Scalper1 News

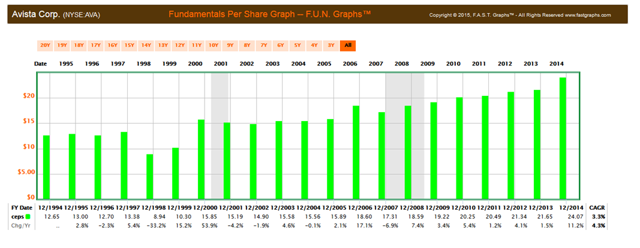

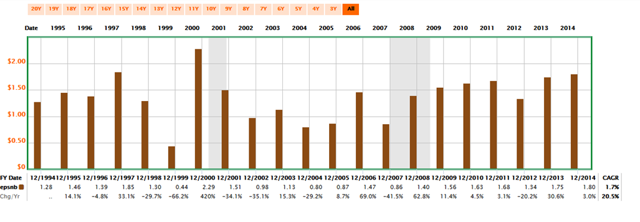

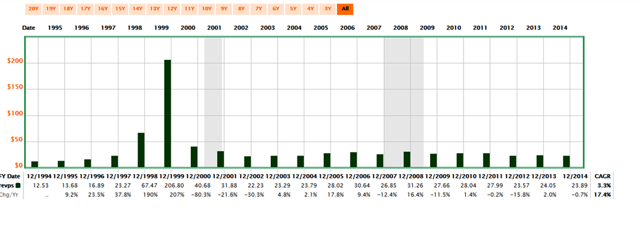

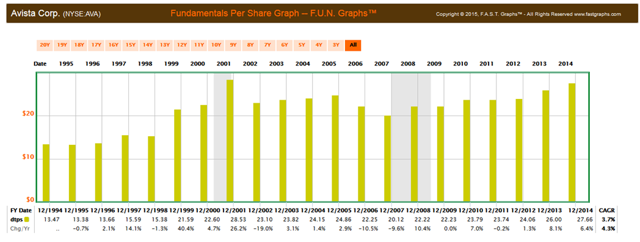

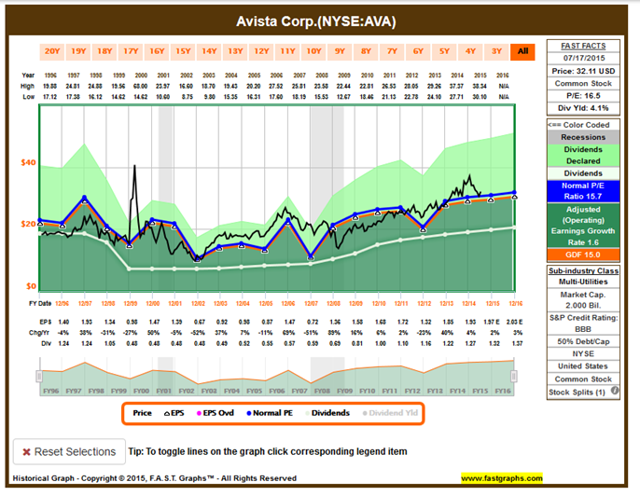

Summary Avista Corp has demonstrated a history of solid fundamental performance. There are currently a couple positive factors – mostly favorable rate case settlements – which should support earnings estimates going forward. Shares seem fairly priced at current levels – not a spectacular discount, but not overpriced, either. The Thesis The thesis here is that Avista (NYSE: AVA ) is a solid company in the utilities space with a history of solid fundamentals. While there are several specific company challenges, there are also some positive trends which should make earnings estimates realistic. At current share price levels (about $32), shares seem priced close to valuation. While not a screaming discount at the moment, this company may fill a need in a portfolio looking for dividend income and long-term growth. This article will review historical performance of company fundamentals, including past trend per-share results for book value, earnings, revenue, and debt. Several company-specific positive trends and challenges will be presented, and a suggested company valuation will be provided. Lastly, two specific strategies will be offered for consideration. Avista Corp: History of Fundamental Performance As usual I find my F.A.S.T. Graphs subscription to be very valuable to study a company’s fundamentals. Using the “F.U.N. Graphs” feature allows a visual of each company fundamental. To assess the trend of fundamentals for AVA, I chose to review metrics going back 20 years. This historical view gives evidence of management success or struggles in growing these particular fundamentals over time. Book Value Per Share Trends The ideal for this metric is a trend of steadily rising book value per share. Why? This number is difficult to manipulate and a rising metric suggests management has made decisions to add value over time. In my view, AVA demonstrates very effective growth of this metric, as demonstrated by the growing green bars over time. (click to enlarge) source: fastgraphs.com Earnings History In order to conduct a reasonable valuation analysis, earnings are a key metric to consider. Historical earnings are worthy of review, in my opinion, because a person gets data on consistency over time and several cycles. Of course the idea is for the company to generate consistent earnings growth over time. As the graph below seems to illustrate, AVA has delivered earnings over time. My read of this graph is that earnings are generally predictable, but not spectacularly so. Overall, given this space and how the company performs relative to peers, in my view AVA demonstrates a reasonable earnings growth historical track record. (click to enlarge) source: fastgraphs.com Revenue History As would be expected in this industry, revenue (not considering the anomaly in 1999) has been quite consistent. And given the company’s recent success with rate settlements, there is no reason to believe these trends will not remain supported for the foreseeable future. (click to enlarge) source: fastgraphs.com Debt The idea here is to review debt to gain a perspective on use of debt over time to finance company obligations. In my opinion, AVA has utilized debt as one would expect in this industry and management has delivered results which position the company well for the future. (click to enlarge) source: fastgraphs.com In my humble opinion, based on the data Avista Corp management has delivered a solid foundation of fundamental metrics over time. This suggests a level of predictability and offers balance sheet strength to build upon in the future. Company-Specific Trends This article suggests that AVA is about fairly priced right now – neither excessively overvalued or extremely undervalued. As one considers trends or issues that may impact earnings going forward, the following seem relevant: (sources include the company web-site, earnings calls and 10-k) Positive Trends The company is getting the benefit of the Alaska Electric Light & Power acquisition last summer Rate case settlements suggest earnings will increase for this year and 2016 Management continues guidance for consolidated earnings to be in the range of $1.86 to $2.06 per diluted share The board of directors raised the dividend for the first quarter Challenges AVA operates in a highly regulated environment – this tends to add costs and time to various initiatives