Scalper1 News

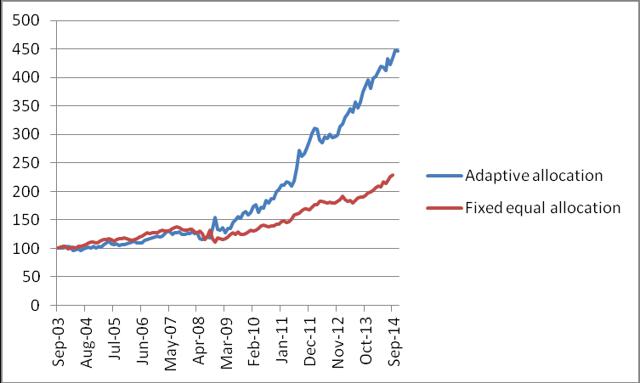

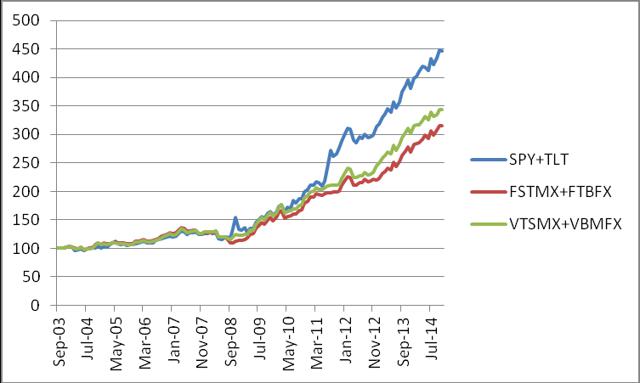

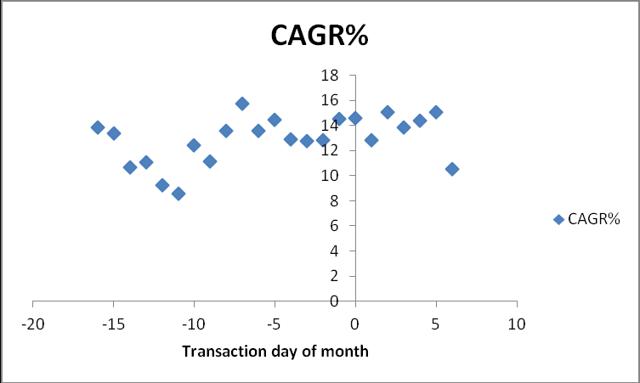

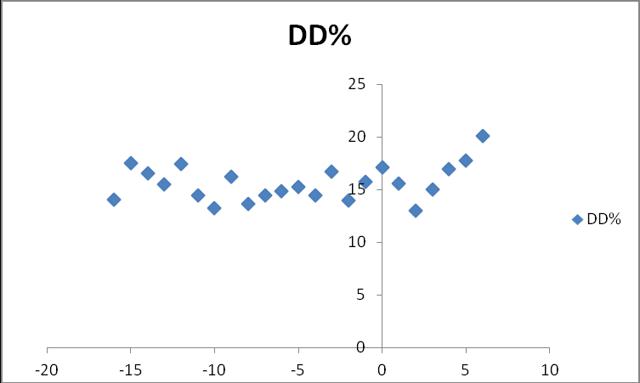

Summary The performance of adaptive asset allocation is sensitive to the day of the month when transactions are executed. The performance is better if the trades are executed around the end/beginning of the month than close to the middle of the month. The day of month effect is consistent for ETFs and related mutual funds. We obtained similar effects on (SPY, TLT), (VTI, AGG), (FSTMX, FTBFX), and (VTSMX, VBMFX) pairs. In a couple of recent articles , we demonstrated that a very simple and well-diversified portfolio may be made up of two instruments, one representing the total stock market and the other the total bond market. These portfolios are quite robust and achieve decent returns using simple strategies such as rebalancing and momentum-based adaptive allocation. At the suggestion of some readers, we investigate the effect of the day of month on the performance of the momentum-based adaptive asset allocation strategy. From many possibilities, I selected the following four portfolios: one built with SPY and TLT, the second with iShares and Vanguard ETFs, the third with Vanguard mutual funds, and the fourth with Fidelity mutual funds. ETFs portfolio: iShares 20+ Year Treasury Bond ETF (NYSEARCA: TLT ) and SPDR S&P 500 Trust ETF (NYSEARCA: SPY ). ETFs portfolio: iShares Core Total US Bond Market ETF (NYSEARCA: AGG ) and Vanguard Total Stock Market ETF (NYSEARCA: VTI ). Mutual funds portfolio: Vanguard Total Bond Market Index Fund (MUTF: VBMFX ) and Vanguard Total Stock Market Index Fund (MUTF: VTSMX ). Mutual funds portfolio: Fidelity Total Bond Market Index Fund (MUTF: FTBFX ) and Fidelity Spartan Total Stock Market Index Fund (MUTF: FSTMX ). For purposes of comparison, we simulate these portfolios from December 2003 to December 2014, a total of eleven years. The time period of the study was selected based on the availability of historical data of the investment instruments; AGG was created in September 2003. The data for the study were downloaded from Yahoo Finance on the Historical Prices menu for the eight tickers, SPY, TLT, AGG, VTI , VBMFX , VTSTX , FTBFX and FSTMX. We use the monthly price data from September 2003 to December 2014, adjusted for stock splits and dividend payments. The article has two parts. In the first part, we present general results for the four portfolios. The second part presents the effect of varying the day of the month when the trading is done. Part I. General Results The first study was done on the SPY + TLT. In it, we compare the results obtained with the following two strategies: (1) A portfolio with 50% SPY and 50% TLT without rebalancing. This portfolio is called “fixed allocation”. (2) A portfolio that is, at all times, invested 100% in either SPY or TLT. The switching, if necessary, is done monthly at the closing of the last trading day of the month. All the funds are invested in the instrument with the highest return over the previous 3 months. This portfolio is called “adaptive allocation”. The data below shows the investment results over 11 years (132 months). The first line is a buy-and-hold on SPY, the second is a buy-and-hold on TLT, the third is buy-and-hold of an initial investment of 50% in SPY and 50% in TLT, while the fourth line is adaptive allocation on SPY and TLT based on a look back of 3 months. Table 1. SPY + TLT portfolios January 2004-December 2014 Total Return% CAGR% Max DD% SPY 130.4 7.88 -50.79 TLT 126.6 7.72 -21.81 Fixed Allocation 128.5 7.76 -18.68 Adaptive Allocation 347.0 14.58 -17.13 The equity curves for the fixed