Scalper1 News

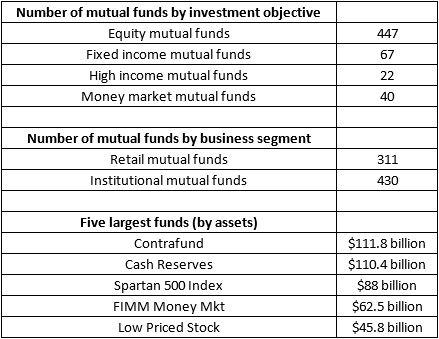

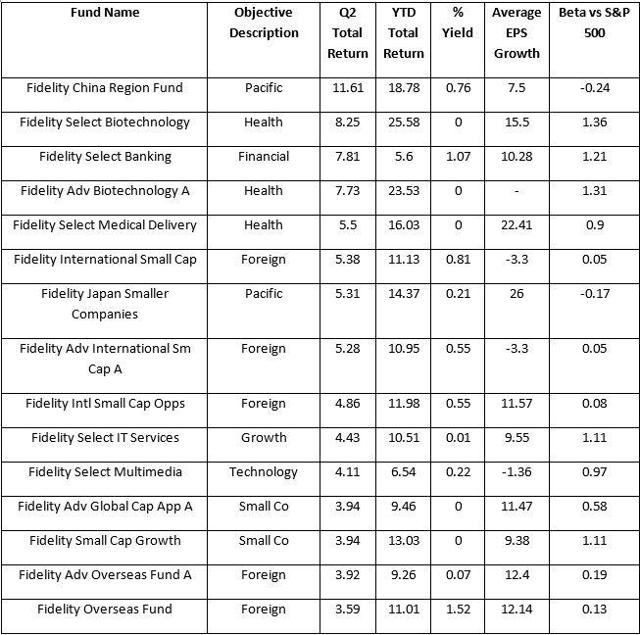

Performance wise, markets had a very tough first half of 2015 as the second quarter could do little to offset the concerns set up in the first quarter. Only four of the mutual fund categories posted above a 10% gain in the first half. Also, just 41% of mutual funds could manage to finish in the green in the second quarter. This is less than half of the 81% gains scored by mutual funds in the first quarter. These losses however owed a lot to the selloff on the eve of the quarter’s end. Amid the dismal numbers, Fidelity Funds comparatively had a decent second quarter with a top gain of 11.6% in the second quarter. Of the 950 funds under the study, 504 funds had positive return. Though a large number of funds ended in the red, only 22 funds lost more than 5%. (Note: This number includes same funds of different classes) Category Returns The 11.6% gain from the Fidelity China Region Fund (MUTF: FHKCX ) helped Fidelity beat other prominent fund families like Vanguard, BlackRock and American Funds to mention a few. The ones ahead of Fidelity were ProFunds, Matthews International, Allianz and Invesco. Except for one, all funds who gained more than FHKCX belonged to the China category. China had a strong performance in the second quarter as well, before hitting a sudden slump in late June. As China’s Bull Run ended momentarily, the government actions were swift to boost the markets. While Japan scored the most gains during the first half of 2015, healthcare followed next, which is shown by Fidelity’s healthcare fund notching the number 2 spot. However, before we look into the top 10 Fidelity gainers in second quarter, let’s look at some other developments. Fund Family: Fidelity Investments Fidelity Investments is one of the largest mutual fund companies in the world having $1,814.3 billion of mutual fund assets under management (as of Mar 31, 2015). It has a wide variety of mutual funds spanning across a varied spectrum of sectors. The number of mutual funds managed by Fidelity stood at 576 as of Mar 31, 2015. Below we present other key numbers: According to Morningstar data, Fidelity’s total return in 2015 as of Jun 30 is 3.7%, beating the category average of 2.7%. Of the total assets, 48.1% were invested in domestic stocks, 10.5% in international stock, 14.3% in taxable bond and about 2% in municipal bond. About 94.5% of assets carried no sales load. Q2 Trends In the second quarter, Fidelity notes that there was slow global growth but developed economies witnessed better traction than the emerging ones. While the US and Europe were steady, commodity prices stabilized and deflation pressures eased. Deflation fears eased based on volatile global economic progress and inflated bond yields. Fidelity says: “We continue to expect a moderately benign environment of modest cyclical improvement led by developed economies, though higher market volatility is likely and