Scalper1 News

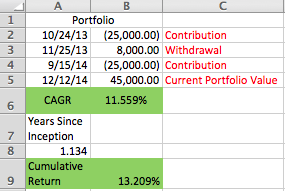

Summary Benchmarking your portfolio is very important. The math involved in tracking portfolios can be complex and confusing. A good investor always knows how well they are doing and how they can improve. Benchmarking is the first step to get there. One of my favorite SA contributors, Dale Roberts, recently posted a great article entitled “Are You Beating The Market? It’s Important To Know.” The article was informative and right on the money. Dale explains the importance of benchmarking and how a few percentage point difference each year can add up to big money. Stock pickers should not be the only ones benchmarking their portfolio’s returns. If you have any money with a financial advisor, you should try to benchmark them as well. After all, if they consistently lose to the benchmark by more than 1 percentage point, then why are you paying them to manage your money? I would like to spring board off of Dale’s article and give SA readers the tools to benchmark themselves to any given index of their choice. Before we get started, I would like to start with some basics. As Dale points out in his article, investors should be careful to benchmark themselves to appropriate indexes. To choose an index the first question one should ask themselves is – “If I wasn’t picking my own stocks, where would I put my money?” It’s ok to use a mutual fund or an ETF as a benchmark. Actually, it may even be better. Using an index as a benchmark means no expenses or transaction fees. Yet, if you chose to actually invest in an index, there would be real expenses (think of SPY (NYSEARCA: SPY ) with brokerage commissions and expense ratios). Therefore, it may make more sense to find an ETF that tracks the index you choose, and use the ETF as your benchmark. So long as the ETF is passively tracking the index you choose, you will end up with a more realistic picture of what your returns would be. The easiest is, if you can find an ETF or mutual fund that will allocate its assets exactly how you would if you decided to invest passively. Unfortunately, that scenario is unlikely. Most of us would make the choice to hold a certain amount of bonds, stocks, commodities, and other assets. Therefore, we are stuck with the unpleasant task of assembling and keeping track of these indices. Before I get started on how to benchmark yourself, you should be aware that there are some free online tools that can help with this. Check out low-risk-investing.com . It allows you to put in any stocks, ETFs, and mutual funds to compare to the S&P 500. However, if your portfolio changes (i.e. you buy and sell during the year) this tool will not help you benchmark yourself over the long term. Furthermore, it assumes you weight each security evenly. Since that is usually not the case for most investors, I would like to show you how to do this yourself. Tracking Your Portfolio – Crash Course Tracking your portfolio should be easy, but it rarely is. When I first started learning finance, I searched online for how to calculate the CAGR of a portfolio (for benchmarking purposes, as well as just knowing how I was doing) and found that there are very few articles that go through the math involved, especially the part dealing with money flowing in and out of the portfolio. Yet, this is math that is used everyday in the institutional world of finance. Mutual funds must publish their returns, despite the inflows and outflows that occur everyday. Portfolio tracking can quickly get complicated when you need to start adjusting for money you contribute and withdraw. As far as I know, no free online tracker is able to make these adjustments, which means you will need to learn how to do it yourself (if anyone knows of one, please tell me in the comment section). Fortunately, I will explain how to do this using excel. ( Using Google Finance to compare your portfolio to the S&P 500 is tough if you add money to the account. Here’s a chart of an IRA with contributions each year for the last 4 years.) (click to enlarge) In order to get the above IRA into numbers that can actually be used to compare to the S&P 500 one should use the XIRR function in Excel. I feel that most SA readers will have no problem learning to use this function, but for the few that aren’t as computer savvy, I will show a picture of what this may look like. (The red text is to show you what each number represents.) The most important thing to remember is that numbers representing going into the portfolio need to be the opposite of the amount going in. In the above image, I use negatives for the money going into my brokerage and positive for the amount I take out and for the current value. (The reason I use negatives for contributions is simply because I find it easier to use the ending value as a positive.) Once you put in the dates and the amounts contributed or withdrawn (keeping them positive for withdrawals and negative for contributions), you will then enter in today’s date and the total value of your portfolio. In the next box, you will type in the following: =XIRR( Once that is done, a small window will pop-up telling you to put in “values” which is the amounts and the dates. You will drag your mouse over the amounts then put in a comma. You will then drag your mouse over the dates. Ignore the “guess” and just end the function with a ” ). ” It should look something like this: =XIRR(B2:B5,A2:A5) The number that the function will give you is the compounded annualized growth rate [CAGR] of your portfolio. If you would like to turn that into a cumulative return amount, you will need two more formulas. Time in years. To calculate this you will type into a box the following formula: = (A5-$A$2)/365 This will put the dates of your portfolio into how many years your portfolio has existed. 