and adaptive allocation of the SPY + TLT portfolios are shown in Figure 1. (click to enlarge) Figure 1. Equities of SPY + TLT portfolios Source: This chart is based on EXCEL calculations using the adjusted monthly closing share prices of securities. The second study compares the four pairs using the momentum-based adaptive allocation. The trading is done at the month’s closing prices. The results are given in Table 2. Table 2. Adaptive allocation of four portfolios January 2004-December 2014 Total Return% CAGR% Max DD% SPY + TLT 347.0 14.58 -17.13 VTI + AGG 241.6 11.82 -13.03 VTSMX + VBMFX 243.4 11.87 -13.81 FSTMX + FTBFX 214.8 10.99 -20.29 The equity curves for the three portfolios with adaptive allocation are shown in Figure 2. The Vanguard mutual fund was omitted because it virtually overlaps with the Vanguard ETF portfolio. (click to enlarge) Figure 2. Equities of portfolios with adaptive allocation Source: This chart is based on EXCEL calculations using the adjusted monthly closing share prices of securities. Part II. Day of Month Trading Results The study was done using the daily historical prices of the eight instruments. Because the results were very similar for the four pairs, we report mostly the results for the SPY + TLT pair only. The switching between bond and stock funds was done, if necessary, on the same day of the month. The look back period was three months, comparing prices on the same day of the month, but for three months apart. The day of the month is indicated by a variable called “shift”. Shift takes values between -16 and 6. Here shift=6 means the 6th trading day of the month, shift=0 means the last trading day of the month, shift=-1 means the trading day before the last trading day, etc. The equity curves for the SPY + TLT portfolio for three different trading days and with adaptive allocation are shown in Figure 3. As can be seen, the trading day of the month has a significant effect on the results. Trading on the last day of the month is better than trading on the 6th day of the month, but a little worse than trading seven days before the end of the month. These results are related to the specific historical data and cannot be generalized. (click to enlarge) Figure 3. Equities of the SPY + TLT portfolios with adaptive allocation Source: This chart is based on EXCEL calculations using the adjusted daily closing share prices of securities. To illustrate better the variability of the performance of adaptive allocation with the trading day of the month, we show the scatter plots of CAGR and DD versus the shift values from -16 to 6. (click to enlarge) Figure 4. CAGR% of the SPY + TLT portfolios with adaptive allocation Source: This chart is based on EXCEL calculations using the adjusted daily closing share prices of securities. As can be seen in Figure 4, CAGR varies very little for shift values from -5 to 5, but decreases substantially for shift values outside this range. (click to enlarge) Figure 5. DD% of the SPY + TLT portfolios with adaptive allocation Source: This chart is based on EXCEL calculations using the adjusted daily closing share prices of securities. As can be seen in Figure 5, DD varies very little for shift values from -16 to 4, but increases somewhat for shift=6. Conclusions The day of the month when the trading is done affects the performance obtained applying the adaptive asset allocation strategy. The performance is better if the trades are executed around the end/beginning of the month, than close to the middle of the month. The day of month effect is consistent for ETFs and related mutual funds. It may be useful to extend this study to various portfolios with instruments from other asset classes. Scalper1 News

