Avery Dennison Corporation AVY is slated to report fourth-quarter 2016 results, before the opening bell on Feb 1.

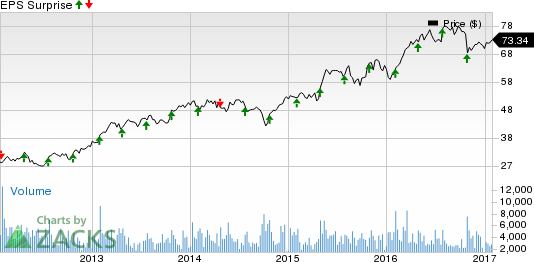

Last quarter, the company had posted a positive earnings surprise of 1.00%. Avery Dennison has beaten estimates in each of the trailing four quarters, with an average positive earnings surprise of 6.80%. Let’s see how things are shaping up for this announcement.

Let’s see how things are shaping up prior to this announcement.

Avery Dennison Corporation Price and EPS Surprise

Avery Dennison Corporation Price and EPS Surprise | Avery Dennison Corporation Quote

Factors at Play

Avery Dennison anticipates that sales in its retail branding and information solutions will remain sluggish in the fourth quarter, reflecting the difficult comparison to the prior year. Sales outside of RFID continue to be soft, down in low-single digits in the fourth quarter, reflecting modest growth in volume, which was more than offset by the impact of strategic pricing actions taken in late 2016.

Moreover, Avery Dennison believes that the transformation of its business model toward becoming more cost and price effective will boost performance. However, the challenging retail apparel environment will affect its results.

Earnings Whispers

Our proven model does not conclusively show that Avery Dennison is likely to beat earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below.

Zacks ESP: Avery Dennison has an Earnings ESP of 0.00%. That is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 93 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter .

Zacks Rank: Avery Dennison has a Zacks Rank #4 (Sell). Please note that we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

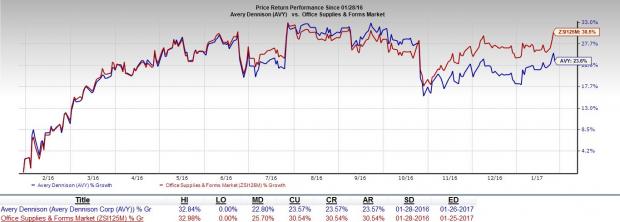

Share Price Performance

In the last one year, Avery Dennison has underperformed the Zacks classified Office Supplies & Forms sub-industry with respect to price performance. The stock gained 23.6%, while the industry rose 30.5% over the same time frame.

Stocks to Consider

Here are some companies you may consider as our model shows that they have the right combination of elements to post an earnings beat in the upcoming quarter:

Fairmount Santrol Holdings Inc. FMSA has a positive Earnings ESP of +19.24% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Optoelectronics, Inc. AAOI has an Earnings ESP of +106.74% and a Zacks Rank #1.

Deere & Company DE has an Earnings ESP of +13.73% and a Zacks Rank #3.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 “Strong Buy” stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 “Strong Sells” and other private research. See these stocks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Avery Dennison Corporation (AVY): Free Stock Analysis Report

Fairmount Santrol Holdings Inc. (FMSA): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International