Scalper1 News

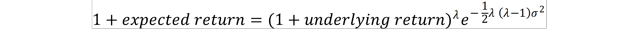

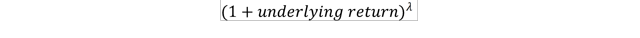

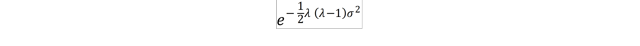

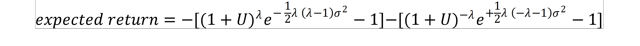

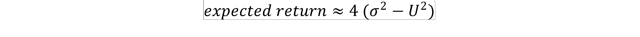

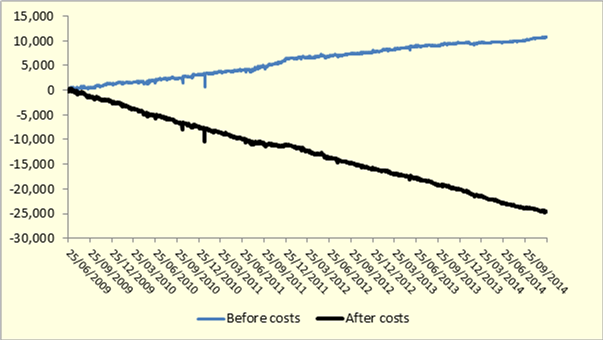

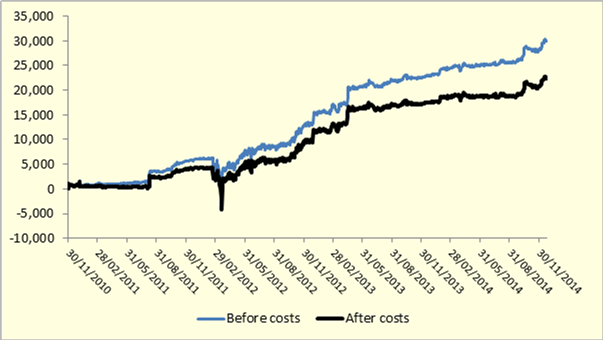

Summary In general, shorting pairs of leveraged ETFs does not generate favourable returns. An exception to this is shorting the volatility future TVIX, XIV pair, with this giving seemingly excellent returns. But this strategy is not advised, with the investor effectively selling financial catastrophe insurance. The theory The core equation describing the expected return of a leveraged ETF is as follows: Here ‘underlying return’ is simply the return on the asset the ETF leverages, anything from SPY, industry-specific equity funds, VIX futures and various commodities. λ specifies the ETF’s leverage; typically this is -1 (i.e. inverse), 2 or sometimes 3. Finally, σ is the standard deviation of the underlying return. The equation can be split into two, showing the key drivers of the return: The return on the underlying, leveraged λ times: The decay from volatility: It is the second – volatility decay – term that generates much of the criticism of leveraged ETFs. It reduces the return unless the ETF is unlevered i.e. λ = 1 or has no volatility i.e. σ = 0. Its adverse impact increases with leverage and the volatility of the underlying. The practical reason for volatility decay is the ETF’s daily rebalancing: a, say, 10% fall in the underlying, followed by a 10% rise will leave the underlying unchanged but see a leveraged ETF lose money. A leveraged ETF’s return is, however, not necessarily negative. It depends on the balance between the underlying’s return and the volatility decay factor. For example, SPY – representing the S&P 500 – has a (conservative) expected return of, say, 6% p.a. and a standard deviation of, say, 20% p.a. Plugging these numbers into the above formula gives a long-run expected return of ~8% for a 2x leveraged SPY ETF. This is well below the naïve 2 x 6% = 12% expectation, but is an improvement on the unlevered 6%. It is nevertheless at the cost of more than proportionally increased volatility. The theory applied to shorting leveraged ETF pairs Moving on to this article’s main subject, shorting pairs of leveraged ETFs. Applying the equation to shorting a pair of ETFs with leverage λ and -λ: The next step needs some algebra. Take the above equation and expand out (using Taylor’s series), neglecting any term higher than order 2 (these terms will be small in comparison). Then with λ = 2: Examining this equation shows the return will be positive for realistic pairs of leveraged ETFs: an asset’s return standard deviation (σ) will be bigger than its expected return (U). By shorting a pair of ETFs with opposite leverage and the same underlying, the return of the underlying cancels out and