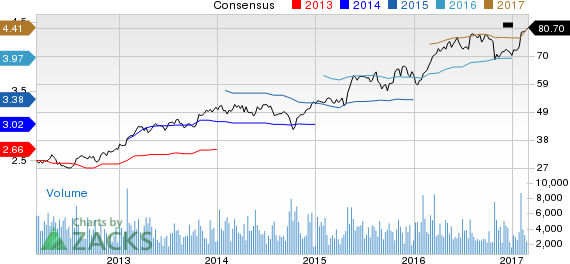

Shares of Avery Dennison Corporation AVY scaled a new 52-week high of $ 81.27 on Feb 27, before eventually closing the day’s trading at $ 80.70. The stock price appreciation came on the back of strong fourth-quarter results as well as an upbeat guidance.

This Pasadena, CA-based manufacturer of pressure-sensitive materials has a market cap of $ 7.11 billion. Average volume of shares traded in the last three months was approximately 769K. The stock flaunts a year-to-date return of 15.5%. The company has an impressive earnings history, having outperformed the Zacks Consensus Estimate in the trailing four quarters with an average positive surprise of 6.17%. The stock has an estimated long-term earnings growth of 7%.

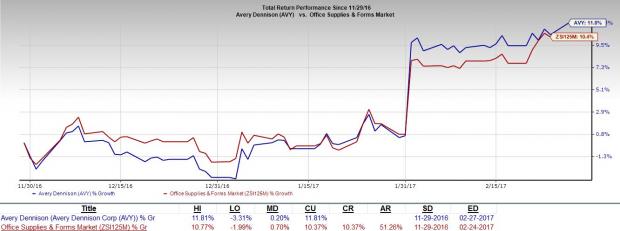

Avery Dennison’s shares have been outperforming the Zacks categorized Office Supplies & Forms sub industry for the last three months. Over the time period, the stock gained 11.8%, while the industry recorded growth of 10.4%.

Key Drivers

Avery Dennison reported upbeat results for fourth-quarter 2016 on Feb 1. Adjusted earnings of 99 cents per share climbed 16% from 85 cents earned in the year-ago quarter. Total revenue jumped 7% to $ 1,550.8 million from $ 1,454.8 million in the year-earlier quarter. Avery Dennison’s top-line and bottom-line both beat the respective Zacks Consensus Estimate. For 2017, the company expects adjusted earnings per share to lie in the range of $ 4.30-$ 4.50.

Avery Dennison Corporation Price and Consensus

Avery Dennison Corporation Price and Consensus | Avery Dennison Corporation Quote

The company witnessed volumes increase across customer categories in the last few quarters despite a difficult retail apparel market, demonstrating early success of its multi-year transformation strategy. Avery Dennison’s effort to reduce complexity as well as focus on cost structure, and qualify lower-cost locally sourced materials will support more competitive pricing.

Further, it will continue to increase the pace of investment to leverage specialty labels, graphics, and reflective solutions business, as demonstrated by the acquisitions of Mactac Europe, Hanita Coatings, and Ink Mill, as well as its investment to expand the plant in Luxembourg. Moreover, consistent focus on productivity, cost control and share repurchases will also drive results.

Zacks Rank & Other Key Picks

Currently, Avery Dennison carries a Zacks Rank #2 (Buy).

Some other favorably placed stocks in the same space include ACCO Brands Corp. ACCO , Deere & Company DE and The Timken Company TKR . All three of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

ACCO Brands has a positive average earnings surprise of 24.74% for the last four quarters. Deere generated a positive average earnings surprise of 60.5% in the trailing four quarters. Timken has delivered an average positive earnings surprise of 7.62% in the past four quarters.

A Full-Blown Technological Breakthrough in the Making

Zacks’ Aggressive Growth Strategist Brian Bolan explores autonomous cars in our latest Special Report, Driverless Cars: Your Roadmap to Mega-Profits Today. In addition to who will be selling them and how the auto industry will be impacted, Brian reveals 8 stocks with tremendous gain potential to feed off this phenomenon. Click to see the stocks right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deere & Company (DE): Free Stock Analysis Report

Timken Company (The) (TKR): Free Stock Analysis Report

Avery Dennison Corporation (AVY): Free Stock Analysis Report

Acco Brands Corporation (ACCO): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International