Scalper1 News

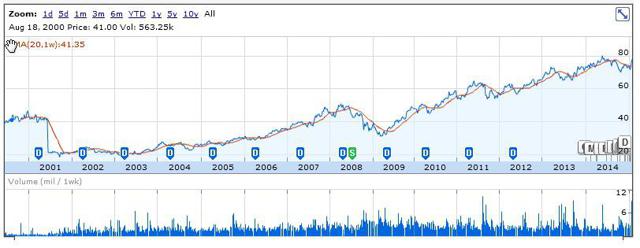

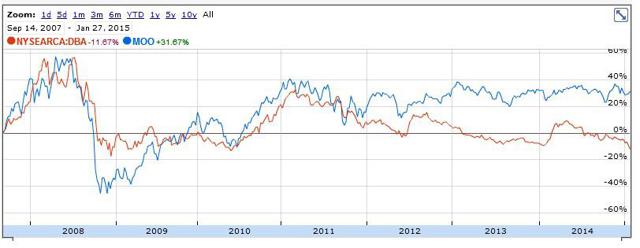

One of our holdings, (Nestle) may have lower profits in the short term due to the strength of the Swiss Franc. Nevertheless we are holding this stock long term. Our long bond position is performing very well. It gives our portfolio stability and it acts as a hedge against falling prices in our equities. We have added 2 new agricultural ETFs to our portfolio. We are investing with the trend for the time being but I expect to deploy more capital into DBA soon. First of all, an update on our 1% portfolio. In our equity asset class, we are holding Nestle ( OTCPK:NSRGY ). As many of you know, the Swiss National Bank announced the abandonment of the currency peg with the euro. The following day a follower emailed me and asked if we were going to continue to hold Nestle as this company is headquartered in Switzerland. The answer is a definite yes! We may have some downward movement in Nestle in the short term as the Swiss Franc strengthens against other currencies. Nestle sells all over the world in other currencies and if these international currencies weaken substantially against the Swiss Franc, then Nestle profit margins may be hit as their accounts are filed in Swiss Francs. Nevertheless this is a currency issue, not a fundamental issue. The stock has excellent fundamentals and has been in strong bull mode since 2001 (see chart). The company is yielding just under 3% and has increased its dividend for the past 18 years straight! Similar to American Express (NYSE: AXP ), we are going to stay the course with this holding. (click to enlarge) Our bond position in the Vanguard Total Bond Market ETF (NYSEARCA: BND ) is creating a lot of controversy as many think our stake in this asset class is too large. Currently we have $100k invested in this asset class. Let me explain the reasoning behind this decision. I learned early on in my investing career that if your money is divided equally but your investments are not equal in their risk, you are not balanced. Most portfolios are made up of stocks and the problem with these types of portfolios is that they don’t protect you in bear markets. Today (27-1-2015) we have the S&P falling sharply and bonds rallying. This has been the case more or less since the 2008 equity crash. U.S. Bonds have been a flight to safety when U.S. equities have fallen. A portfolio is not just made up of asset classes in equal proportions. We must also understand how these asset classes compare to each other. In the short term, our bond position is going to act as a hedge against our stock positions and we will also collect the 2% yield it pays out. We need to have a portfolio that will make us money if we have inflation or deflation or if we have economic growth or recessions. Every asset class has its bull markets and bear markets and nobody (no matter who they are) can predict the future. We have had the real estate bull market in the early 2000’s and then the stock market revival since 2008. What asset class will provide the next bull run? Gold, Agriculture, will real estate come back strong? The fact of the matter is that nobody knows and until new trends start to take place, we will stay long our bond position Finally, we are going to add an agricultural presence to our portfolio. These ETFs are going to give our portfolio stability as they are not volatile. I compared the Market Vectors Agribusiness ETF (NYSEARCA: MOO ) and the PowerShares DB Agriculture ETF (NYSEARCA: DBA ) (see chart below): (click to enlarge) We will invest an initial $70k into this sector with $50k going into the Market Vectors Agribusiness ETF and $20k into the PowerShares DB Agriculture ETF. The Market Vectors Agribusiness ETF has vastly outperformed The PowerShares DB Agriculture Fund over the last 7 years because it’s a fund invested in U.S. companies in this sector. Moreover, it definitely has been helped by the stock market rally since 2008. However, I expect the trend in the above chart to change in the near future. When it does, we will rebalance this sector and invest more heavily into DBA. This fund solely concentrates on price movement of the agricultural commodities (corn, sugar, wheat, etc.) and that is where I think the big gains will be in this sector going forward. Editor’s Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

