Scalper1 News

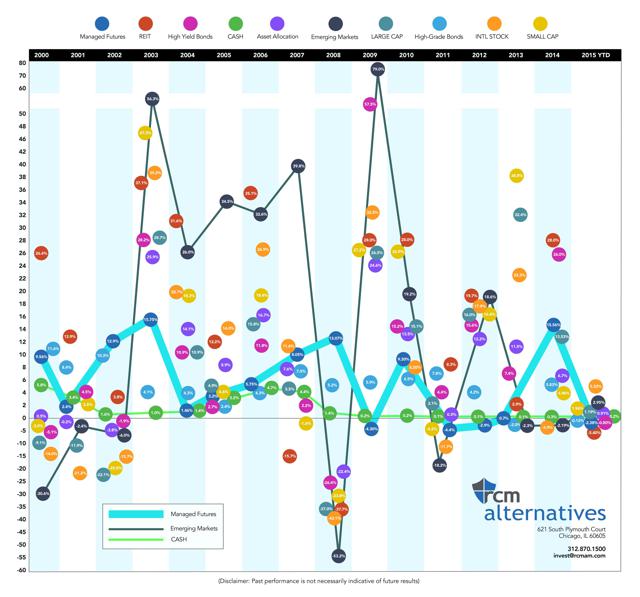

We’re living in a post 2008-2009 financial crisis world. Investors and advisors alike know that having your eggs all in one basket could land you in some hot water (especially if it’s the arguably broken 60/40 portfolio). The reason being, one single person or group isn’t able to call what’s going to be the “best” asset class (by performance only) in any given year. Enter the ever so popular diversification quilt , which essentially ranks each asset class top to bottom over the past 15 years. The issue, of course, is that although they include 10 asset classes, they really don’t include alternative investments, specifically Managed Futures. The latest to release a chart like this is Business Insider. As you might remember, we took the liberty of changing around the “quilts” published by Bloomberg back in September by adding Managed Futures to the mix. The second issue with the quilt table is that these “quilts” are all on the same axis level. For example, if an investment was the worst performer of the year and still up 2 or 3 percent, it would look the same as an investment that came in last at a -10% on a different year. Which got us thinking how different would the table look if we spread out the investments so that the performance range would be visible? This is what we got. P.S – Looking at each asset class on its own fluctuates year to year, is just one way to look at volatility. So, so we connected the dots of the largest performance range (Emerging Markets), Managed Futures, and the smallest performance range (Cash). (click to enlarge) (Past performance is not necessarily indicative of future results) Source: Large Cap = S&P 500 Small Cap = Russell 2000 Intl Stocks = MSCI EAFE Emerging Markets = MSCI Emerging Markets REIT = FTSE NAREIT All Equity Index HG Bond = Barclay’s U.S. Aggregate Bond Index HY Bond =BoAML US High Yield Master II Cash= 3 Month T Bill Rate AA = Asset Allocation Portfolio (15% Large Cap, 15% Intl Stocks, 10% Small Cap, 10% Emerging Markets, 10% REIT, 40% HG Bond Share this article with a colleague Scalper1 News

We’re living in a post 2008-2009 financial crisis world. Investors and advisors alike know that having your eggs all in one basket could land you in some hot water (especially if it’s the arguably broken 60/40 portfolio). The reason being, one single person or group isn’t able to call what’s going to be the “best” asset class (by performance only) in any given year. Enter the ever so popular diversification quilt , which essentially ranks each asset class top to bottom over the past 15 years. The issue, of course, is that although they include 10 asset classes, they really don’t include alternative investments, specifically Managed Futures. The latest to release a chart like this is Business Insider. As you might remember, we took the liberty of changing around the “quilts” published by Bloomberg back in September by adding Managed Futures to the mix. The second issue with the quilt table is that these “quilts” are all on the same axis level. For example, if an investment was the worst performer of the year and still up 2 or 3 percent, it would look the same as an investment that came in last at a -10% on a different year. Which got us thinking how different would the table look if we spread out the investments so that the performance range would be visible? This is what we got. P.S – Looking at each asset class on its own fluctuates year to year, is just one way to look at volatility. So, so we connected the dots of the largest performance range (Emerging Markets), Managed Futures, and the smallest performance range (Cash). (click to enlarge) (Past performance is not necessarily indicative of future results) Source: Large Cap = S&P 500 Small Cap = Russell 2000 Intl Stocks = MSCI EAFE Emerging Markets = MSCI Emerging Markets REIT = FTSE NAREIT All Equity Index HG Bond = Barclay’s U.S. Aggregate Bond Index HY Bond =BoAML US High Yield Master II Cash= 3 Month T Bill Rate AA = Asset Allocation Portfolio (15% Large Cap, 15% Intl Stocks, 10% Small Cap, 10% Emerging Markets, 10% REIT, 40% HG Bond Share this article with a colleague Scalper1 News

Scalper1 News