Scalper1 News

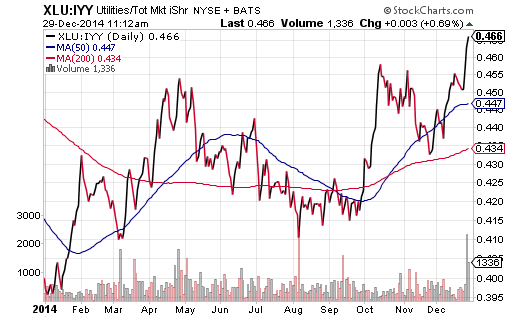

I am baffled by the economic acceleration certainty that nearly every respected voice has endorsed. In spite of the rosiest government data on jobs and GDP, which ETF asset classes proved most resilient in a month of volatile price movement? Utilities and REITs. The more the public is being told about the inevitability of rate increases, the greater the momentum for proxies like XLU and VNQ. Lost in the bull market euphoria is the reality that economists have been dead wrong about the direction of asset prices, particularly bond prices. Last December, when 55 of the most prestigious economists across a wide range of institutions had been polled by Bloomberg about where the 10-year yield (3.0%) would end the year, each of the 55 professionals anticipated higher rates. The average of those estimates? 3.41%. And yet, the 10-year will finish the year closer to 2.25%. That is one heck of an astonishing miss for the entire professional community. This December, polling of economists has produced an average forecast for the 10-year yield at 3.0% by the close of 2015. In other words, they expect intermediate term rates will climb in 2015, and yet, the projections merely approximate where 2013 ended. Even if the recent crop of poll respondents are correct this time around, what does this “non-normalization” of rates tell us about the highly touted strength of the U.S. economy? For all the hoopla, I am baffled by the economic acceleration certainty that nearly every respected voice has endorsed. Will Q4 gross domestic product (GDP) be as robust as the 5% in Q3? Not likely. Will Q1 2015 be better than the average of 2.1% sub-par growth that has existed each year since the Great Recession ended? Probably not. For one thing, lower bond yields have been warning U.S. investors that the world’s stagnation alongside regional recessions will eventually weigh down the U.S. It is one thing to pretend that the U.S. is a self-contained economic island, yet quite another thing to ignore the reality that close to 50% of corporate profits come from overseas. Moreover, there are a variety of potential crises that could sap the world (and yes, the U.S.) of economic demand, from a disorderly slowdown in China to an emerging market credit collapse to a second iteration of a euro-zone break-up scare. Need proof that scores of investors remain unconvinced by the notion that all is perfect in stock-land? In spite of the rosiest government data on jobs and GDP – in spite of strong retail sales as well as consumer confidence readings – which ETF asset classes proved most resilient in a month of volatile price movement? Utilities and REITs. Are The Bets On Lower Rates Still Continuing? MOM% SPDR Select Sector Utilities (NYSEARCA: XLU ) 9.0% iShares DJ Utilities (NYSEARCA: IDU ) 8.7% Vanguard Utilities (NYSEARCA: VPU ) 8.6% iShares Cohen Steers Realty Majors (NYSEARCA: ICF ) 4.2% Vanguard REIT (NYSEARCA: VNQ ) 4.2% SPDR DJ REIT (NYSEARCA: RWR ) 4.1% iShares DJ Total Market (NYSEARCA: IYY ) 1.0% If an investor is looking for modest growth in an area less tied to the economy, he/she may journey to the consumer staples segment or the health care sector. They are frequently identified as “non-cyclicals” since they represent things we need in good times and bad. And if an investor is looking for more total return in areas less tethered to economic well-being, he/she often travels to utilities and REITs. The exception to that rule? If rates are expected to rapidly rise across the yield curve, an investor would tend to shy away from the rate sensitivity associated with utilities and REITs. That’s not happening. In fact, the more the public is being told about the inevitability of rate increases, the greater the momentum for proxies like XLU and VNQ. The price-ratios for XLU:IYY as well as VNQ:IYY are at or near their highest points of 2014. I am not advocating that investors abandon economically sensitive stock assets let alone chase yield-sensitive stock segments. On the other hand, just as I recommended throughout 2014, I believe it makes sense to remain committed to longer-term bonds in funds like iShares 10-20 Year Treasury (NYSEARCA: TLH ) as well as lower volatility stocks across the sector spectrum. One of my largest client holdings, iShares USA Minimum Volatility (NYSEARCA: USMV ), is diversified across all of the economic sectors; the top 3 segments are health care, financials and information technology. What makes USMV particularly attractive in the current environment? The equities have lower volatility properties relative to the U.S. market at large, offering the possibility that losses during declining markets will be less dramatic. Similarly, gains in rising markets will emanate from exposure to strong economy stock sectors as well as weaker economy stock sectors. Click here for Gary’s latest podcast. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

