Scalper1 News

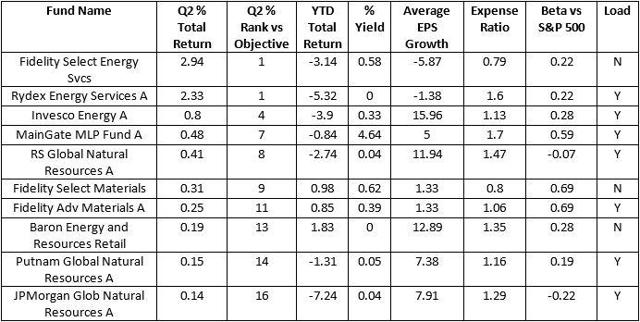

Despite crude prices rebounding in March this year and trending up before hitting a roadblock again this month, energy prices were nonetheless far short of their year-ago levels. Nevertheless, the energy sector enjoyed improving fundamentals in the second quarter. The U.S. Energy Department’s weekly inventory had shown that crude stockpiles continued to fall and continued to set new records. The federal government’s EIA report had also revealed that crude inventories were down. However, this could not translate into significant gains for energy mutual funds in the second quarter. According to Morningstar, in the 3-month period, energy sector mutual funds lost 3.8%. Of the 200 funds under the study, only 39 funds could finish in the green. The highest gain reached just 2.9% and the average gain for these 39 funds is 0.6%. Compared to the average loss for the remaining 161 funds of -2%. The biggest loss of -5.5% came from US Global Investors Global Res (MUTF: PSPFX ), which currently holds a Zacks Mutual Fund Rank #5 (Strong Sell). (Note: This number includes the same funds of different classes) Weakness in energy is also prominent in earnings projections. Per the Earnings Trends, the second quarter earnings for the Oil/Energy sector may slump 61% on 39.3% lower revenues. The earnings analysis pertains to the S&P 500 index. Moreover, it was also a tough quarter for the broader markets. The Dow was the only benchmark in the first quarter to end in the red, but the S&P 500 joined the blue-chip index in negative territory in the second quarter. Just 41% of mutual funds could manage to finish in the green in the second quarter. This is less than half of the 81% gains scored by mutual funds in the first quarter. Crude Price Slump Again The downtrend is again creating jitters. In mid-July, the crude had the steepest one-day fall in over three months. West Texas Intermediate (WTI) crude had plunged 8.4%. This was the largest one-day percentage decline since February. Now, the Iran deal is a major headwind. After 20 months of negotiations, a nuclear deal has been reached between Iran and six world powers. The agreement is meant to restrict Iran from manufacturing nuclear weapons in exchange of removing economic sanctions – which also include constraining crude oil export from Tehran. But the big question that arises is how the nuclear accord might impact the oil market. However, it will take Iran months or more to ramp up its production to previous levels. Moreover, it will take around two months for the U.S. to get congressional approval for the nuclear pact, indicating that the sanctions won’t be removed immediately. Top 10 Energy Funds of Q2 2015 Below we present the top 10 Energy funds with best returns of Q2 2015: (click to enlarge) Note: The list excludes the same funds with different classes, and institutional funds have been excluded. Funds having minimum initial investment above $5000 have been excluded. Q2 % Rank vs Objective* equals the percentage the fund falls among its peers. Here, 1 being the best and 99 being the worst. As already discussed, the Q2 gains are really muted. However, these 10 funds could at least reverse the losing trend for the overall energy category. Gains of the bottom 3 here, Baron Energy and Resources Retail (MUTF: BENFX ), Putnam Global Natural Resources A (MUTF: EBERX ) and JPMorgan Glob Natural Resources A, are below 0.2%. Here, BENFX and EBERX carry a Zacks Mutual Fund Rank #1 (Strong Buy). Both these funds have a healthy average EPS growth. Joining them in this category of promising average EPS growth are Invesco Energy A (MUTF: IENAX ) and RS Global Natural Resources A (MUTF: RSNRX ). While IENAX carries a Zacks Mutual Fund Rank #2 (Buy), RSNRX carries a Zacks Mutual Fund Rank #3 (Hold) . The other Strong-Buy rank funds in the list are Fidelity Select Materials (MUTF: FSDPX ) and Fidelity Adv Materials A (MUTF: FMFAX ). While both these funds from the Fidelity family has a Strong Buy rank, the top gainer in second quarter Fidelity Select Energy Svcs (MUTF: FSESX ) holds a Zacks Mutual Fund Rank #4 (Sell). Going forward, energy funds will surely be looking to rebound. A downtrend in crude prices helps companies involved in the downstream (refining and marketing). The business of the downstream players is negatively correlated with crude prices. Also, Master Limited Partnerships (MLPs) offered considerable returns at significantly lower risk. Most MLPs are involved in processing and transportation of energy commodities such as natural gas, crude oil, and refined products, under long-term contracts. Original Post Scalper1 News

