Scalper1 News

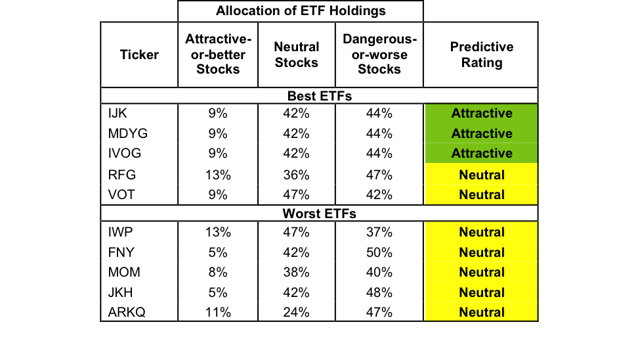

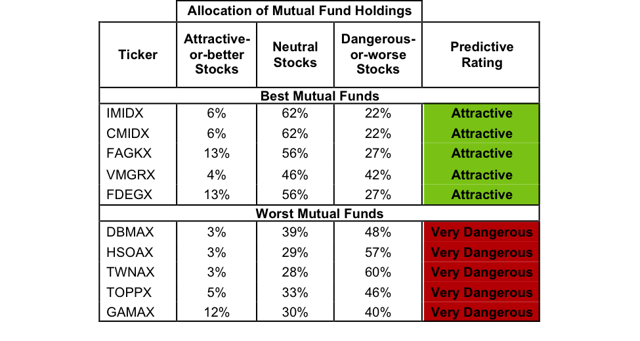

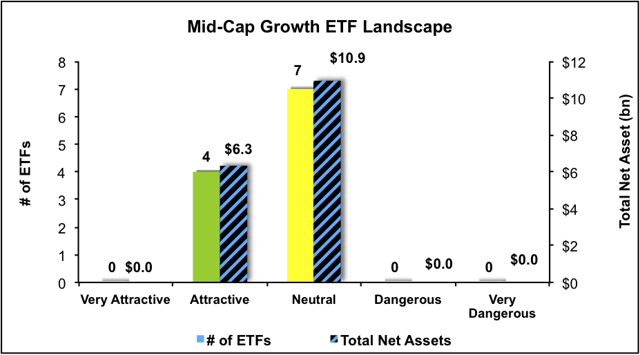

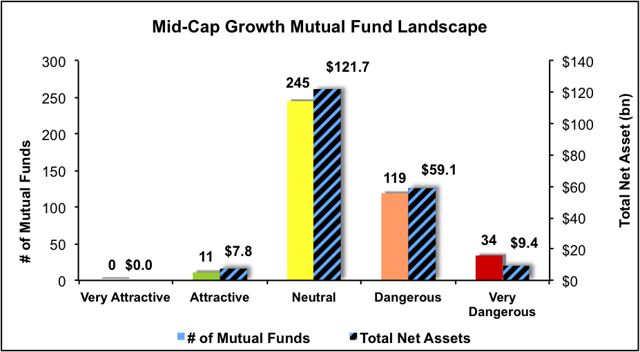

Summary Mid Cap Growth style ranks eighth in Q2’15. Based on an aggregation of ratings of 11 ETFs and 409 mutual funds. IJK is our top rated Mid Cap Growth ETF and IMIDX is our top rated Mid Cap Growth mutual fund. The Mid Cap Growth style ranks eighth out of the 12 fund styles as detailed in our Q2’15 Style Ratings report. It gets our Dangerous rating, which is based on an aggregation of ratings of 11 ETFs and 409 mutual funds in the Mid Cap Growth style. Figures 1 and 2 show the five best and worst rated ETFs and mutual funds in the style. Not all Mid Cap Growth style ETFs and mutual funds are created the same. The number of holdings varies widely (from 24 to 623). This variation creates drastically different investment implications and, therefore, ratings. Investors seeking exposure to the Mid Cap Growth style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2. Figure 1: ETFs with the Best & Worst Ratings – Top 5 (click to enlarge) * Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity. Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity. The iShares S&P Mid-Cap 400 Growth ETF (NYSEARCA: IJK ) is our top-rated Mid Growth ETF and the C ongress Mid Cap Growth Fund Inst (MUTF: IMIDX ) is our top-rated Mid Cap Growth mutual fund. Both earn our Attractive rating. CF Industries Holdings (NYSE: CF ) is one of our favorite stocks held by Mid Cap Growth ETFs and mutual funds. CF has grown after-tax profit ( NOPAT ) by 14% compounded annually for the past five years and currently earns a 21% return on invested capital ( ROIC ) that places it in the top quintile of all companies we cover. CF has also generated positive economic earnings every year since 2007. The best news of all is that the market’s expectations for CF are very low, which leaves the company largely undervalued at its current price of ~$63/share. If CF can grow NOPAT by 10% compounded annually for the next five years , the stock is worth $85/share today – a 35% upside. CF’s track record of 14% compounded annual profit growth and strong returns on capital suggests that the market’s expectations should be easily achievable. The Ark Industrial Innovation ETF (NYSEARCA: ARKQ ) is our worst-rated Mid Cap Growth ETF and The Goodwood SMID Cap Discovery Fund (MUTF: GAMAX ) is our worst rated Mid Cap Growth mutual fund. ARKQ earns our Neutral rating and GAMAX earns our Very Dangerous rating. One of the worst stocks in Mid Cap Growth ETFs and mutual funds is Tuesday Morning Corporation (NASDAQ: TUES ). Since 2009 the company’s ROIC has never exceeded 5%. However, the company’s cost of capital (WACC) has been greater than ROIC over the same time frame. This has contributed to negative economic earnings every year for the past six years. NOPAT growth has been equally disappointing and over the last four years and has declined by 12% compounded annually over this timeframe. The decline is even more pronounced over longer periods. Over the last decade NOPAT has fallen from $69 million in 2004 to $9 million in 2014. NOPAT margin over this period has also declined from 8% in 2004 to just 1% in 2014. Despite low NOPAT growth and shareholder value destruction, the company has nearly tripled in share price since 2011, making the stock very overvalued. To justify its current price of $14/ share, the company would need to grow NOPAT by 20% for the next 15 years . This seems highly unlikely given Tuesday Morning’s consistently declining profits over the past decade. Figures 3 and 4 show the rating landscape of all Mid Cap Growth ETFs and mutual funds. Figure 3: Separating the Best ETFs From the Worst ETFs (click to enlarge) Figure 4: Separating the Best Mutual Funds From the Worst Funds (click to enlarge) Sources Figures 1-4: New Constructs, LLC and company filings D isclosure: David Trainer and Allen L. Jackson receive no compensation to write about any specific stock, style, style or theme. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Mid Cap Growth style ranks eighth in Q2’15. Based on an aggregation of ratings of 11 ETFs and 409 mutual funds. IJK is our top rated Mid Cap Growth ETF and IMIDX is our top rated Mid Cap Growth mutual fund. The Mid Cap Growth style ranks eighth out of the 12 fund styles as detailed in our Q2’15 Style Ratings report. It gets our Dangerous rating, which is based on an aggregation of ratings of 11 ETFs and 409 mutual funds in the Mid Cap Growth style. Figures 1 and 2 show the five best and worst rated ETFs and mutual funds in the style. Not all Mid Cap Growth style ETFs and mutual funds are created the same. The number of holdings varies widely (from 24 to 623). This variation creates drastically different investment implications and, therefore, ratings. Investors seeking exposure to the Mid Cap Growth style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2. Figure 1: ETFs with the Best & Worst Ratings – Top 5 (click to enlarge) * Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity. Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity. The iShares S&P Mid-Cap 400 Growth ETF (NYSEARCA: IJK ) is our top-rated Mid Growth ETF and the C ongress Mid Cap Growth Fund Inst (MUTF: IMIDX ) is our top-rated Mid Cap Growth mutual fund. Both earn our Attractive rating. CF Industries Holdings (NYSE: CF ) is one of our favorite stocks held by Mid Cap Growth ETFs and mutual funds. CF has grown after-tax profit ( NOPAT ) by 14% compounded annually for the past five years and currently earns a 21% return on invested capital ( ROIC ) that places it in the top quintile of all companies we cover. CF has also generated positive economic earnings every year since 2007. The best news of all is that the market’s expectations for CF are very low, which leaves the company largely undervalued at its current price of ~$63/share. If CF can grow NOPAT by 10% compounded annually for the next five years , the stock is worth $85/share today – a 35% upside. CF’s track record of 14% compounded annual profit growth and strong returns on capital suggests that the market’s expectations should be easily achievable. The Ark Industrial Innovation ETF (NYSEARCA: ARKQ ) is our worst-rated Mid Cap Growth ETF and The Goodwood SMID Cap Discovery Fund (MUTF: GAMAX ) is our worst rated Mid Cap Growth mutual fund. ARKQ earns our Neutral rating and GAMAX earns our Very Dangerous rating. One of the worst stocks in Mid Cap Growth ETFs and mutual funds is Tuesday Morning Corporation (NASDAQ: TUES ). Since 2009 the company’s ROIC has never exceeded 5%. However, the company’s cost of capital (WACC) has been greater than ROIC over the same time frame. This has contributed to negative economic earnings every year for the past six years. NOPAT growth has been equally disappointing and over the last four years and has declined by 12% compounded annually over this timeframe. The decline is even more pronounced over longer periods. Over the last decade NOPAT has fallen from $69 million in 2004 to $9 million in 2014. NOPAT margin over this period has also declined from 8% in 2004 to just 1% in 2014. Despite low NOPAT growth and shareholder value destruction, the company has nearly tripled in share price since 2011, making the stock very overvalued. To justify its current price of $14/ share, the company would need to grow NOPAT by 20% for the next 15 years . This seems highly unlikely given Tuesday Morning’s consistently declining profits over the past decade. Figures 3 and 4 show the rating landscape of all Mid Cap Growth ETFs and mutual funds. Figure 3: Separating the Best ETFs From the Worst ETFs (click to enlarge) Figure 4: Separating the Best Mutual Funds From the Worst Funds (click to enlarge) Sources Figures 1-4: New Constructs, LLC and company filings D isclosure: David Trainer and Allen L. Jackson receive no compensation to write about any specific stock, style, style or theme. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News