Weather and costs are always a bit unpredictable; the weather affects sales as well as the cost of natural gas and supply power Energy resource risk management can affect earnings – the company hedges some commodity pricing costs and this can cause variability based on fluctuations All things considered, in my opinion AVA is well aware of the challenges of the environment and is doing an effective job to address those challenges going forward. The results are in the past fundamental performance and estimated results for the future. But what about the price to value relationship? This article suggests AVA is priced about to value. Let’s have a look at some data to substantiate this view. A Valuation Method When valuing a company, I like to compare that company against its own historical valuation. Again a F.A.S.T. Graphs subscription is an excellent tool to visually demonstrate the history of a company’s own valuation past record. In the chart below, the orange line represents earnings history and what could be considered “fair valuation” at a price/earnings multiple of 15X. The blue line represents an historic normalized average PE. Finally, the black line is the market price of AVA. Note that a normal PE for AVA over the past 20 years has been 15.7X earnings. When considering just the past 8 years since the Great Recession, the normal PE ratio has been about 15X earnings. Today AVA is priced at 16.5X earnings. Visually, the graph demonstrates this data well: first, notice how historically the market price (black line) follows the valuation line (blue PE line). And notice how today the black line (market price) is very near historical valuation lines. (click to enlarge) source: fastgraphs.com What Might Be A Strategy to Consider? AVA seems to present a potential opportunity for a person seeking dividend, but not expecting excessive upward price movement. If an individual desired to take a position, it may be reasonable to begin a position (albeit not 100% of the entire allocation to this company) at these levels. Alternatively, a person could consider selling puts (at a strike price below the current market price) as a possible way to either a)keep the premium if AVA rises or b)purchase shares at a discount from the price today. All of the above in my opinion offered for your consideration. Thank you very much for your time. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Avista Corp has demonstrated a history of solid fundamental performance. There are currently a couple positive factors – mostly favorable rate case settlements – which should support earnings estimates going forward. Shares seem fairly priced at current levels – not a spectacular discount, but not overpriced, either. The Thesis The thesis here is that Avista (NYSE: AVA ) is a solid company in the utilities space with a history of solid fundamentals. While there are several specific company challenges, there are also some positive trends which should make earnings estimates realistic. At current share price levels (about $32), shares seem priced close to valuation. While not a screaming discount at the moment, this company may fill a need in a portfolio looking for dividend income and long-term growth. This article will review historical performance of company fundamentals, including past trend per-share results for book value, earnings, revenue, and debt. Several company-specific positive trends and challenges will be presented, and a suggested company valuation will be provided. Lastly, two specific strategies will be offered for consideration. Avista Corp: History of Fundamental Performance As usual I find my F.A.S.T. Graphs subscription to be very valuable to study a company’s fundamentals. Using the “F.U.N. Graphs” feature allows a visual of each company fundamental. To assess the trend of fundamentals for AVA, I chose to review metrics going back 20 years. This historical view gives evidence of management success or struggles in growing these particular fundamentals over time. Book Value Per Share Trends The ideal for this metric is a trend of steadily rising book value per share. Why? This number is difficult to manipulate and a rising metric suggests management has made decisions to add value over time. In my view, AVA demonstrates very effective growth of this metric, as demonstrated by the growing green bars over time. (click to enlarge) source: fastgraphs.com Earnings History In order to conduct a reasonable valuation analysis, earnings are a key metric to consider. Historical earnings are worthy of review, in my opinion, because a person