One of our holdings, (Nestle) may have lower profits in the short term due to the strength of the Swiss Franc. Nevertheless we are holding this stock long term. Our long bond position is performing very well. It gives our portfolio stability and it acts as a hedge against falling prices in our equities. We have added 2 new agricultural ETFs to our portfolio. We are investing with the trend for the time being but I expect to deploy more capital into DBA soon. First of all, an update on our 1% portfolio. In our equity asset class, we are holding Nestle ( OTCPK:NSRGY ). As many of you know, the Swiss National Bank announced the abandonment of the currency peg with the euro. The following day a follower emailed me and asked if we were going to continue to hold Nestle as this company is headquartered in Switzerland. The answer is a definite yes! We may have some downward movement in Nestle in the short term as the Swiss Franc strengthens against other currencies. Nestle sells all over the world in other currencies and if these international currencies weaken substantially against the Swiss Franc, then Nestle profit margins may be hit as their accounts are filed in Swiss Francs. Nevertheless this is a currency issue, not a fundamental issue. The stock has excellent fundamentals and has been in strong bull mode since 2001 (see chart). The company is yielding just under 3% and has increased its dividend for the past 18 years straight! Similar to American Express (NYSE: AXP ), we are going to stay the course with this holding. (click to enlarge) Our bond position in the Vanguard Total Bond Market ETF (NYSEARCA: BND ) is creating a lot of controversy as many think our stake in this asset class is too large. Currently we have $100k invested in this asset class. Let me explain the reasoning behind this decision. I learned early on in my investing career that if your money is divided equally but your investments are not equal in their risk, you are not balanced. Most portfolios are made up of stocks and the problem with these types of portfolios is that they don’t protect you in bear markets. Today (27-1-2015) we have the S&P falling sharply and bonds rallying. This has been the case more or less since the 2008 equity crash. U.S. Bonds have been a flight to safety when U.S. equities have fallen. A portfolio is not just made up of asset classes in equal proportions. We must also understand how these asset classes compare to each other. In the short term, our bond position is going to act as a hedge against our stock positions and we will also collect the 2% yield it pays out. We need to have a portfolio that will make us money if we have inflation or deflation or if we have economic growth or recessions. Every asset class has its bull markets and bear markets and nobody (no matter who they are) can predict the future. We have had the real estate bull market in the early 2000’s and then the stock market revival since 2008. What asset class will provide the next bull run? Gold, Agriculture, will real estate come back strong? The fact of the matter is that nobody knows and until new trends start to take place, we will stay long our bond position Finally, we are going to add an agricultural presence to our portfolio. These ETFs are going to give our portfolio stability as they are not volatile. I compared the Market Vectors Agribusiness ETF (NYSEARCA: MOO ) and the PowerShares DB Agriculture ETF (NYSEARCA: DBA ) (see chart below): (click to enlarge) We will invest an initial $70k into this sector with $50k going into the Market Vectors Agribusiness ETF and $20k into the PowerShares DB Agriculture ETF. The Market Vectors Agribusiness ETF has vastly outperformed The PowerShares DB Agriculture Fund over the last 7 years because it’s a fund invested in U.S. companies in this sector. Moreover, it definitely has been helped by the stock market rally since 2008. However, I expect the trend in the above chart to change in the near future. When it does, we will rebalance this sector and invest more heavily into DBA. This fund solely concentrates on price movement of the agricultural commodities (corn, sugar, wheat, etc.) and that is where I think the big gains will be in this sector going forward. Editor’s Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News