does not impact the strategy’s result. The strategy instead collects the (on average) losses generated by the interaction of the asset’s volatility and the daily rebalancing. In practice: Shorting UPRO and SPXU These two ETFs are designed to give 3x and -3x the compounded daily return on the S&P 500. Shorting $100k of both gives the following return chart: …equating to a stable before cost return of ~2% p.a. Unfortunately, the after cost return is ~-5%! These costs are principally the cost of borrowing the shares to short. I have UPRO costing ~5% p.a. to borrow and SPXU ~3.5% p.a. Notwithstanding the theory above, the market is efficient and has reached such by increasing borrow costs to unusually high levels. Similar results occur for all – bar one – pairs of leveraged ETFs that I have examined. In practice: Shorting TVIX and XIV The exception are a couple of volatility ETFs, TVIX and XIV. TVIX is designed to return 2x the VIX futures short term index. XIV is designed to return -1x the same index. Because the fund’s leverages are not equal and opposite, this strategy involves shorting $2 of XIV for every $1 of TVIX. It results in the following return chart, for a $100k notional investment: After costs, it yields a return of ~10% p.a. with a Sharpe ratio of ~ 2 (compared to the S&P 500’s ~ 0.5). It is also possible to leverage this strategy further; as shown it starts at -$33k TVIX and -$67k XIV, but (if you have portfolio margin) your broker may allow multiples of these amounts. The strategy works because of the exceptionally high volatility of the underlying VIX futures, together with the ETF’s relatively large tracking errors. The large drawdown in early 2012 was caused by a short squeeze on TVIX. Its price rose well above its net asset value. The short squeeze occurred because the issuing bank reached its internal risk limits in respect of VIX futures. It hence stopped creating new TVIX units, removing the normal mechanism for keeping the ETF’s price near its net asset value. Holders of this strategy may well have had their TVIX shares called at the worst possible time – the minimum of the black curve – missing out on the subsequent recovery. The key problem with this strategy is, however, its tail risk. Gains from shorting a stock are limited to 100% of its value. Losses are unlimited. A large enough single-day increase in the value of VIX could see the strategy lose more than 100% of the notional investment. In particular, if a day sees the VIX short term futures index double or more, XIV – if it functions as designed – will go to zero. But TVIX can continue to rise, generating unhedged, potentially unlimited losses for the strategy. I suspect this is the main reason that the market allows this apparent inefficiency. Executing the strategy is equivalent to selling financial catastrophe insurance. Additional disclosure: I am sometimes long / short XIV, but do not execute this strategy. Scalper1 News