gets data on consistency over time and several cycles. Of course the idea is for the company to generate consistent earnings growth over time. As the graph below seems to illustrate, AVA has delivered earnings over time. My read of this graph is that earnings are generally predictable, but not spectacularly so. Overall, given this space and how the company performs relative to peers, in my view AVA demonstrates a reasonable earnings growth historical track record. (click to enlarge) source: fastgraphs.com Revenue History As would be expected in this industry, revenue (not considering the anomaly in 1999) has been quite consistent. And given the company’s recent success with rate settlements, there is no reason to believe these trends will not remain supported for the foreseeable future. (click to enlarge) source: fastgraphs.com Debt The idea here is to review debt to gain a perspective on use of debt over time to finance company obligations. In my opinion, AVA has utilized debt as one would expect in this industry and management has delivered results which position the company well for the future. (click to enlarge) source: fastgraphs.com In my humble opinion, based on the data Avista Corp management has delivered a solid foundation of fundamental metrics over time. This suggests a level of predictability and offers balance sheet strength to build upon in the future. Company-Specific Trends This article suggests that AVA is about fairly priced right now – neither excessively overvalued or extremely undervalued. As one considers trends or issues that may impact earnings going forward, the following seem relevant: (sources include the company web-site, earnings calls and 10-k) Positive Trends The company is getting the benefit of the Alaska Electric Light & Power acquisition last summer Rate case settlements suggest earnings will increase for this year and 2016 Management continues guidance for consolidated earnings to be in the range of $1.86 to $2.06 per diluted share The board of directors raised the dividend for the first quarter Challenges AVA operates in a highly regulated environment – this tends to add costs and time to various initiatives Weather and costs are always a bit unpredictable; the weather affects sales as well as the cost of natural gas and supply power Energy resource risk management can affect earnings – the company hedges some commodity pricing costs and this can cause variability based on fluctuations All things considered, in my opinion AVA is well aware of the challenges of the environment and is doing an effective job to address those challenges going forward. The results are in the past fundamental performance and estimated results for the future. But what about the price to value relationship? This article suggests AVA is priced about to value. Let’s have a look at some data to substantiate this view. A Valuation Method When valuing a company, I like to compare that company against its own historical valuation. Again a F.A.S.T. Graphs subscription is an excellent tool to visually demonstrate the history of a company’s own valuation past record. In the chart below, the orange line represents earnings history and what could be considered “fair valuation” at a price/earnings multiple of 15X. The blue line represents an historic normalized average PE. Finally, the black line is the market price of AVA. Note that a normal PE for AVA over the past 20 years has been 15.7X earnings. When considering just the past 8 years since the Great Recession, the normal PE ratio has been about 15X earnings. Today AVA is priced at 16.5X earnings. Visually, the graph demonstrates this data well: first, notice how historically the market price (black line) follows the valuation line (blue PE line). And notice how today the black line (market price) is very near historical valuation lines. (click to enlarge) source: fastgraphs.com What Might Be A Strategy to Consider? AVA seems to present a potential opportunity for a person seeking dividend, but not expecting excessive upward price movement. If an individual desired to take a position, it may be reasonable to begin a position (albeit not 100% of the entire allocation to this company) at these levels. Alternatively, a person could consider selling puts (at a strike price below the current market price) as a possible way to either a)keep the premium if AVA rises or b)purchase shares at a discount from the price today. All of the above in my opinion offered for your consideration. Thank you very much for your time. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News