Despite crude prices rebounding in March this year and trending up before hitting a roadblock again this month, energy prices were nonetheless far short of their year-ago levels. Nevertheless, the energy sector enjoyed improving fundamentals in the second quarter. The U.S. Energy Department’s weekly inventory had shown that crude stockpiles continued to fall and continued to set new records. The federal government’s EIA report had also revealed that crude inventories were down. However, this could not translate into significant gains for energy mutual funds in the second quarter. According to Morningstar, in the 3-month period, energy sector mutual funds lost 3.8%. Of the 200 funds under the study, only 39 funds could finish in the green. The highest gain reached just 2.9% and the average gain for these 39 funds is 0.6%. Compared to the average loss for the remaining 161 funds of -2%. The biggest loss of -5.5% came from US Global Investors Global Res (MUTF: PSPFX ), which currently holds a Zacks Mutual Fund Rank #5 (Strong Sell). (Note: This number includes the same funds of different classes) Weakness in energy is also prominent in earnings projections. Per the Earnings Trends, the second quarter earnings for the Oil/Energy sector may slump 61% on 39.3% lower revenues. The earnings analysis pertains to the S&P 500 index. Moreover, it was also a tough quarter for the broader markets. The Dow was the only benchmark in the first quarter to end in the red, but the S&P 500 joined the blue-chip index in negative territory in the second quarter. Just 41% of mutual funds could manage to finish in the green in the second quarter. This is less than half of the 81% gains scored by mutual funds in the first quarter. Crude Price Slump Again The downtrend is again creating jitters. In mid-July, the crude had the steepest one-day fall in over three months. West Texas Intermediate (WTI) crude had plunged 8.4%. This was the largest one-day percentage decline since February. Now, the Iran deal is a major headwind. After 20 months of negotiations, a nuclear deal has been reached between Iran and six world powers. The agreement is meant to restrict Iran from manufacturing nuclear weapons in exchange of removing economic sanctions – which also include constraining crude oil export from Tehran. But the big question that arises is how the nuclear accord might impact the oil market. However, it will take Iran months or more to ramp up its production to previous levels. Moreover, it will take around two months for the U.S. to get congressional approval for the nuclear pact, indicating that the sanctions won’t be removed immediately. Top 10 Energy Funds of Q2 2015 Below we present the top 10 Energy funds with best returns of Q2 2015: (click to enlarge) Note: The list excludes the same funds with different classes, and institutional funds have been excluded. Funds having minimum initial investment above $5000 have been excluded. Q2 % Rank vs Objective* equals the percentage the fund falls among its peers. Here, 1 being the best and 99 being the worst. As already discussed, the Q2 gains are really muted. However, these 10 funds could at least reverse the losing trend for the overall energy category. Gains of the bottom 3 here, Baron Energy and Resources Retail (MUTF: BENFX ), Putnam Global Natural Resources A (MUTF: EBERX ) and JPMorgan Glob Natural Resources A, are below 0.2%. Here, BENFX and EBERX carry a Zacks Mutual Fund Rank #1 (Strong Buy). Both these funds have a healthy average EPS growth. Joining them in this category of promising average EPS growth are Invesco Energy A (MUTF: IENAX ) and RS Global Natural Resources A (MUTF: RSNRX ). While IENAX carries a Zacks Mutual Fund Rank #2 (Buy), RSNRX carries a Zacks Mutual Fund Rank #3 (Hold) . The other Strong-Buy rank funds in the list are Fidelity Select Materials (MUTF: FSDPX ) and Fidelity Adv Materials A (MUTF: FMFAX ). While both these funds from the Fidelity family has a Strong Buy rank, the top gainer in second quarter Fidelity Select Energy Svcs (MUTF: FSESX ) holds a Zacks Mutual Fund Rank #4 (Sell). Going forward, energy funds will surely be looking to rebound. A downtrend in crude prices helps companies involved in the downstream (refining and marketing). The business of the downstream players is negatively correlated with crude prices. Also, Master Limited Partnerships (MLPs) offered considerable returns at significantly lower risk. Most MLPs are involved in processing and transportation of energy commodities such as natural gas, crude oil, and refined products, under long-term contracts. Original Post Scalper1 News

Scalper1 News