I am baffled by the economic acceleration certainty that nearly every respected voice has endorsed. In spite of the rosiest government data on jobs and GDP, which ETF asset classes proved most resilient in a month of volatile price movement? Utilities and REITs. The more the public is being told about the inevitability of rate increases, the greater the momentum for proxies like XLU and VNQ. Lost in the bull market euphoria is the reality that economists have been dead wrong about the direction of asset prices, particularly bond prices. Last December, when 55 of the most prestigious economists across a wide range of institutions had been polled by Bloomberg about where the 10-year yield (3.0%) would end the year, each of the 55 professionals anticipated higher rates. The average of those estimates? 3.41%. And yet, the 10-year will finish the year closer to 2.25%. That is one heck of an astonishing miss for the entire professional community. This December, polling of economists has produced an average forecast for the 10-year yield at 3.0% by the close of 2015. In other words, they expect intermediate term rates will climb in 2015, and yet, the projections merely approximate where 2013 ended. Even if the recent crop of poll respondents are correct this time around, what does this “non-normalization” of rates tell us about the highly touted strength of the U.S. economy? For all the hoopla, I am baffled by the economic acceleration certainty that nearly every respected voice has endorsed. Will Q4 gross domestic product (GDP) be as robust as the 5% in Q3? Not likely. Will Q1 2015 be better than the average of 2.1% sub-par growth that has existed each year since the Great Recession ended? Probably not. For one thing, lower bond yields have been warning U.S. investors that the world’s stagnation alongside regional recessions will eventually weigh down the U.S. It is one thing to pretend that the U.S. is a self-contained economic island, yet quite another thing to ignore the reality that close to 50% of corporate profits come from overseas. Moreover, there are a variety of potential crises that could sap the world (and yes, the U.S.) of economic demand, from a disorderly slowdown in China to an emerging market credit collapse to a second iteration of a euro-zone break-up scare. Need proof that scores of investors remain unconvinced by the notion that all is perfect in stock-land? In spite of the rosiest government data on jobs and GDP – in spite of strong retail sales as well as consumer confidence readings – which ETF asset classes proved most resilient in a month of volatile price movement? Utilities and REITs. Are The Bets On Lower Rates Still Continuing? MOM% SPDR Select Sector Utilities (NYSEARCA: XLU ) 9.0% iShares DJ Utilities (NYSEARCA: IDU ) 8.7% Vanguard Utilities (NYSEARCA: VPU ) 8.6% iShares Cohen Steers Realty Majors (NYSEARCA: ICF ) 4.2% Vanguard REIT (NYSEARCA: VNQ ) 4.2% SPDR DJ REIT (NYSEARCA: RWR ) 4.1% iShares DJ Total Market (NYSEARCA: IYY ) 1.0% If an investor is looking for modest growth in an area less tied to the economy, he/she may journey to the consumer staples segment or the health care sector. They are frequently identified as “non-cyclicals” since they represent things we need in good times and bad. And if an investor is looking for more total return in areas less tethered to economic well-being, he/she often travels to utilities and REITs. The exception to that rule? If rates are expected to rapidly rise across the yield curve, an investor would tend to shy away from the rate sensitivity associated with utilities and REITs. That’s not happening. In fact, the more the public is being told about the inevitability of rate increases, the greater the momentum for proxies like XLU and VNQ. The price-ratios for XLU:IYY as well as VNQ:IYY are at or near their highest points of 2014. I am not advocating that investors abandon economically sensitive stock assets let alone chase yield-sensitive stock segments. On the other hand, just as I recommended throughout 2014, I believe it makes sense to remain committed to longer-term bonds in funds like iShares 10-20 Year Treasury (NYSEARCA: TLH ) as well as lower volatility stocks across the sector spectrum. One of my largest client holdings, iShares USA Minimum Volatility (NYSEARCA: USMV ), is diversified across all of the economic sectors; the top 3 segments are health care, financials and information technology. What makes USMV particularly attractive in the current environment? The equities have lower volatility properties relative to the U.S. market at large, offering the possibility that losses during declining markets will be less dramatic. Similarly, gains in rising markets will emanate from exposure to strong economy stock sectors as well as weaker economy stock sectors. Click here for Gary’s latest podcast. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

Scalper1 News