inflationary and deflationary risks remain.” As deflation fears eased, government bond yields in many developed countries went up in the second quarter. The sudden rise in Europe came after yields had dropped to multi-year lows in first quarter. Second quarter handed most fixed-income categories losses. Equities posted modest gains and non-US equities had better returns over the US counterparts. As for the economies, Fidelity notes “Europe continues to gain traction in its mid-cycle reacceleration, the U.S. is solidly mid-cycle, and Japan has entered a tepid early cycle along with monetary stimulus and a weaker yen. China has slipped into a growth recession.” Top 15 Fidelity Funds of Q2 2015 Below we present the top 15 Fidelity funds with best returns of Q2 2015: (click to enlarge) Note: The list excludes the same funds with different classes, and institutional funds have been excluded. If we compare the list with the first quarter performance, only four funds made it to the second quarter top performing list. These are the Fidelity Select Biotechnology (MUTF: FBIOX ), the Fidelity Adv Biotechnology A (MUTF: FBTAX ), the Fidelity Japan Smaller Companies (MUTF: FJSCX ) and the Fidelity Small Cap Growth (MUTF: FCPGX ). While FCPGX carries a Zacks Mutual Fund Rank #1 (Strong Buy) and FBIOX has a Zacks Mutual Fund Rank #2 (Buy), FJSCX and FBTAX hold Zacks Mutual Fund Rank #4 (Sell) and Zacks Mutual Fund Rank #5 (Strong Sell). The quarterly gains are also lower in comparison to the first quarter. The best gain during the first quarter was 16%, while the lowest then was 6.5%. The lowest gain, scored by the Fidelity Overseas Fund (MUTF: FOSFX ), is 3.6%. A simple average calculation shows that the average gain of these top 15 funds in Q2 is 5.9%. It is significantly lower than average gain of 9.6% in first quarter. The other trend we noticed is that Healthcare, Foreign and to an extent Small Cap dominated the list of top 15 Fidelity funds. This is apt given that overseas funds category in general had a profitable second quarter. Healthcare has continued the momentum that it has been enjoying for past quarters. Small Growth does feature in Morningstar’s top 10 category performers, thus helping two of Fidelity’s funds get a place in top 15. These are the Fidelity Adv Global Cap App A (MUTF: FGEAX ) and the Fidelity Small Cap Growth ( FCPGX ). Among the other favorably-ranked funds in this list are the Fidelity China Region Fund, the Fidelity Select Medical Delivery (MUTF: FSHCX ), the Fidelity International Small Cap (MUTF: FISMX ), the Fidelity Adv International Small Cap A (MUTF: FIASX ), the Fidelity Intl Small Cap Opps (MUTF: FSCOX ), the Fidelity Select Multimedia (MUTF: FBMPX ), the Fidelity Adv Overseas Fund A (MUTF: FAOAX ) and the Fidelity Overseas Fund ( FOSFX ). While FHKCX, FSCOX, FAOAX and FOSFX carry a Zacks Mutual Fund Rank #1, FSHCX, FISMX, FIASX and FBMPX hold a Zacks Mutual Fund Rank #2. Link to the original post on Zacks.com Scalper1 News

