Scalper1 News

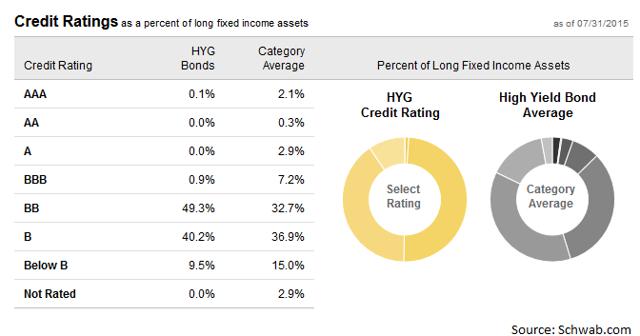

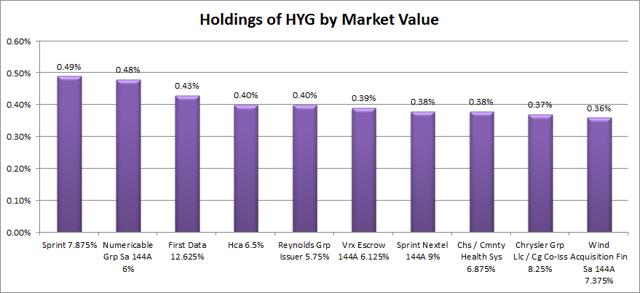

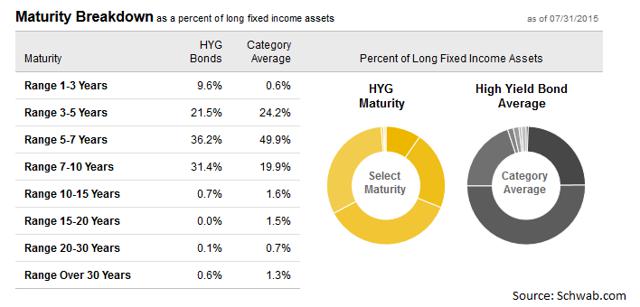

Summary The IShares iBoxx $ High Yield Corporate Bond ETF has the expected credit risk for a high yield fund, but the yield is worth it. The holdings show reasonable diversification in the debt securities in the portfolio. Maturities are scattered from 1 year through 10 years with the heaviest levels in the 5 to 7 year range. The correlation to SPY which causes the ETF to dip with the S&P 500 is a concern of investing in junk bond funds. The correlation issues should be less pronounced if investors include other (not junk, lower yield) bond funds in their portfolio. The iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA: HYG ) is a solid bond fund for exposure to securities rated BB or B. As I’ve been searching for appealing bond funds, finding great ETFs for bonds of mediocre quality and higher yields has been difficult. After looking through the portfolio, I think the holdings are fairly reasonable for an investor wanting to regularly keep part of their portfolio in a bond fund. The holdings clearly don’t have impeccable credit ratings but they do offer investors a decent yield. The distribution yield is about 5.5% which means investors are actually getting some respectable income out a bond fund. Credit Quality When the name says “High Yield Corporate Bond”, investors should know that is going to mean that credit ratings won’t be very high. The allocation here seems within reason even if it is a little heavier on the specific ratings it targets than the category average. See the chart below: (click to enlarge) The concentration doesn’t bother me. If I’m going to invest in a credit sensitive bond portfolio I want the holdings to be diversified when considering the issuer of the debt, however having a heavy focus on the specific credit ratings is nice when an investor wants to build an entire portfolio and use multiple bond funds. Holdings I prepared the following chart showing the largest debt holdings of HYG. There were a couple equity holdings showing up but they were inconsequential to the overall portfolio as their combined value was significantly less than 1% of the portfolio. (click to enlarge) Maturities I grabbed another chart to show the maturity ranges across the portfolio: (click to enlarge) The maturity profile for the iShares iBoxx $ High Yield Corporate Bond ETF is fairly reasonable for an investor trying to get a solid diversification across the yield curve with a preference for shorter to medium length securities which should reduce the volatility of the portfolio. Of course, the credit risk on the portfolio could be an issue for some investors and may influence volatility in its own way. Regardless, the portfolio is showing almost no exposure beyond 10 years while having a solid yield. When it comes to maturities, I think this breakdown looks fairly solid. Risk HYG has been around since early 2007 which is wonderful for seeing how the fund did during that challenging period that followed. The shares did drop hard along with the market, which is not surprising given that they are investing in high yield (and thus higher risk) securities, however it did not fall even remotely as hard as the S&P 500. The biggest risk factor from a portfolio standpoint that came up for me was a 73.8% correlation in monthly returns with the S&P 500. Since one purpose of the bond portion of the portfolio is to provide diversification, it is a strike against junk bond funds that they tend to move with the market. That is a problem that should be impacting most junk bonds though, not a risk unique to HYG. Expense Ratio The one thing I really don’t care for is the expense ratio at .50%. I’m not going to say that this is terrible for a bond fund, but my expectations for low expense ratios are not met. Conclusion HYG is a fairly solid option for junk bond exposure. The portfolio appears to be designed well, the distribution of maturities works to help avoid excessive exposure to a single part of the yield curve and the portfolio produces a respectable amount of income. I could go for a lower expense ratio to really make this fund stand out, but that is the only weakness I see that is specific to the fund. If an investor is looking at the role of the bond fund in their portfolio, it would be wise to consider having multiple bond funds if the first one is going to be investing in junk bonds. This kind of fund can offer some diversification benefits to investors but it would be most productive in a portfolio that combines it with a few other bond funds with different duration exposures and higher credit ratings to enhance the diversification benefits that bonds bring to the investor’s portfolio. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary The IShares iBoxx $ High Yield Corporate Bond ETF has the expected credit risk for a high yield fund, but the yield is worth it. The holdings show reasonable diversification in the debt securities in the portfolio. Maturities are scattered from 1 year through 10 years with the heaviest levels in the 5 to 7 year range. The correlation to SPY which causes the ETF to dip with the S&P 500 is a concern of investing in junk bond funds. The correlation issues should be less pronounced if investors include other (not junk, lower yield) bond funds in their portfolio. The iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA: HYG ) is a solid bond fund for exposure to securities rated BB or B. As I’ve been searching for appealing bond funds, finding great ETFs for bonds of mediocre quality and higher yields has been difficult. After looking through the portfolio, I think the holdings are fairly reasonable for an investor wanting to regularly keep part of their portfolio in a bond fund. The holdings clearly don’t have impeccable credit ratings but they do offer investors a decent yield. The distribution yield is about 5.5% which means investors are actually getting some respectable income out a bond fund. Credit Quality When the name says “High Yield Corporate Bond”, investors should know that is going to mean that credit ratings won’t be very high. The allocation here seems within reason even if it is a little heavier on the specific ratings it targets than the category average. See the chart below: (click to enlarge) The concentration doesn’t bother me. If I’m going to invest in a credit sensitive bond portfolio I want the holdings to be diversified when considering the issuer of the debt, however having a heavy focus on the specific credit ratings is nice when an investor wants to build an entire portfolio and use multiple bond funds. Holdings I prepared the following chart showing the largest debt holdings of HYG. There were a couple equity holdings showing up but they were inconsequential to the overall portfolio as their combined value was significantly less than 1% of the portfolio. (click to enlarge) Maturities I grabbed another chart to show the maturity ranges across the portfolio: (click to enlarge) The maturity profile for the iShares iBoxx $ High Yield Corporate Bond ETF is fairly reasonable for an investor trying to get a solid diversification across the yield curve with a preference for shorter to medium length securities which should reduce the volatility of the portfolio. Of course, the credit risk on the portfolio could be an issue for some investors and may influence volatility in its own way. Regardless, the portfolio is showing almost no exposure beyond 10 years while having a solid yield. When it comes to maturities, I think this breakdown looks fairly solid. Risk HYG has been around since early 2007 which is wonderful for seeing how the fund did during that challenging period that followed. The shares did drop hard along with the market, which is not surprising given that they are investing in high yield (and thus higher risk) securities, however it did not fall even remotely as hard as the S&P 500. The biggest risk factor from a portfolio standpoint that came up for me was a 73.8% correlation in monthly returns with the S&P 500. Since one purpose of the bond portion of the portfolio is to provide diversification, it is a strike against junk bond funds that they tend to move with the market. That is a problem that should be impacting most junk bonds though, not a risk unique to HYG. Expense Ratio The one thing I really don’t care for is the expense ratio at .50%. I’m not going to say that this is terrible for a bond fund, but my expectations for low expense ratios are not met. Conclusion HYG is a fairly solid option for junk bond exposure. The portfolio appears to be designed well, the distribution of maturities works to help avoid excessive exposure to a single part of the yield curve and the portfolio produces a respectable amount of income. I could go for a lower expense ratio to really make this fund stand out, but that is the only weakness I see that is specific to the fund. If an investor is looking at the role of the bond fund in their portfolio, it would be wise to consider having multiple bond funds if the first one is going to be investing in junk bonds. This kind of fund can offer some diversification benefits to investors but it would be most productive in a portfolio that combines it with a few other bond funds with different duration exposures and higher credit ratings to enhance the diversification benefits that bonds bring to the investor’s portfolio. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News