2. Next you will use the following formula to calculate your portfolio’s cumulative return: =(1* ( ( 1+ B6 ) ^ A8) )-1 Now that you have both the CAGR and the cumulative return of your return, you can now compare it to any other investment – including your friends’. Fees – If you have any fees that are paid out of the portfolio (i.e. to an asset manager), you do not count these as withdrawals. However, if you pay these fees from outside the account (some people do this so that their money manager doesn’t need to accumulate dividends to get paid, instead he can reinvest them knowing he will be paid from outside of the portfolio), then you should account for these as contributions to your account. Think of it as putting money into your account so that you can pay those fees. Your Benchmark After choosing a benchmark you will be using the XIRR function to compare your returns. The most important thing will be getting the starting price of the index, ETF, or mutual fund that you choose. You must make sure you get the price from the same date that you started your portfolio from. After all, the purpose is comparing your returns to the benchmarks over the same time frame. Accounting for Dividends When calculating the returns of your benchmark you must make sure you include the dividends!! I can’t stress this enough. Every year a few clients walk in by tax season and tell us how they are doing better than the S&P 500. They can even show you the math. I always feel terrible (ok, I really don’t because I enjoy one upping everyone) when I show them that they forgot to account for dividends. Ask any of the DGI’s here on SA and they will tell you that a large portion of their returns comes from those dividends. And if those dividends are then reinvested, they can be huge. Moral of the story, always make sure your accounting for dividends. There are two ways to account for dividends. If you are keeping your dividends in your brokerage account to reinvest, whether in the stock that paid the dividend or in another stock, then you should make sure that your benchmark includes the result of dividends being reinvested. If you are withdrawing your dividends, which is usually the case in retirement, then you should account for those withdrawals in your benchmark as well. The S&P 500 Price Index is worthless as a benchmark! Now that we’ve covered that, I would like to introduce you to the S&P 500 TR (Total Return). This is an index that tracks the S&P 500 and reinvests all dividends (see here for historical prices ). There is also the S&P 500 Net TR, which tracks those same returns minus the tax consequences of the dividends (sorry, I can’t seem to find historical prices going back more than 2 years for the Net TR). You should really use the S&P 500 TR for tax-deferred accounts and the Net TR for taxable accounts. To account for the tax consequence of you own portfolio, you should calculate the taxes your portfolio causes you to pay, and then put this amount in as a contribution into the account. This is similar to the fees some people pay from outside their account mentioned above. (If your taxes for the year are lower because of losses in your portfolio, then account for this as a draw. It’s like you took money out of the portfolio, without the valuing of your portfolio going down.) Taxes can have a major impact on your portfolio, especially if you find that you don’t hold securities for more than 12 months at a time. So it is important to try to account for taxes in your portfolio as well. Note: S&P 500 Net TR accounts for taxes using the highest marginal tax bracket. If you don’t fall into that bracket, you may want to use the Total Return index and then make your own entries for taxes using your personal tax bracket percentage. If you are using an ETF or mutual fund as your benchmark, you will have to account for the tax consequences of these investments as well. As I said, benchmarking can be complex and annoying. Yet, if you are truly interested in seeing how well you are doing, then this is the way to do it. Asset Allocation Now that you know how to track an index, let’s discuss tracking multiple indices so that you can benchmark how well you would have done had you allocated your portfolio over various assets. Imagine you had decided to benchmark yourself to The Permanent Portfolio. This is a portfolio made up of stocks, bonds, cash, and gold, each making up 25% of the portfolio. You decide your benchmark will be rebalanced every quarter (instead of every year or every month). The quickest way to track this benchmark would be to use an online portfolio tracker (such as the one mentioned above, low-risk-investing.com ). However, if you’d like to do it yourself, then find an online portfolio that is able to also add dividends to your cash (such as Google Finance). Every quarter you will rebalance (making sure to reinvest those dividends if appropriate) and see what the ending value is. Plug that ending number into your spreadsheet. Now you have your benchmark and its performance. For those willing to take the time and do the math, if you find that you are beating the market you will be rewarded with a great feeling knowing that you are doing a good job. As for those of you who are not beating the market, you should try to figure out why. It’s ok if you aren’t “winning.” But you may have to ask yourself some tough questions. As Dale wrote, is your enjoyment picking stocks worth $600,000 in retirement money? Perhaps you should move more of your money into your benchmark. Scalper1 News