Performance wise, markets had a very tough first half of 2015 as the second quarter could do little to offset the concerns set up in the first quarter. Only four of the mutual fund categories posted above a 10% gain in the first half. Also, just 41% of mutual funds could manage to finish in the green in the second quarter. This is less than half of the 81% gains scored by mutual funds in the first quarter. These losses however owed a lot to the selloff on the eve of the quarter’s end. Amid the dismal numbers, Fidelity Funds comparatively had a decent second quarter with a top gain of 11.6% in the second quarter. Of the 950 funds under the study, 504 funds had positive return. Though a large number of funds ended in the red, only 22 funds lost more than 5%. (Note: This number includes same funds of different classes) Category Returns The 11.6% gain from the Fidelity China Region Fund (MUTF: FHKCX ) helped Fidelity beat other prominent fund families like Vanguard, BlackRock and American Funds to mention a few. The ones ahead of Fidelity were ProFunds, Matthews International, Allianz and Invesco. Except for one, all funds who gained more than FHKCX belonged to the China category. China had a strong performance in the second quarter as well, before hitting a sudden slump in late June. As China’s Bull Run ended momentarily, the government actions were swift to boost the markets. While Japan scored the most gains during the first half of 2015, healthcare followed next, which is shown by Fidelity’s healthcare fund notching the number 2 spot. However, before we look into the top 10 Fidelity gainers in second quarter, let’s look at some other developments. Fund Family: Fidelity Investments Fidelity Investments is one of the largest mutual fund companies in the world having $1,814.3 billion of mutual fund assets under management (as of Mar 31, 2015). It has a wide variety of mutual funds spanning across a varied spectrum of sectors. The number of mutual funds managed by Fidelity stood at 576 as of Mar 31, 2015. Below we present other key numbers: According to Morningstar data, Fidelity’s total return in 2015 as of Jun 30 is 3.7%, beating the category average of 2.7%. Of the total assets, 48.1% were invested in domestic stocks, 10.5% in international stock, 14.3% in taxable bond and about 2% in municipal bond. About 94.5% of assets carried no sales load. Q2 Trends In the second quarter, Fidelity notes that there was slow global growth but developed economies witnessed better traction than the emerging ones. While the US and Europe were steady, commodity prices stabilized and deflation pressures eased. Deflation fears eased based on volatile global economic progress and inflated bond yields. Fidelity says: “We continue to expect a moderately benign environment of modest cyclical improvement led by developed economies, though higher market volatility is likely and inflationary and deflationary risks remain.” As deflation fears eased, government bond yields in many developed countries went up in the second quarter. The sudden rise in Europe came after yields had dropped to multi-year lows in first quarter. Second quarter handed most fixed-income categories losses. Equities posted modest gains and non-US equities had better returns over the US counterparts. As for the economies, Fidelity notes “Europe continues to gain traction in its mid-cycle reacceleration, the U.S. is solidly mid-cycle, and Japan has entered a tepid early cycle along with monetary stimulus and a weaker yen. China has slipped into a growth recession.” Top 15 Fidelity Funds of Q2 2015 Below we present the top 15 Fidelity funds with best returns of Q2 2015: (click to enlarge) Note: The list excludes the same funds with different classes, and institutional funds have been excluded. If we compare the list with the first quarter performance, only four funds made it to the second quarter top performing list. These are the Fidelity Select Biotechnology (MUTF: FBIOX ), the Fidelity Adv Biotechnology A (MUTF: FBTAX ), the Fidelity Japan Smaller Companies (MUTF: FJSCX ) and the Fidelity Small Cap Growth (MUTF: FCPGX ). While FCPGX carries a Zacks Mutual Fund Rank #1 (Strong Buy) and FBIOX has a Zacks Mutual Fund Rank #2 (Buy), FJSCX and FBTAX hold Zacks Mutual Fund Rank #4 (Sell) and Zacks Mutual Fund Rank #5 (Strong Sell). The quarterly gains are also lower in comparison to the first quarter. The best gain during the first quarter was 16%, while the lowest then was 6.5%. The lowest gain, scored by the Fidelity Overseas Fund (MUTF: FOSFX ), is 3.6%. A simple average calculation shows that the average gain of these top 15 funds in Q2 is 5.9%. It is significantly lower than average gain of 9.6% in first quarter. The other trend we noticed is that Healthcare, Foreign and to an extent Small Cap dominated the list of top 15 Fidelity funds. This is apt given that overseas funds category in general had a profitable second quarter. Healthcare has continued the momentum that it has been enjoying for past quarters. Small Growth does feature in Morningstar’s top 10 category performers, thus helping two of Fidelity’s funds get a place in top 15. These are the Fidelity Adv Global Cap App A (MUTF: FGEAX ) and the Fidelity Small Cap Growth ( FCPGX ). Among the other favorably-ranked funds in this list are the Fidelity China Region Fund, the Fidelity Select Medical Delivery (MUTF: FSHCX ), the Fidelity International Small Cap (MUTF: FISMX ), the Fidelity Adv International Small Cap A (MUTF: FIASX ), the Fidelity Intl Small Cap Opps (MUTF: FSCOX ), the Fidelity Select Multimedia (MUTF: FBMPX ), the Fidelity Adv Overseas Fund A (MUTF: FAOAX ) and the Fidelity Overseas Fund ( FOSFX ). While FHKCX, FSCOX, FAOAX and FOSFX carry a Zacks Mutual Fund Rank #1, FSHCX, FISMX, FIASX and FBMPX hold a Zacks Mutual Fund Rank #2. Link to the original post on Zacks.com Scalper1 News

Scalper1 News