< div id =" articleText" legibility=" 145.55030800821" > IMAGE RESOURCE: AGRIUM COMPANY SITE. In Oct 2014, protestor hedge fund ValueAct Financing divulged a 5.7% concern in Agrium (NYSE: AGU).

Because after that, the firm has awarded investors with accumulating capital, growing rewards, and enormous contribute repurchases. Along with $ 2.1 billion in EBITDA last year, Agrium was actually able to return over $ 1 billion to shareholders by means of buybacks and also dividends, nearly 10% from its own market cap. Since 2013, this’s about increased its own cost-free capital production.

With various secular tailwinds behind it, this can be only the start.

Diversified profit flows

Agrium has actually built a special company in what historically has been an unstable agrarian items market. A number of Agrium’s competitors are actually reliant on a single product resource that makes up a majority of purchases. As an example, a sizable majority from both PotashCorp (NYSE: CONTAINER) and Variety Co.‘s( NYSE: MOS) sales come from potash alone.

Agrium, on the other hand, is so much more diversified, without any singular product comprising a majority from sales. In 2015, profits were split rather equally in between nitrogen, potash, crop-protection chemicals, as well as various other nutrients. The service also possesses visibility to seeds, phosphates, as well as various other solutions.

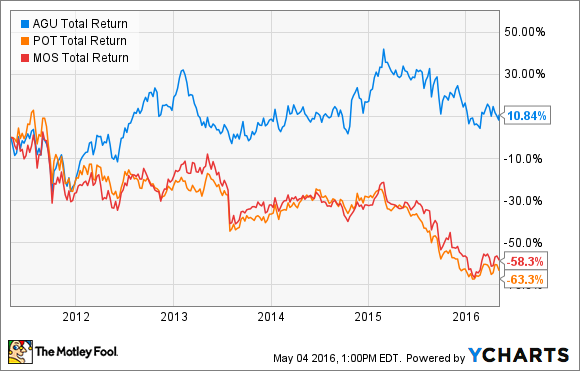

Due to the fact that 2008, potash rates have fallen by over FIFTY%, pushing very most manufacturers near breakeven area; PotashCorp published a $ 1.2 billion earnings final year, its own lowest in over five years. Accordingly, reveals of much less varied agricultural input manufacturers dropped through 60% or even more. Agrium, on the other hand, saw its take-home pay expand to $ 988 million coming from $ 798 million a year prior to, driving its stock price to new highs. The business took advantage of strong revenues in crop defense chemicals, seeds, as well as high-margin farming services.

In today’s unpredictable commodities atmosphere, Agrium’s diversified operating design is settling significant.

< img course=" articleImgLg" alt=" Create" src

=” https://www.scalper1.com/wp-content/uploads/2016/06/generate_fund_chart_wHhJgsD_large.png”/ > A significant distribution system Agrium’s diversified portfolio creates this the biggest worldwide retail rep of plant inputs in a market where range concerns. The service has over 1,500 retail and wholesale sites spread around both Canada as well as the United States. This additionally possesses a sprawling system via several of South America as well as many of Australia. These places have the ability to deliver plant inputs and solutions for over 50 different crops .

This system is a distinct benefit; fertilizer video production peers like PotashCorp and also Variety lack an existing retail circulation system. Whereas Agrium control has noted peers spending a notable amount from funds to construct brand-new distribution centers, Agrium may rely on its industry-dominating link of existing commercial infrastructure to offer clients a lot faster and also a lot more completely.

Preserving capital spending are anticipated to fall off a 2014 high of $ 2 billion to only $ 550 thousand next year. This scenario ought to launch an extra $ 1.5 billion in extra capital to become shared out to investors.

Space to increase

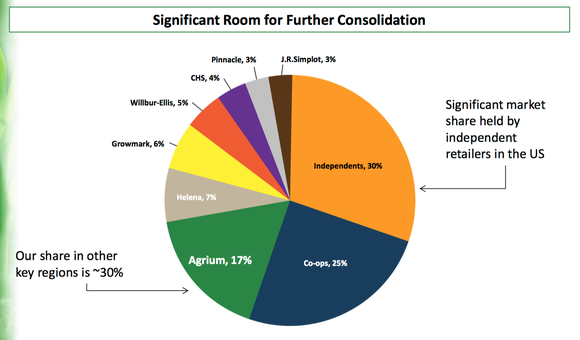

In the U.S. retail market, Agrium possesses a leading market portion from 17%, with the closest competitor coming in at simply 7%. The service’s international operations have even more significant market portions better to regarding 30%.

While Agrium is the very clear market leader, there are actually still significant options for the business to expand both naturally and through achievements. For instance, 30% of the UNITED STATE market is serviced by means of little, private carriers. Yet another 25% is serviced through farmer co-ops. This implies that over one-half from the marketplace can profit through hooking up to Agrium’s sprawling, full-service retail areas.

Agrium has actually likewise had the capacity to buy a significant volume of smaller sized competitors, opening market value by attaching them to its present circulation network. Given that 2010 the provider has actually acquired 272 areas, including $ 1.7 billion in sales and $ 174 million in EBITDA.

< img class=" articleImgLg" alt= "Display screen Go" src=" https://www.scalper1.com/wp-content/uploads/2016/06/screen-shot-2016-05-04-at-125227-pm_large.png"/ > PHOTO RESOURCE: AGRIUM CORPORATE PRESENTATION.

Just the beginning

All the perks Agrium presently takes pleasure in must simply reinforce in the nearing future. The service has loads of space to carry on settling the ragged retail market, contributing to its leadership role. In the meantime, demand for crop nutrients has actually never been actually much higher, as well as Agrium’s diversified model reduces the impact from rate swings in any type of one product.

Long-lasting investors from any type ought to check out Agrium as a sturdy possibility. Installing free of cost revenue circulations ought to enable regular returns rises, while growth tailwinds and contribute buybacks must remain to grow profits per reveal for a long times to follow.

A top secret billion-dollar share option

The globe’s largest technology company neglected to present you one thing, but a few Exchange experts and the Fool didn’t skip a beat: There’s a small provider that is actually powering their brand-new gadgets and the coming revolution in technology. And our company believe its stock price has nearly infinite room to run for early in-the-know real estate investors! To be actually some of them, < a href

=” http://www.fool.com/mms/mark/ecap-foolcom-apple-wearable?aid=6965&source=irbeditxt0000017&ftm_cam=rb-wearable-d&ftm_pit=2692&ftm_veh=article_pitch&utm_campaign=article&utm_medium=feed&utm_source=nasdaq” rel=” nofollow” > simply visit here. The viewpoints as well as point of views revealed within are the sights and opinions of the writer and do certainly not automatically indicate those from Nasdaq, Inc.

Most recent Contents Plantations International