CF Industries Holdings Inc. ( CF ) is expected to see sharply lower earnings in 2016 as the fertilizer market remains weak. This Zacks Rank #5 (Strong Sell) is forecast to see earnings drop by almost half this year.

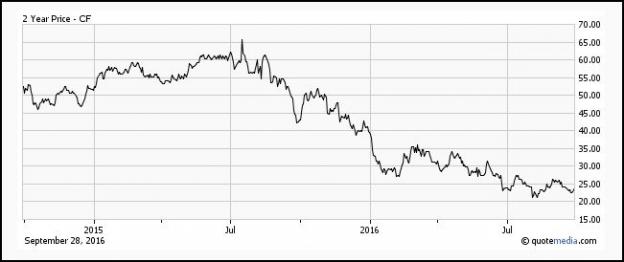

CF Industries is one of the largest manufacturers of nitrogen products in the world. It operates nitrogen manufacturing complexes in the US, Canada and the United Kingdom with customers throughout the world. It also owns a 50% interest in an ammonia facility in the Republic of Trinidad and Tobago. A Tough 2016 On Aug 3, CF reported second quarter results and, for the fourth quarter in a row, it missed on the Zacks Consensus Estimate as the fertilizer market remained weak. They haven’t been small misses either. The second quarter miss was by $ 0.35. It reported just $ 0.33 but the analysts were expecting $ 0.68. Fertilizer prices in North America continue to be pressured. Wet and cool weather delayed fertilizer applications in the second quarter and a high level of imported products in April and May pressured prices. Net sales declined to $ 1.13 billion from $ 1.3 billion in the second quarter of 2015 due to lower selling prices across all segments. There continues to be a worldwide oversupply of nitrogen products which is impacting prices. Estimates Slashed Again Given the big miss and the weak outlook in the industry, the analysts have been cutting both 2016 and 2017 estimates. The 2016 Zacks Consensus Estimate has fallen to $ 1.18 from $ 1.32 in the past 30 days. That is down from $ 2.00 just 90 days ago. CF Industries made $ 3.88 in 2015 so that’s an earnings decline of 69.5%. 2017 isn’t looking much better, although the analysts do see a floor in the earnings drop. They’ve been cutting 2017 estimates as well. The 2017 Zacks Consensus Estimate is now down to $ 1.29 from $ 2.27 just 3 months ago. That’s an earnings increase of 9%, but it’s not much to cheer about given the huge cut in earnings in 2016. It does, however, indicate that the analysts expect some stabilization in fertilizer prices in 2017. Shares Hit 2-Year Low Shares continue to sink as the outlook for the fertilizer industry for the rest of the year is negative.  Does this make CF Industries a value stock? Even with the shares hitting new lows, it’s still trading with a high forward P/E of 19.3. I wouldn’t consider it a value stock just yet. The rest of the industry is seeing the same thing. There’s no where for investors to hide out. But Potash ( POT ) and Agrium ( AGU ) have decided to merge. That merger could have implications on the remaining big suppliers like CF Industries and Mosaic ( MOS ). Want to know more about what is happening in the fertilizer industry? Check out this podcast discussing if or when there may be a turnaround in this industry. More Stocks to Sell. Now. Beyond our Bear Stock of the Day, today’s list of 220 Zacks Rank #5 Strong Sells demand even more urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. Many appear to be sound investments but, since 1988, such stocks have actually performed more than 11X worse than the S&P 500. See today’s Zacks “”Strong Sells”” absolutely free >>.

Does this make CF Industries a value stock? Even with the shares hitting new lows, it’s still trading with a high forward P/E of 19.3. I wouldn’t consider it a value stock just yet. The rest of the industry is seeing the same thing. There’s no where for investors to hide out. But Potash ( POT ) and Agrium ( AGU ) have decided to merge. That merger could have implications on the remaining big suppliers like CF Industries and Mosaic ( MOS ). Want to know more about what is happening in the fertilizer industry? Check out this podcast discussing if or when there may be a turnaround in this industry. More Stocks to Sell. Now. Beyond our Bear Stock of the Day, today’s list of 220 Zacks Rank #5 Strong Sells demand even more urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. Many appear to be sound investments but, since 1988, such stocks have actually performed more than 11X worse than the S&P 500. See today’s Zacks “”Strong Sells”” absolutely free >>.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

POTASH SASK (POT): Free Stock Analysis Report

MOSAIC CO/THE (MOS): Free Stock Analysis Report

CF INDUS HLDGS (CF): Free Stock Analysis Report

AGRIUM INC (AGU): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International