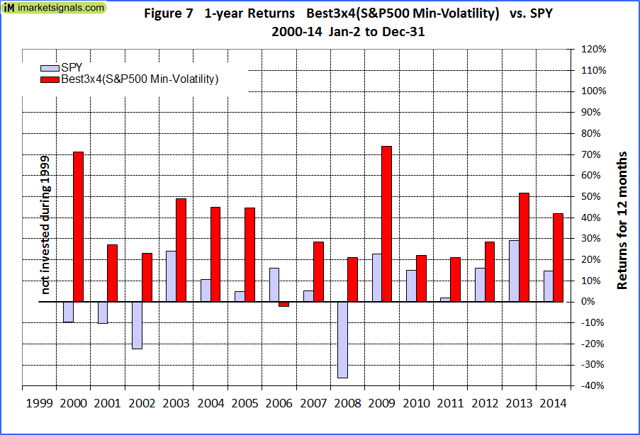

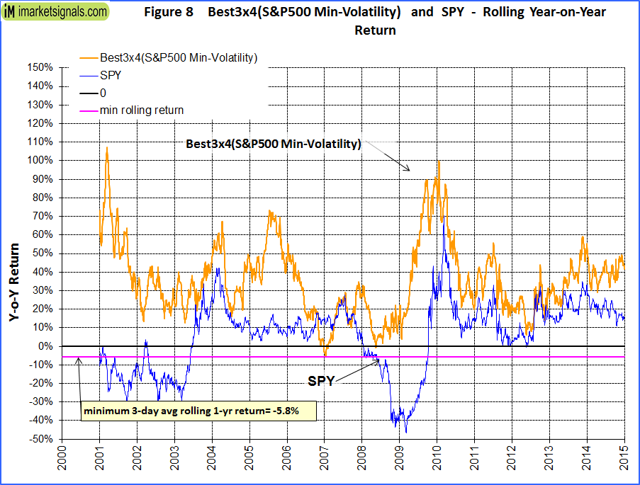

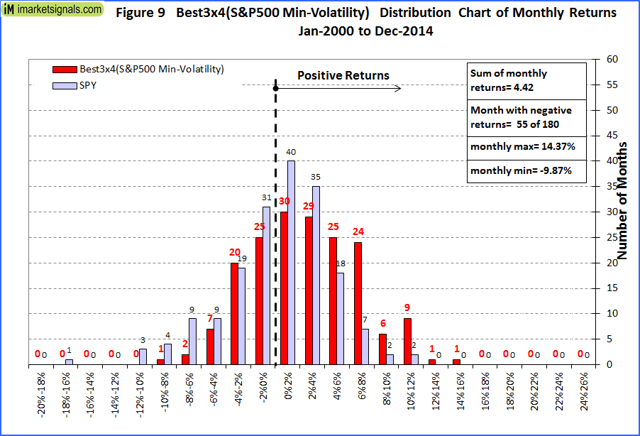

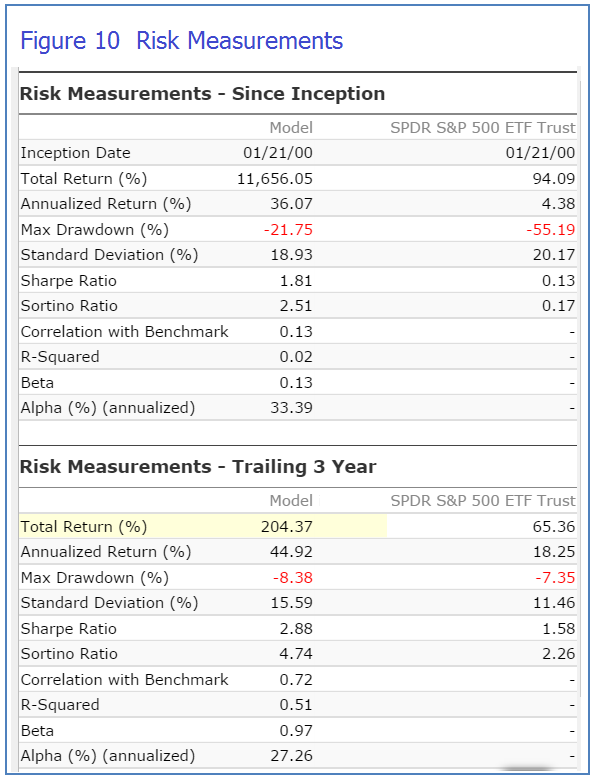

Summary This model can hold 3 to 12 stocks, at variable weightings, selected by a ranking system from a minimum volatility stock universe of the S&P 500. The model has 12 equally weighted slots; a very high ranked stock could occupy a maximum of 4 slots, that is a nominal 33% weighting of the model’s total assets. When adverse stock market conditions exist, the model reduces stock holdings by 35% and invests the proceeds in SDS. The backtest produced a simulated average annual return of about 36% from Jan-2000 to end of June-2015 with a maximum draw-down of minus 22%. The Minimum Volatility Stock Universe of the S&P 500 Minimum volatility stocks should exhibit lower drawdowns than the broader market and show reasonable returns over an extended period of time. It was found that a universe of stocks mainly from the Health Care, Consumer Staples and Utilities sectors satisfied those conditions. This minimum volatility universe of the S&P 500 currently holds 117 large-cap stocks (market cap ranging from $4- to $277-billion), and there were 111 stocks in the universe at the inception of the model, in Jan-2000. Trading Rules The ranking system employed is the same as for our Best8(S&P500 Min-Volatility) system, but the trading system differs in regard to the hedge used and some additional sell rules. The model assumes that stocks are bought and sold at the next day’s average of the Low and High price after a signal is generated. Variable slippage of about 0.12% of a trade amount was taken into account to provide for brokerage fees and transaction slippage. Buy Rules: Some of the largest market cap stocks are exclude from being selected. Sell Rules: Rank Keep the weight of a position in a slot to +10% and -15% of the nominal weight. Realized Trades Analysis An analysis of all the realized trades is shown in Table 1. There were 749 winning trades out of 1116, resulting in a win rate of 67.1%. The average yearly turnover was about 370%. On average a position was held for 78 days. Holdings The models can potentially hold a maximum of 12 different stocks, and a minimum of 3 different stocks. As of July 15 it held 8 different stocks with various weights as shown in Table 2. Performance In the figures below, the red graph represents the model and the blue graph shows the performance of benchmark SPY. The backtest period was 15.5 years, from January 2000 to June 2015. Figures 