Beverage can maker, Ball Corporation BLL is scheduled to report fourth-quarter 2016 results before the opening bell on Feb 2. In the last-reported quarter, the company registered a year-over-year decline in earnings despite an increase in revenues. Let’s see how things are shaping up prior to this quarter.

Earnings Whispers

Our proven model does not conclusively show that Ball Corporation is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. However, that is not the case here, as you will see below.

Zacks ESP : Ball Corporation’s Earnings ESP is +0.00% as the Most Accurate estimate of 86 cents is in line with the Zacks Consensus Estimate. A positive Earnings ESP serves as a meaningful and leading indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank : Though Ball Corporation’s Zacks Rank #3 increases the predictive power of the ESP, its 0.00% ESP makes surprise prediction difficult. Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

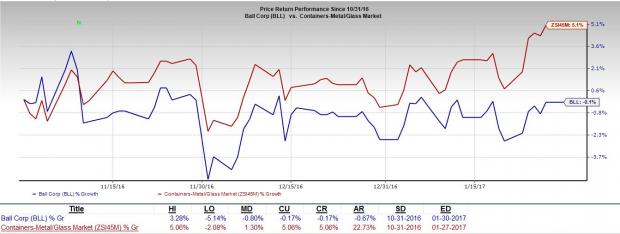

Price Performance

Ball Corporation’s share price has underperformed the Zacks categorized Containers- Metal/ Glass subindustry in the past three months. Ball Corporation’s share price has dipped 0.1% in contrast with 5.1% climb recorded by the sub industry over the said time frame.

Surprise History

In the last-reported quarter, the company posted a positive earnings surprise of 4.35%. Ball Corporation outpaced the Zacks Consensus Estimate in three out of the trailing four quarters, with an average positive surprise of 0.65%.

Ball Corporation Price and EPS Surprise

Ball Corporation Price and EPS Surprise | Ball Corporation Quote

Factors at Play this Quarter

In third-quarter, Ball Corporation shipped and invoiced salable cans from its new Myanmar facility. The company continued the previously-initiated European beverage cost-out initiatives, including the closure of the Berlin, Germany beverage can facility that was announced in Dec 2015. Further, the new Monterrey, Mexico facility continues to make production strides, while the Mexican domestic and export demand remains strong.

The company’s Aerospace and technologies business will benefit from a diverse portfolio of new contracts which will leverage its existing technologies and value-added approach to deliver solutions to customers. Contracted backlog grew to a record $ 1.4 billion at the end of third quarter, more than double the backlog at 2015 end. Ball Corporation is ramping up and staffing up for all of the new contracts which will benefit fourth-quarter 2016.

However, higher interest expense and undistributed expenses will hurt earnings in fourth-quarter 2016. Ball Corporation also continues to face headwinds in China business due to competitive pricing environment.

Stocks That Warrant a Look

Here are some stocks you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Cintas Corporation CTAS has an Earnings ESP of +0.94% and sports a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here .

AGCO Corporation AGCO has an Earnings ESP of +5.63 % and a Zacks Rank #3.

Deere & Company DE also carries a Zacks Rank #3 and has an Earnings ESP of +13.73%.

Now See Our Private Investment Ideas

While the above ideas are being shared with the public, other trades are hidden from everyone but selected members. Would you like to peek behind the curtain and view them? Starting today, for the next month, you can follow all Zacks’ private buys and sells in real time from value to momentum . . . from stocks under $ 10 to ETF and option moves . . . from insider trades to companies that are about to report positive earnings surprises (we’ve called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks’ secret trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ball Corporation (BLL): Free Stock Analysis Report

Cintas Corporation (CTAS): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International