Scalper1 News

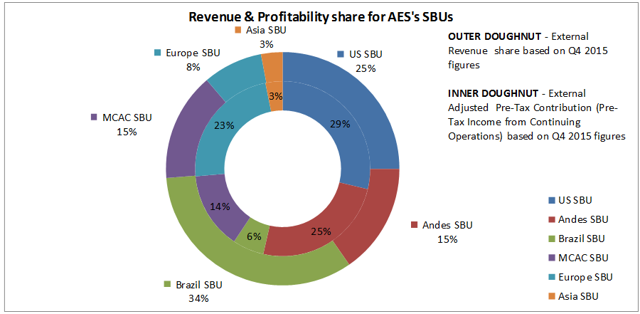

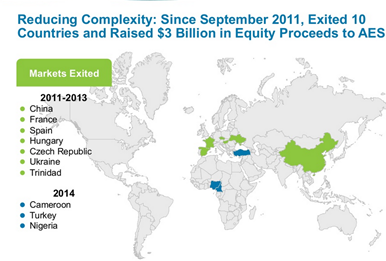

Summary AES is well-diversified Fortune 200 global power company. An early mover in the energy storage business, AES appears to have a good strategic focus. The company’s stock appears to be undervalued relative to its peers. Headquartered in Arlington, Virginia, AES Corporation (NYSE: AES ) is a $17b global power company, which makes it a Fortune 200 company. It owns and operates a diverse portfolio of electricity generation and distribution businesses. I think the company is a good long-term pick because of the following 3 reasons: Global Diversification The company’s electricity generation and distribution operations are spread globally across 18 countries. In terms of power generation capacity, only 12GW out of a total of 36GW is generated by the company in the US. The company’s operations in emerging economies should help the company achieve higher growth rates over the next few years. Its operations in US and Europe should provide relatively lower but stable growth for the company. Such global diversification helps the company mitigate risk. Overall, I would argue that this geographical diversification is a good strategy, though some would argue otherwise citing the foreign exchange risk and the political risk that comes inherent with such strategies. Looking at the last quarter revenues and profitability measure of the company’s different Strategic Business Units (NYSEARCA: SBUS ), two observations stand out – First, while Brazil contributed the highest revenues (34%) amongst all SBUs, its profitability share was only 6%. A major contributing factor to the low profit margins from Brazil was the unfavourable foreign exchange impact. Second, Europe is contributing disproportionately higher profits to the company compared to its revenues. Combined, these individual inconsistencies a part and parcel of the company’s strategy of global diversification. Strong Strategic Focus The company has a reasonably good corporate and business strategy in place. In the last few areas, the company has exited some “non-core” markets and recycled the sell-off proceeds. Since September 2011, the company has exited 10 countries and raised $3b in equity proceeds. In the markets where the company believes it has a competitive advantage, $7 billion worth of projects are in the pipeline. These are expected to be completed in the period from 2015 to 2018. (Source: AES Investor Presentation, May 2015, www.aes.com/investors/presentations-and-… ) AES has been an early mover in the battery-based energy storage business. With distributed energy gaining prominence, this augurs well for the company. Tesla (NASDAQ: TSLA ) was in the news recently for introducing batteries to manage energy needs. However, AES already has batteries operating in big battery farms on the grid (86 MW), some projects under construction (50 MW) and other projects in the late stage of construction (210 MW). AES also recently acquired Main Street Solar, which gives AES the capabilities to enter the distributed solar market, a future growth market. Undervalued Stock AES appears to be undervalued when we look at its P/E ratio and Price-to-sales ratio relative to some of its peers. If we were to base our judgment of the company based on these two ratios alone, AES should have been a strong buy. These two ratios for the company are amongst the lowest in the industry. However, another ratio the Price-to-book (P/B) ratio is amongst the highest in the industry, indicating the company is overvalued. Price-to-book ratio is definitely a good ratio to look at, especially when looking at capital-intensive businesses like AES. The reason for the high P/B ratio is the high levels of debt that the company has. The company had a debt-to-equity ratio of close to 5, which is relatively high, in March 2015. With high debt, its interest coverage ratio at that time was a not-so-healthy 1.83. So, although this would be an area of concern for some, I believe the company has the ability to navigate safely through this. This is based on the fact that these ratios have been in a similar range for AES before and the company has a sound business plan going forward. The company appears to be well-positioned for a decent growth in the next few years, according to the company guidance. The company has estimated the following for the future – the period from 2015 to 2018 – 10-15% annual free cash flow growth – 5% average EPS growth from – 10% annual growth in dividends – 8% average annual total return Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary AES is well-diversified Fortune 200 global power company. An early mover in the energy storage business, AES appears to have a good strategic focus. The company’s stock appears to be undervalued relative to its peers. Headquartered in Arlington, Virginia, AES Corporation (NYSE: AES ) is a $17b global power company, which makes it a Fortune 200 company. It owns and operates a diverse portfolio of electricity generation and distribution businesses. I think the company is a good long-term pick because of the following 3 reasons: Global Diversification The company’s electricity generation and distribution operations are spread globally across 18 countries. In terms of power generation capacity, only 12GW out of a total of 36GW is generated by the company in the US. The company’s operations in emerging economies should help the company achieve higher growth rates over the next few years. Its operations in US and Europe should provide relatively lower but stable growth for the company. Such global diversification helps the company mitigate risk. Overall, I would argue that this geographical diversification is a good strategy, though some would argue otherwise citing the foreign exchange risk and the political risk that comes inherent with such strategies. Looking at the last quarter revenues and profitability measure of the company’s different Strategic Business Units (NYSEARCA: SBUS ), two observations stand out – First, while Brazil contributed the highest revenues (34%) amongst all SBUs, its profitability share was only 6%. A major contributing factor to the low profit margins from Brazil was the unfavourable foreign exchange impact. Second, Europe is contributing disproportionately higher profits to the company compared to its revenues. Combined, these individual inconsistencies a part and parcel of the company’s strategy of global diversification. Strong Strategic Focus The company has a reasonably good corporate and business strategy in place. In the last few areas, the company has exited some “non-core” markets and recycled the sell-off proceeds. Since September 2011, the company has exited 10 countries and raised $3b in equity proceeds. In the markets where the company believes it has a competitive advantage, $7 billion worth of projects are in the pipeline. These are expected to be completed in the period from 2015 to 2018. (Source: AES Investor Presentation, May 2015, www.aes.com/investors/presentations-and-… ) AES has been an early mover in the battery-based energy storage business. With distributed energy gaining prominence, this augurs well for the company. Tesla (NASDAQ: TSLA ) was in the news recently for introducing batteries to manage energy needs. However, AES already has batteries operating in big battery farms on the grid (86 MW), some projects under construction (50 MW) and other projects in the late stage of construction (210 MW). AES also recently acquired Main Street Solar, which gives AES the capabilities to enter the distributed solar market, a future growth market. Undervalued Stock AES appears to be undervalued when we look at its P/E ratio and Price-to-sales ratio relative to some of its peers. If we were to base our judgment of the company based on these two ratios alone, AES should have been a strong buy. These two ratios for the company are amongst the lowest in the industry. However, another ratio the Price-to-book (P/B) ratio is amongst the highest in the industry, indicating the company is overvalued. Price-to-book ratio is definitely a good ratio to look at, especially when looking at capital-intensive businesses like AES. The reason for the high P/B ratio is the high levels of debt that the company has. The company had a debt-to-equity ratio of close to 5, which is relatively high, in March 2015. With high debt, its interest coverage ratio at that time was a not-so-healthy 1.83. So, although this would be an area of concern for some, I believe the company has the ability to navigate safely through this. This is based on the fact that these ratios have been in a similar range for AES before and the company has a sound business plan going forward. The company appears to be well-positioned for a decent growth in the next few years, according to the company guidance. The company has estimated the following for the future – the period from 2015 to 2018 – 10-15% annual free cash flow growth – 5% average EPS growth from – 10% annual growth in dividends – 8% average annual total return Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News