Summary In general, shorting pairs of leveraged ETFs does not generate favourable returns. An exception to this is shorting the volatility future TVIX, XIV pair, with this giving seemingly excellent returns. But this strategy is not advised, with the investor effectively selling financial catastrophe insurance. The theory The core equation describing the expected return of a leveraged ETF is as follows: Here ‘underlying return’ is simply the return on the asset the ETF leverages, anything from SPY, industry-specific equity funds, VIX futures and various commodities. λ specifies the ETF’s leverage; typically this is -1 (i.e. inverse), 2 or sometimes 3. Finally, σ is the standard deviation of the underlying return. The equation can be split into two, showing the key drivers of the return: The return on the underlying, leveraged λ times: The decay from volatility: It is the second – volatility decay – term that generates much of the criticism of leveraged ETFs. It reduces the return unless the ETF is unlevered i.e. λ = 1 or has no volatility i.e. σ = 0. Its adverse impact increases with leverage and the volatility of the underlying. The practical reason for volatility decay is the ETF’s daily rebalancing: a, say, 10% fall in the underlying, followed by a 10% rise will leave the underlying unchanged but see a leveraged ETF lose money. A leveraged ETF’s return is, however, not necessarily negative. It depends on the balance between the underlying’s return and the volatility decay factor. For example, SPY – representing the S&P 500 – has a (conservative) expected return of, say, 6% p.a. and a standard deviation of, say, 20% p.a. Plugging these numbers into the above formula gives a long-run expected return of ~8% for a 2x leveraged SPY ETF. This is well below the naïve 2 x 6% = 12% expectation, but is an improvement on the unlevered 6%. It is nevertheless at the cost of more than proportionally increased volatility. The theory applied to shorting leveraged ETF pairs Moving on to this article’s main subject, shorting pairs of leveraged ETFs. Applying the equation to shorting a pair of ETFs with leverage λ and -λ: The next step needs some algebra. Take the above equation and expand out (using Taylor’s series), neglecting any term higher than order 2 (these terms will be small in comparison). Then with λ = 2: Examining this equation shows the return will be positive for realistic pairs of leveraged ETFs: an asset’s return standard deviation (σ) will be bigger than its expected return (U). By shorting a pair of ETFs with opposite leverage and the same underlying, the return of the underlying cancels out and does not impact the strategy’s result. The strategy instead collects the (on average) losses generated by the interaction of the asset’s volatility and the daily rebalancing. In practice: Shorting UPRO and SPXU These two ETFs are designed to give 3x and -3x the compounded daily return on the S&P 500. Shorting $100k of both gives the following return chart: …equating to a stable before cost return of ~2% p.a. Unfortunately, the after cost return is ~-5%! These costs are principally the cost of borrowing the shares to short. I have UPRO costing ~5% p.a. to borrow and SPXU ~3.5% p.a. Notwithstanding the theory above, the market is efficient and has reached such by increasing borrow costs to unusually high levels. Similar results occur for all – bar one – pairs of leveraged ETFs that I have examined. In practice: Shorting TVIX and XIV The exception are a couple of volatility ETFs, TVIX and XIV. TVIX is designed to return 2x the VIX futures short term index. XIV is designed to return -1x the same index. Because the fund’s leverages are not equal and opposite, this strategy involves shorting $2 of XIV for every $1 of TVIX. It results in the following return chart, for a $100k notional investment: After costs, it yields a return of ~10% p.a. with a Sharpe ratio of ~ 2 (compared to the S&P 500’s ~ 0.5). It is also possible to leverage this strategy further; as shown it starts at -$33k TVIX and -$67k XIV, but (if you have portfolio margin) your broker may allow multiples of these amounts. The strategy works because of the exceptionally high volatility of the underlying VIX futures, together with the ETF’s relatively large tracking errors. The large drawdown in early 2012 was caused by a short squeeze on TVIX. Its price rose well above its net asset value. The short squeeze occurred because the issuing bank reached its internal risk limits in respect of VIX futures. It hence stopped creating new TVIX units, removing the normal mechanism for keeping the ETF’s price near its net asset value. Holders of this strategy may well have had their TVIX shares called at the worst possible time – the minimum of the black curve – missing out on the subsequent recovery. The key problem with this strategy is, however, its tail risk. Gains from shorting a stock are limited to 100% of its value. Losses are unlimited. A large enough single-day increase in the value of VIX could see the strategy lose more than 100% of the notional investment. In particular, if a day sees the VIX short term futures index double or more, XIV – if it functions as designed – will go to zero. But TVIX can continue to rise, generating unhedged, potentially unlimited losses for the strategy. I suspect this is the main reason that the market allows this apparent inefficiency. Executing the strategy is equivalent to selling financial catastrophe insurance. Additional disclosure: I am sometimes long / short XIV, but do not execute this strategy. Scalper1 News

Scalper1 News