1 to 5 show performance comparisons: Figure 1: Performance 2000-2015 with market-timing and hedging with long SDS. The model uses a hedge ratio of 35% of current holdings during down-market conditions. (Note: The inception date of SDS was Jul-2006. Prior to this date values are “synthetic”, derived from the S&P 500.) Annualized Return= 36.1%, Max Drawdown= -21.8%. Figure 2: Performance 2000-2015 without hedging. Annualized Return= 34.2%, Max Drawdown= -22.9%. Figure 3: Performance 2000-2015 without hedging and market timing. Annualized Return= 27.8%, Max Drawdown= -49.8%. Figure 4: Performance Jan-2000 to Jun-2015 . Annualized Return= 39.7%, Max Drawdown= -21.5%. Figure 5: Performance Jul-2014 to Jun-2015. Total Return= 58.8%, Max Drawdown= -7.3%. This can be directly compared with our Best12(NYSEARCA: USMV )-Trader model’s return of 28.6% for the same time period. (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) Figures 6 to 10 show performance details from Jan-2000 to Dec-2014 for the model with hedging and market timing: Figure 6: Performance versus SPY. Over the 15-year period $100 invested at inception would have grown to $9,170, which is 50-times what the same investment in SPY would have produced. Figure 7: 1-year returns. Except for 2006 the 1-year returns were always higher than for SPY. Figure 8: 1-year rolling returns. The minimum 1-year rolling return of the 3-day moving average was -5.8% early in 2007. Figure 9: Distribution of monthly returns relative to SPY. Figure 10: Risk measurements for 15.5-years and trailing 3-year periods. (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) Following the Model This model can be followed, exclusively, live at iMarketSignals where it will be updated weekly together with our other trading models. It will not be available as a subscription model at Portfolio 123. Disclaimer One should be aware that all results shown are from a simulation and not from actual trading. They are presented for informational and educational purposes only and shall not be construed as advice to invest in any assets. Out-of-sample performance may be much different. Backtesting results should be interpreted in light of differences between simulated performance and actual trading, and an understanding that past performance is no guarantee of future results. All investors should make investment choices based upon their own analysis of the asset, its expected returns and risks, or consult a financial adviser. The designer of this model is not a registered investment adviser. Scalper1 News