Summary The performance of adaptive asset allocation is sensitive to the day of the month when transactions are executed. The performance is better if the trades are executed around the end/beginning of the month than close to the middle of the month. The day of month effect is consistent for ETFs and related mutual funds. We obtained similar effects on (SPY, TLT), (VTI, AGG), (FSTMX, FTBFX), and (VTSMX, VBMFX) pairs. In a couple of recent articles , we demonstrated that a very simple and well-diversified portfolio may be made up of two instruments, one representing the total stock market and the other the total bond market. These portfolios are quite robust and achieve decent returns using simple strategies such as rebalancing and momentum-based adaptive allocation. At the suggestion of some readers, we investigate the effect of the day of month on the performance of the momentum-based adaptive asset allocation strategy. From many possibilities, I selected the following four portfolios: one built with SPY and TLT, the second with iShares and Vanguard ETFs, the third with Vanguard mutual funds, and the fourth with Fidelity mutual funds. ETFs portfolio: iShares 20+ Year Treasury Bond ETF (NYSEARCA: TLT ) and SPDR S&P 500 Trust ETF (NYSEARCA: SPY ). ETFs portfolio: iShares Core Total US Bond Market ETF (NYSEARCA: AGG ) and Vanguard Total Stock Market ETF (NYSEARCA: VTI ). Mutual funds portfolio: Vanguard Total Bond Market Index Fund (MUTF: VBMFX ) and Vanguard Total Stock Market Index Fund (MUTF: VTSMX ). Mutual funds portfolio: Fidelity Total Bond Market Index Fund (MUTF: FTBFX ) and Fidelity Spartan Total Stock Market Index Fund (MUTF: FSTMX ). For purposes of comparison, we simulate these portfolios from December 2003 to December 2014, a total of eleven years. The time period of the study was selected based on the availability of historical data of the investment instruments; AGG was created in September 2003. The data for the study were downloaded from Yahoo Finance on the Historical Prices menu for the eight tickers, SPY, TLT, AGG, VTI , VBMFX , VTSTX , FTBFX and FSTMX. We use the monthly price data from September 2003 to December 2014, adjusted for stock splits and dividend payments. The article has two parts. In the first part, we present general results for the four portfolios. The second part presents the effect of varying the day of the month when the trading is done. Part I. General Results The first study was done on the SPY + TLT. In it, we compare the results obtained with the following two strategies: (1) A portfolio with 50% SPY and 50% TLT without rebalancing. This portfolio is called “fixed allocation”. (2) A portfolio that is, at all times, invested 100% in either SPY or TLT. The switching, if necessary, is done monthly at the closing of the last trading day of the month. All the funds are invested in the instrument with the highest return over the previous 3 months. This portfolio is called “adaptive allocation”. The data below shows the investment results over 11 years (132 months). The first line is a buy-and-hold on SPY, the second is a buy-and-hold on TLT, the third is buy-and-hold of an initial investment of 50% in SPY and 50% in TLT, while the fourth line is adaptive allocation on SPY and TLT based on a look back of 3 months. Table 1. SPY + TLT portfolios January 2004-December 2014 Total Return% CAGR% Max DD% SPY 130.4 7.88 -50.79 TLT 126.6 7.72 -21.81 Fixed Allocation 128.5 7.76 -18.68 Adaptive Allocation 347.0 14.58 -17.13 The equity curves for the fixed and adaptive allocation of the SPY + TLT portfolios are shown in Figure 1. (click to enlarge) Figure 