Scalper1 News

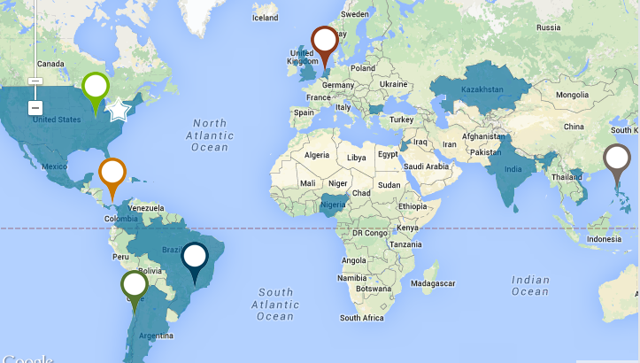

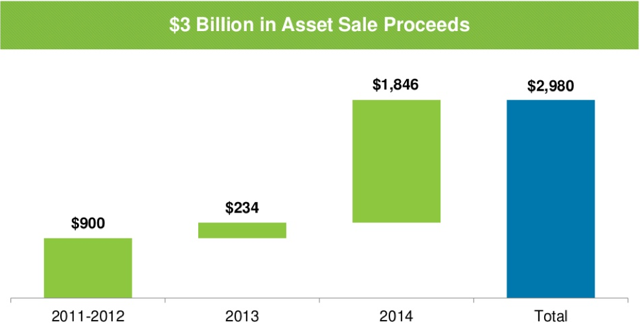

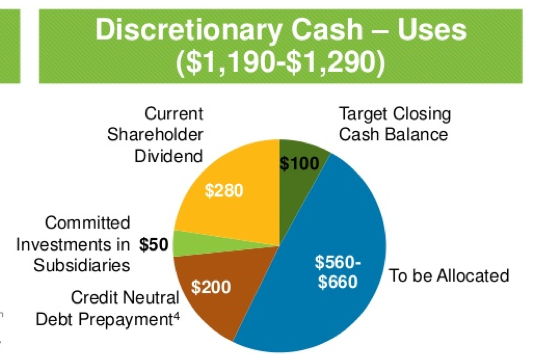

The company recently raised its dividend 100%. The company offers exposure to a lot of different markets. Growth is looking to get back on track and shares look undervalued. It expects to increase the dividend by 10% annually for the next few years. As I not only look to add higher yield plays to my portfolio but also better diversify I came upon AES Corporation (NYSE: AES ). The company meets both of these criteria and I think the shares look quite attractive here. Long-term I think the company is fairly safe play and has a good story going forward. AES is a global power company that through its various units operates, and delivers power in 19 different countries. Below is a map of its countries of operation and also the units in which they divide the business by. (The units are marked with the pin) ( click to enlarge) (Source: AES website ) The company has exposure to a lot of different markets, which can most definitely be seen as a good thing, but also as a bad thing. Its good because it’s very diversified, gives opportunity for more growth, and offers protection from specific market issues. The bad would be that exchange rates can hurt it easily, and instability risks are also prevalent in emerging markets. The company does have a risk management program when it comes to currency and utilize hedges to combat fluctuations effecting the company drastically. As it can be seen the company operates in several emerging markets which I think is great for future growth and makes it a great diversification play. The first thing that catches the eye is the company’s great yield. On December 15th the company announced a 100% increase of its dividend marking its second increase since bringing it back. I see this as a big step as it gets a trend of dividend growth going. It brought the dividend back in late 2012 and has grown it from 4 cents quarterly to currently 10 cents quarterly. Why I like this dividend even more is the fact the payout ratio is just 31%. With an annual dividend of 40 cents the shares currently yield over 3% and I believe in the future the company will be able to raise it further. In fact in its most recent presentation it says that it expects to increase the dividend 10% annually until at least 2018 (Its plans just outline 2015-2018). This will be made possible by the fact the company also expects to increase free cash flow by 10-15% annually through 2018. Over the past few years the company has been trimming some fat and bettering it balance sheet with the sales of some assets and minority interests. Since 2012 the company has sold nearly $3B worth of assets to better position itself. It may opt to continue in 2015 to trim some more non-core holdings as it continues to focus its scope. ( click to enlarge) (Source: AES website ) Also over the past few years the company completed the repurchase of 72 million shares. It may continue to buy back shares in 2015 as well. The company has not decided yet what it will do with basically half of its discretionary cash. It projects that it will have between $560-$660 million extra to allocate to new growth investments along with possibly more share repurchases. Below is the capital plan for 2015. (Source: AES website ) Looking forward growth appears to be on good track. This is shown in the estimates for FY 2014 and FY 2015 below. 2014(est) 2015(est) % Change Revenue $16.98B $17.55B 3.30% EPS $1.28 $1.35 5.47% (Source: Yahoo Finance ) The 2014 revenue estimates are almost 7% higher than what the company reported in 2013 and this trend looks to continue into 2016 as well. The increase in EPS is a great sign as earnings next year of $1.35 points to a payout ratio of just 29.6%. EPS could also see a boost if some of the extra cash is utilized for further share repurchases. Growth through operations are going strong with 7,000 megawatts under construction, the largest construction pipeline in the company’s history. The total investment in these projects is $9 billion in which the company’s equity portion has already been funded. The ROE on these projects is expected to be greater than 15% and the company expects by the time they are all completed by 2018 they will be contributing roughly 30 cents of EPS. A short term catalyst is going to be the completion of the company’s Mong Duong power plant in Vietnam which will be brought online this year. Along with all of this the shares look undervalued at current levels as well. For starters, it currently trades at just .55x sales. I don’t usually use this as a gauge, but I believe in this case it is noteworthy because the company continues to grow revenue at a good rate. The real indicator though would be its forward price-to-earnings. At just 9.39 it is ridiculously lower than the current electric utilities industry average of 24.7 and the forward average the industry has of 19.3. This clearly points to the shares being undervalued and potentially having big upside. In conclusion, now looks like an opportune time to possible initiate a long-term position in AES. The company continues to create shareholder value through dividends and share buybacks. It also continues to expand and reinvest in its core business while trimming assets as it sees fit. Taking a look at the earnings and revenue the shares look undervalued trading nearly 20% off 52 week highs and just 3% from the lows. I believe the company is a great diversifier, and all around good long-term play. Scalper1 News