Summary This model can hold 3 to 12 stocks, at variable weightings, selected by a ranking system from a minimum volatility stock universe of the S&P 500. The model has 12 equally weighted slots; a very high ranked stock could occupy a maximum of 4 slots, that is a nominal 33% weighting of the model’s total assets. When adverse stock market conditions exist, the model reduces stock holdings by 35% and invests the proceeds in SDS. The backtest produced a simulated average annual return of about 36% from Jan-2000 to end of June-2015 with a maximum draw-down of minus 22%. The Minimum Volatility Stock Universe of the S&P 500 Minimum volatility stocks should exhibit lower drawdowns than the broader market and show reasonable returns over an extended period of time. It was found that a universe of stocks mainly from the Health Care, Consumer Staples and Utilities sectors satisfied those conditions. This minimum volatility universe of the S&P 500 currently holds 117 large-cap stocks (market cap ranging from $4- to $277-billion), and there were 111 stocks in the universe at the inception of the model, in Jan-2000. Trading Rules The ranking system employed is the same as for our Best8(S&P500 Min-Volatility) system, but the trading system differs in regard to the hedge used and some additional sell rules. The model assumes that stocks are bought and sold at the next day’s average of the Low and High price after a signal is generated. Variable slippage of about 0.12% of a trade amount was taken into account to provide for brokerage fees and transaction slippage. Buy Rules: Some of the largest market cap stocks are exclude from being selected. Sell Rules: Rank Keep the weight of a position in a slot to +10% and -15% of the nominal weight. Realized Trades Analysis An analysis of all the realized trades is shown in Table 1. There were 749 winning trades out of 1116, resulting in a win rate of 67.1%. The average yearly turnover was about 370%. On average a position was held for 78 days. Holdings The models can potentially hold a maximum of 12 different stocks, and a minimum of 3 different stocks. As of July 15 it held 8 different stocks with various weights as shown in Table 2. Performance In the figures below, the red graph represents the model and the blue graph shows the performance of benchmark SPY. The backtest period was 15.5 years, from January 2000 to June 2015. Figures 1 to 5 show performance comparisons: Figure 1: Performance 2000-2015 with market-timing and hedging with long SDS. The model uses a hedge ratio of 35% of current holdings during down-market conditions. (Note: The inception date of SDS was Jul-2006. Prior to this date values are “synthetic”, derived from the S&P 500.) Annualized Return= 36.1%, Max Drawdown= -21.8%. Figure 2: Performance 2000-2015 without hedging. Annualized Return= 34.2%, Max Drawdown= -22.9%. Figure 3: Performance 2000-2015 without hedging and market timing. Annualized Return= 27.8%, Max Drawdown= -49.8%. Figure 4: Performance Jan-2000 to Jun-2015 . Annualized Return= 39.7%, Max Drawdown= -21.5%. Figure 5: Performance Jul-2014 to Jun-2015. Total Return= 58.8%, Max Drawdown= -7.3%. This can be directly compared with our Best12(NYSEARCA: USMV )-Trader model’s return of 28.6% for the same time period. (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) Figures 6 to 10 show performance details from Jan-2000 to Dec-2014 for the model with hedging and market timing: Figure 6: Performance versus SPY. Over the 15-year period $100 invested at inception would have grown to $9,170, which is 50-times what the same investment in SPY would have produced. Figure 7: 1-year returns. Except for 2006 the 1-year returns were always higher than for SPY. Figure 8: 1-year rolling returns. The minimum 1-year rolling return of the 3-day moving average was -5.8% early in 2007. Figure 9: Distribution of monthly returns relative to SPY. Figure 10: Risk measurements for 15.5-years and trailing 3-year periods. (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) Following the Model This model can be followed, exclusively, live at iMarketSignals where it will be updated weekly together with our other trading models. It will not be available as a subscription model at Portfolio 123. Disclaimer One should be aware that all results shown are from a simulation and not from actual trading. They are presented for informational and educational purposes only and shall not be construed as advice to invest in any assets. Out-of-sample performance may be much different. Backtesting results should be interpreted in light of differences between simulated performance and actual trading, and an understanding that past performance is no guarantee of future results. All investors should make investment choices based upon their own analysis of the asset, its expected returns and risks, or consult a financial adviser. The designer of this model is not a registered investment adviser. Scalper1 News

Scalper1 News