Bayer AG’s BAYRY fourth-quarter 2016 core earnings increased 10.2% year over year to €1.19 per share (approximately $ 1.28). Reported earnings missed the Zacks Consensus Estimate of $ 1.37.

Total sales in the fourth quarter improved 4.7% to €11.8 billion (approximately $ 12.7billion) on a reported basis. Quarterly sales were in line with the Zacks Consensus Estimate of $ 12.7 billion.

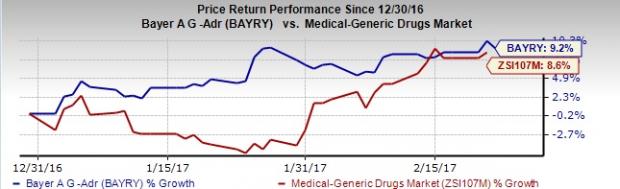

Bayer’s share price has gained 9.2% year to date, while the Zacks classified Medical Generic Drugs industry gained 8.6%.

All growth rates mentioned below are on a year-over-year basis and after adjusting for currency and portfolio changes.

2016 Highlights

Bayer’s full year 2016 earnings increased 7.3% to €7.32 per share (approximately $ 8.1). Reported earnings beat the Zacks Consensus Estimate of $ 7.94.

Total sales in 2016 improved 1.5% to €46.7 billion (approximately $ 51.8 billion) on a reported basis. Sales missed the Zacks Consensus Estimate of $ 53.3 billion.

Effective from the first quarter, Bayer reports results under five divisions – Pharmaceuticals, Consumer Health, Crop Science, Animal Health and Covestro.

Revenues at the Pharmaceuticals segment increased 8.7% backed by a persistently strong performance of the key products Xarelto, Eylea, Xofigo, Stivarga and Adempas. Performance of the other leading pharmaceutical products, Mirena posted significant growth in 2016, due to positive pricing along with the launch of the new low-dose intrauterine device Kyleena. Sales of Gadavist/Gadovist and Aspirin also grow strongly in 2016.

However, sales of the multiple sclerosis treatment Betaferon/Betaseron declined mainly due to weaker business performance in Europe and the U.S.

Consumer Health sales were up 3.5% to €6.0 billion driven by improvement across all regions including Latin America and Asia/Pacific regions. Europe/Middle East/ Africa also led to slight increase in revenues. Products like Elevit and Bepanthen/Bepanthol recorded encouraging sales growth. However, sales in Asia/Pacific were down year over year due to intensified competition and price controls for prescription medicines in Japan.

Crop Science sales were €9.9 billion in 2016 down 2.1% year over year due to the ongoing market weakness. While fungicides registered growth, insecticides and herbicides were down.

Sales of the Animal Health business came in at €1,523 million, up 4.8%. The North America and Asia/Pacific regions developed especially positively due to higher demand. The Seresto flea and tick collar posted very strong sales growth of 55.4% and sales of the Advantage family of flea, tick and worm control products were at par with the previous year.

Covestro garnered sales of approximately €11.9 billion in 2016, relatively flat year over year

Acquisition

Bayer is looking to acquire Monsanto Company MON in an all-cash transaction worth approximately $ 66 billion. The combined business is expected to boost Bayer’s Crop Science business and provide accretion to its core earnings from the first full year of the closing of the transaction (slated to close before the end of 2017), followed by double-digit percentage growth. Bayer also expects annual earnings contributions of around $ 1.5 billion from synergies after three years of closing the transaction, as well as additional future benefits from integrated offerings. In December 2016, Monsanto’s stockholders approved the transaction.

Bayer has also made progress in the necessary antitrust proceedings and has already applied for clearance from some two-thirds of around 30 authorities. Bayer and Monsanto are working closely with the authorities. The proposed Monsanto acquisition is a strategic move which will offer Bayer with a broad set of solutions to meet farmers’ current and future needs.

2017 Earnings Outlook

Bayer expects the positive development to continue in fiscal 2017. Sales of the Bayer Group including Covestro are expected to increase to more than €49 billion in 2017. The Life Science businesses are anticipated to rake in sales of approximately €37 billion. This corresponds to growth in the mid single-digit percentage range.

At Pharmaceuticals, Bayer continues to projects sales to be above €17 billion, reflecting a mid-single-digit improvement. Sales of the key growth products Xarelto, Eylea, Stivarga, Xofigo and Adempas are expected to increase to more than €6 billion.

In the Consumer Health Division, sales are still anticipated to be more than €6 billion, indicating low-to-mid single-digit growth.

Bayer expects Crop Science sales are estimated to be above €10 billion, reflecting low-single-digit percentage increase.

At Animal Health, Bayer continues to expect sales to increase in the low-to-mid single-digit percentage range.

Bayer expects an increase in Covestro sales as well.

Our Take

Bayer missed earnings expectations but exceeded the revenues estimates in the fourth quarter of 2016. Newly launched products at the Pharmaceuticals segment performed impressively during the quarter and should continue to do so in the upcoming quarters. Meanwhile, Bayer is looking to acquire Monsanto in a deal worth approximately $ 66 billion. We note that by this acquisition, Bayer is aiming to become a global leader in agriculture.

Zacks Rank & Key Picks

Bayer currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the health care sector include Sunesis Pharmaceuticals SNSS and GlaxoSmithKline plc GSK . While Sunesis sports a Zacks Rank #1 (Strong Buy), GlaxoSmithKline carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here

Sunesis’ loss estimates narrowed by 5.06% and 8.80% for 2016 and 2017, respectively, over the past 30 days. The company recorded a positive earnings surprise in three of the last four quarters, the average being 0.54%.

GlaxoSmithKline’s earnings estimates increased from $ 2.64 to $ 2.76 for 2017 and from $ 2.78 to $ 2.85 for 2018 over the last 30 days. The company posted a positive earnings surprise in three of the four trailing quarters with an average beat of 11.03%. Its share price increased 4.4% year to date.

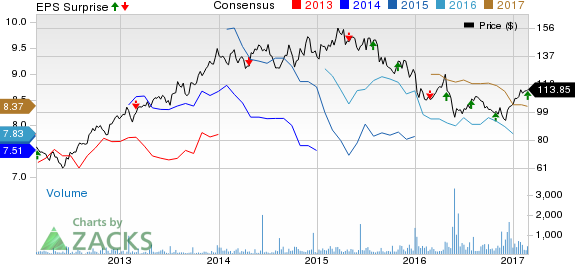

Bayer AG Price, Consensus and EPS Surprise

Bayer AG Price, Consensus and EPS Surprise | Bayer AG Quote

Zacks’ Top 10 Stocks for 2017

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2017? Who wouldn’t? Last year’s market-beating Top 10 portfolio produced 5 double-digit winners. For example, oil and natural gas giant Pioneer Natural Resources and First Republic Bank racked up stellar gains of +44.9% and +44.3% respectively. Now a brand-new list for 2017 has been hand-picked from 4,400 companies covered by the Zacks Rank. See the 2017 Top 10 right now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GlaxoSmithKline PLC (GSK): Free Stock Analysis Report

Bayer AG (BAYRY): Free Stock Analysis Report

Monsanto Company (MON): Free Stock Analysis Report

Sunesis Pharmaceuticals, Inc. (SNSS): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International