Summary Benchmarking your portfolio is very important. The math involved in tracking portfolios can be complex and confusing. A good investor always knows how well they are doing and how they can improve. Benchmarking is the first step to get there. One of my favorite SA contributors, Dale Roberts, recently posted a great article entitled “Are You Beating The Market? It’s Important To Know.” The article was informative and right on the money. Dale explains the importance of benchmarking and how a few percentage point difference each year can add up to big money. Stock pickers should not be the only ones benchmarking their portfolio’s returns. If you have any money with a financial advisor, you should try to benchmark them as well. After all, if they consistently lose to the benchmark by more than 1 percentage point, then why are you paying them to manage your money? I would like to spring board off of Dale’s article and give SA readers the tools to benchmark themselves to any given index of their choice. Before we get started, I would like to start with some basics. As Dale points out in his article, investors should be careful to benchmark themselves to appropriate indexes. To choose an index the first question one should ask themselves is – “If I wasn’t picking my own stocks, where would I put my money?” It’s ok to use a mutual fund or an ETF as a benchmark. Actually, it may even be better. Using an index as a benchmark means no expenses or transaction fees. Yet, if you chose to actually invest in an index, there would be real expenses (think of SPY (NYSEARCA: SPY ) with brokerage commissions and expense ratios). Therefore, it may make more sense to find an ETF that tracks the index you choose, and use the ETF as your benchmark. So long as the ETF is passively tracking the index you choose, you will end up with a more realistic picture of what your returns would be. The easiest is, if you can find an ETF or mutual fund that will allocate its assets exactly how you would if you decided to invest passively. Unfortunately, that scenario is unlikely. Most of us would make the choice to hold a certain amount of bonds, stocks, commodities, and other assets. Therefore, we are stuck with the unpleasant task of assembling and keeping track of these indices. Before I get started on how to benchmark yourself, you should be aware that there are some free online tools that can help with this. Check out low-risk-investing.com . It allows you to put in any stocks, ETFs, and mutual funds to compare to the S&P 500. However, if your portfolio changes (i.e. you buy and sell during the year) this tool will not help you benchmark yourself over the long term. Furthermore, it assumes you weight each security evenly. Since that is usually not the case for most investors, I would like to show you how to do this yourself. Tracking Your Portfolio – Crash Course Tracking your portfolio should be easy, but it rarely is. When I first started learning finance, I searched online for how to calculate the CAGR of a portfolio (for benchmarking purposes, as well as just knowing how I was doing) and found that there are very few articles that go through the math involved, especially the part dealing with money flowing in and out of the portfolio. Yet, this is math that is used everyday in the institutional world of finance. Mutual funds must publish their returns, despite the inflows and outflows that occur everyday. Portfolio tracking can quickly get complicated when you need to start adjusting for money you contribute and withdraw. As far as I know, no free online tracker is able to make these adjustments, which means you will need to learn how to do it yourself (if anyone knows of one, please tell me in the comment section). Fortunately, I will explain how to do this using excel. ( Using Google Finance to compare your portfolio to the S&P 500 is tough if you add money to the account. Here’s a chart of an IRA with contributions each year for the last 4 years.) (click to enlarge) In order to get the above IRA into numbers that can actually be used to compare to the S&P 500 one should use the XIRR function in Excel. I feel that most SA readers will have no problem learning to use this function, but for the few that aren’t as computer savvy, I will show a picture of what this may look like. (The red text is to show you what each number represents.) The most important thing to remember is that numbers representing going into the portfolio need to be the opposite of the amount going in. In the above image, I use negatives for the money going into my brokerage and positive for the amount I take out and for the current value. (The reason I use negatives for contributions is simply because I find it easier to use the ending value as a positive.) Once you put in the dates and the amounts contributed or withdrawn (keeping them positive for withdrawals and negative for contributions), you will then enter in today’s date and the total value of your portfolio. In the next box, you will type in the following: =XIRR( Once that is done, a small window will pop-up telling you to put in “values” which is the amounts and the dates. You will drag your mouse over the amounts then put in a comma. You will then drag your mouse over the dates. Ignore the “guess” and just end the function with a ” ). ” It should look something like this: =XIRR(B2:B5,A2:A5) The number that the function will give you is the compounded annualized growth rate [CAGR] of your portfolio. If you would like to turn that into a cumulative return amount, you will need two more formulas. Time in years. To calculate this you will type into a box the following formula: = (A5-$A$2)/365 This will put the dates of your portfolio into how many years your portfolio has existed. 