Shares of Apogee Enterprises, Inc. APOG rose 3.7% to close at $ 46.11 yesterday, after it posted earnings per share of 77 cents in second-quarter fiscal 2017 (ended Aug 27, 2016). Earnings surged 54% from 50 cents per share in the prior-year quarter and effortlessly beat the Zacks Consensus Estimate of 67 cents.

Operational Update

The company reported total revenues of $ 278.5 million, which grew 16% year over year. Revenues surpassed the Zacks Consensus Estimate of $ 271 million.

Cost of goods sold went up 12% year over year at $ 205.9 million. Gross profit improved 28% year over year to $ 72.5 million. Gross margin also expanded 240 basis points (bps) to 26%. Selling, general and administrative (SG&A) expenses went up 15% year over year to $ 39.5 million. Operating income jumped 47% year over year to $ 33 million. Operating margin was up 260 bps year over year to 11.9%.

Apogee Enterprises Inc. (APOG) Street Actual & Estimate EPS – Last 5 Quarters | FindTheCompany

Segment Performance

Revenues at the Architectural Glass segment increased 7% year over year to $ 99 million on U.S. volume growth and improved pricing and mix. Operating income in the quarter surged 43% to $ 9.6 million from $ 6.7 million in the prior-year quarter.

Revenues at the Architectural Services segment rose 49% year over year to $ 77.7 million as project timing drove high revenue levels in the quarter. The segment reported an operating profit of $ 6.2 million which shot up 340% from $ 1.4 million in the year-ago quarter.

The Architectural Framing Systems segment’s revenues grew 14% year over year to $ 92.2 million led by volume growth along with improved pricing and mix. The segment’s operating income was up 34% to $ 13 million from $ 9.7 million in the prior-year quarter.

The Large-Scale Optical Technologies segment’s revenues declined 5% year over year to $ 21.3 million. Operating income in the reported quarter was $ 5 million, which fell 10% from $ 5.6 million in the year-ago quarter.

Financial Position

At the end of fiscal second-quarter, Apogee had cash and short-term investments of $ 94.6 million versus $ 90.6 million as of fiscal 2016 end. The company generated cash flow from operations of $ 41.2 million for the six-month period ended Aug 27, 2016 compared with $ 62.1 million in the comparable year-ago period.

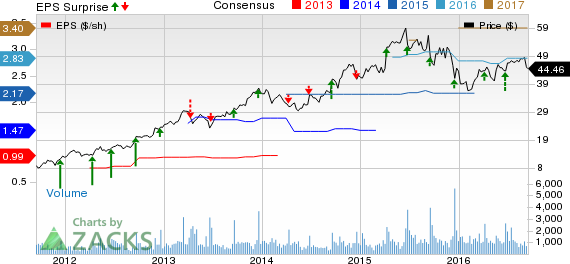

Apogee Entrprs Price, Consensus and EPS Surprise

Apogee Entrprs Price, Consensus and EPS Surprise | Apogee Entrprs Quote

Apogee’s backlog decreased 13% year over year to $ 447.7 million at the end of the quarter. The decline in the backlog resulted from the irregular timing of the committed architectural services segment projects progressing to signed contracts in the quarter. Roughly 63% or $ 281 million of the backlog is expected to be delivered in fiscal 2017, and the balance in fiscal 2018.

Outlook for Fiscal 2017 and Beyond

Apogee raised its earnings per share outlook for fiscal 2017 to $ 2.80-$ 2.90 from the previous guidance of $ 2.70-$ 2.85. The upbeat guidance came on the back of improved operational performance in the second quarter and productivity driven by Lean initiative, as well as continued market strength. The company maintained its outlook for revenue growth of approximately 10% for the full year fiscal 2017.

Apogee expects mid-single digit U.S. commercial construction market growth in fiscal 2017, as market activity, the Architecture Billings Index, office employment and office vacancy rates have witnessed positive momentum.

The company anticipates delivering capital expenditures of approximately $ 70 million in fiscal 2017, increased from the prior outlook of $ 60 million, as it is investing to enhance capabilities and productivity capacity. Gross margin is estimated to be approximately 26.5% and operating margin of approximately 11.3%.

For the long term, Apogee believes to grow through expanding in new geographies, fresh products and markets; along with robust backlog and bidding activity. In addition, focus on better project selection, productivity and operational improvements will boost growth. These actions will support Apogee’s fiscal 2018 goals of a 12-13% operating margin on revenues of $ 1.2-$ 1.3 billion.

Apogee currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the same sector include Berry Plastics Group, Inc. BERY , Deere & Company DE and DXP Enterprises, Inc. DXPE . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks’ best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

APOGEE ENTRPRS (APOG): Free Stock Analysis Report

DEERE & CO (DE): Free Stock Analysis Report

DXP ENTERPRISES (DXPE): Free Stock Analysis Report

BERRY PLASTICS (BERY): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International