The company recently raised its dividend 100%. The company offers exposure to a lot of different markets. Growth is looking to get back on track and shares look undervalued. It expects to increase the dividend by 10% annually for the next few years. As I not only look to add higher yield plays to my portfolio but also better diversify I came upon AES Corporation (NYSE: AES ). The company meets both of these criteria and I think the shares look quite attractive here. Long-term I think the company is fairly safe play and has a good story going forward. AES is a global power company that through its various units operates, and delivers power in 19 different countries. Below is a map of its countries of operation and also the units in which they divide the business by. (The units are marked with the pin) ( click to enlarge) (Source: AES website ) The company has exposure to a lot of different markets, which can most definitely be seen as a good thing, but also as a bad thing. Its good because it’s very diversified, gives opportunity for more growth, and offers protection from specific market issues. The bad would be that exchange rates can hurt it easily, and instability risks are also prevalent in emerging markets. The company does have a risk management program when it comes to currency and utilize hedges to combat fluctuations effecting the company drastically. As it can be seen the company operates in several emerging markets which I think is great for future growth and makes it a great diversification play. The first thing that catches the eye is the company’s great yield. On December 15th the company announced a 100% increase of its dividend marking its second increase since bringing it back. I see this as a big step as it gets a trend of dividend growth going. It brought the dividend back in late 2012 and has grown it from 4 cents quarterly to currently 10 cents quarterly. Why I like this dividend even more is the fact the payout ratio is just 31%. With an annual dividend of 40 cents the shares currently yield over 3% and I believe in the future the company will be able to raise it further. In fact in its most recent presentation it says that it expects to increase the dividend 10% annually until at least 2018 (Its plans just outline 2015-2018). This will be made possible by the fact the company also expects to increase free cash flow by 10-15% annually through 2018. Over the past few years the company has been trimming some fat and bettering it balance sheet with the sales of some assets and minority interests. Since 2012 the company has sold nearly $3B worth of assets to better position itself. It may opt to continue in 2015 to trim some more non-core holdings as it continues to focus its scope. ( click to enlarge) (Source: AES website ) Also over the past few years the company completed the repurchase of 72 million shares. It may continue to buy back shares in 2015 as well. The company has not decided yet what it will do with basically half of its discretionary cash. It projects that it will have between $560-$660 million extra to allocate to new growth investments along with possibly more share repurchases. Below is the capital plan for 2015. (Source: AES website ) Looking forward growth appears to be on good track. This is shown in the estimates for FY 2014 and FY 2015 below. 2014(est) 2015(est) % Change Revenue $16.98B $17.55B 3.30% EPS $1.28 $1.35 5.47% (Source: Yahoo Finance ) The 2014 revenue estimates are almost 7% higher than what the company reported in 2013 and this trend looks to continue into 2016 as well. The increase in EPS is a great sign as earnings next year of $1.35 points to a payout ratio of just 29.6%. EPS could also see a boost if some of the extra cash is utilized for further share repurchases. Growth through operations are going strong with 7,000 megawatts under construction, the largest construction pipeline in the company’s history. The total investment in these projects is $9 billion in which the company’s equity portion has already been funded. The ROE on these projects is expected to be greater than 15% and the company expects by the time they are all completed by 2018 they will be contributing roughly 30 cents of EPS. A short term catalyst is going to be the completion of the company’s Mong Duong power plant in Vietnam which will be brought online this year. Along with all of this the shares look undervalued at current levels as well. For starters, it currently trades at just .55x sales. I don’t usually use this as a gauge, but I believe in this case it is noteworthy because the company continues to grow revenue at a good rate. The real indicator though would be its forward price-to-earnings. At just 9.39 it is ridiculously lower than the current electric utilities industry average of 24.7 and the forward average the industry has of 19.3. This clearly points to the shares being undervalued and potentially having big upside. In conclusion, now looks like an opportune time to possible initiate a long-term position in AES. The company continues to create shareholder value through dividends and share buybacks. It also continues to expand and reinvest in its core business while trimming assets as it sees fit. Taking a look at the earnings and revenue the shares look undervalued trading nearly 20% off 52 week highs and just 3% from the lows. I believe the company is a great diversifier, and all around good long-term play. Scalper1 News

Scalper1 News