2. Next you will use the following formula to calculate your portfolio’s cumulative return: =(1* ( ( 1+ B6 ) ^ A8) )-1 Now that you have both the CAGR and the cumulative return of your return, you can now compare it to any other investment – including your friends’. Fees – If you have any fees that are paid out of the portfolio (i.e. to an asset manager), you do not count these as withdrawals. However, if you pay these fees from outside the account (some people do this so that their money manager doesn’t need to accumulate dividends to get paid, instead he can reinvest them knowing he will be paid from outside of the portfolio), then you should account for these as contributions to your account. Think of it as putting money into your account so that you can pay those fees. Your Benchmark After choosing a benchmark you will be using the XIRR function to compare your returns. The most important thing will be getting the starting price of the index, ETF, or mutual fund that you choose. You must make sure you get the price from the same date that you started your portfolio from. After all, the purpose is comparing your returns to the benchmarks over the same time frame. Accounting for Dividends When calculating the returns of your benchmark you must make sure you include the dividends!! I can’t stress this enough. Every year a few clients walk in by tax season and tell us how they are doing better than the S&P 500. They can even show you the math. I always feel terrible (ok, I really don’t because I enjoy one upping everyone) when I show them that they forgot to account for dividends. Ask any of the DGI’s here on SA and they will tell you that a large portion of their returns comes from those dividends. And if those dividends are then reinvested, they can be huge. Moral of the story, always make sure your accounting for dividends. There are two ways to account for dividends. If you are keeping your dividends in your brokerage account to reinvest, whether in the stock that paid the dividend or in another stock, then you should make sure that your benchmark includes the result of dividends being reinvested. If you are withdrawing your dividends, which is usually the case in retirement, then you should account for those withdrawals in your benchmark as well. The S&P 500 Price Index is worthless as a benchmark! Now that we’ve covered that, I would like to introduce you to the S&P 500 TR (Total Return). This is an index that tracks the S&P 500 and reinvests all dividends (see here for historical prices ). There is also the S&P 500 Net TR, which tracks those same returns minus the tax consequences of the dividends (sorry, I can’t seem to find historical prices going back more than 2 years for the Net TR). You should really use the S&P 500 TR for tax-deferred accounts and the Net TR for taxable accounts. To account for the tax consequence of you own portfolio, you should calculate the taxes your portfolio causes you to pay, and then put this amount in as a contribution into the account. This is similar to the fees some people pay from outside their account mentioned above. (If your taxes for the year are lower because of losses in your portfolio, then account for this as a draw. It’s like you took money out of the portfolio, without the valuing of your portfolio going down.) Taxes can have a major impact on your portfolio, especially if you find that you don’t hold securities for more than 12 months at a time. So it is important to try to account for taxes in your portfolio as well. Note: S&P 500 Net TR accounts for taxes using the highest marginal tax bracket. If you don’t fall into that bracket, you may want to use the Total Return index and then make your own entries for taxes using your personal tax bracket percentage. If you are using an ETF or mutual fund as your benchmark, you will have to account for the tax consequences of these investments as well. As I said, benchmarking can be complex and annoying. Yet, if you are truly interested in seeing how well you are doing, then this is the way to do it. Asset Allocation Now that you know how to track an index, let’s discuss tracking multiple indices so that you can benchmark how well you would have done had you allocated your portfolio over various assets. Imagine you had decided to benchmark yourself to The Permanent Portfolio. This is a portfolio made up of stocks, bonds, cash, and gold, each making up 25% of the portfolio. You decide your benchmark will be rebalanced every quarter (instead of every year or every month). The quickest way to track this benchmark would be to use an online portfolio tracker (such as the one mentioned above, low-risk-investing.com ). However, if you’d like to do it yourself, then find an online portfolio that is able to also add dividends to your cash (such as Google Finance). Every quarter you will rebalance (making sure to reinvest those dividends if appropriate) and see what the ending value is. Plug that ending number into your spreadsheet. Now you have your benchmark and its performance. For those willing to take the time and do the math, if you find that you are beating the market you will be rewarded with a great feeling knowing that you are doing a good job. As for those of you who are not beating the market, you should try to figure out why. It’s ok if you aren’t “winning.” But you may have to ask yourself some tough questions. As Dale wrote, is your enjoyment picking stocks worth $600,000 in retirement money? Perhaps you should move more of your money into your benchmark. Scalper1 News

Scalper1 News