1. Equities of SPY + TLT portfolios Source: This chart is based on EXCEL calculations using the adjusted monthly closing share prices of securities. The second study compares the four pairs using the momentum-based adaptive allocation. The trading is done at the month’s closing prices. The results are given in Table 2. Table 2. Adaptive allocation of four portfolios January 2004-December 2014 Total Return% CAGR% Max DD% SPY + TLT 347.0 14.58 -17.13 VTI + AGG 241.6 11.82 -13.03 VTSMX + VBMFX 243.4 11.87 -13.81 FSTMX + FTBFX 214.8 10.99 -20.29 The equity curves for the three portfolios with adaptive allocation are shown in Figure 2. The Vanguard mutual fund was omitted because it virtually overlaps with the Vanguard ETF portfolio. (click to enlarge) Figure 2. Equities of portfolios with adaptive allocation Source: This chart is based on EXCEL calculations using the adjusted monthly closing share prices of securities. Part II. Day of Month Trading Results The study was done using the daily historical prices of the eight instruments. Because the results were very similar for the four pairs, we report mostly the results for the SPY + TLT pair only. The switching between bond and stock funds was done, if necessary, on the same day of the month. The look back period was three months, comparing prices on the same day of the month, but for three months apart. The day of the month is indicated by a variable called “shift”. Shift takes values between -16 and 6. Here shift=6 means the 6th trading day of the month, shift=0 means the last trading day of the month, shift=-1 means the trading day before the last trading day, etc. The equity curves for the SPY + TLT portfolio for three different trading days and with adaptive allocation are shown in Figure 3. As can be seen, the trading day of the month has a significant effect on the results. Trading on the last day of the month is better than trading on the 6th day of the month, but a little worse than trading seven days before the end of the month. These results are related to the specific historical data and cannot be generalized. (click to enlarge) Figure 3. Equities of the SPY + TLT portfolios with adaptive allocation Source: This chart is based on EXCEL calculations using the adjusted daily closing share prices of securities. To illustrate better the variability of the performance of adaptive allocation with the trading day of the month, we show the scatter plots of CAGR and DD versus the shift values from -16 to 6. (click to enlarge) Figure 4. CAGR% of the SPY + TLT portfolios with adaptive allocation Source: This chart is based on EXCEL calculations using the adjusted daily closing share prices of securities. As can be seen in Figure 4, CAGR varies very little for shift values from -5 to 5, but decreases substantially for shift values outside this range. (click to enlarge) Figure 5. DD% of the SPY + TLT portfolios with adaptive allocation Source: This chart is based on EXCEL calculations using the adjusted daily closing share prices of securities. As can be seen in Figure 5, DD varies very little for shift values from -16 to 4, but increases somewhat for shift=6. Conclusions The day of the month when the trading is done affects the performance obtained applying the adaptive asset allocation strategy. The performance is better if the trades are executed around the end/beginning of the month, than close to the middle of the month. The day of month effect is consistent for ETFs and related mutual funds. It may be useful to extend this study to various portfolios with instruments from other asset classes. Scalper1 News

Scalper1 News