Scalper1 News

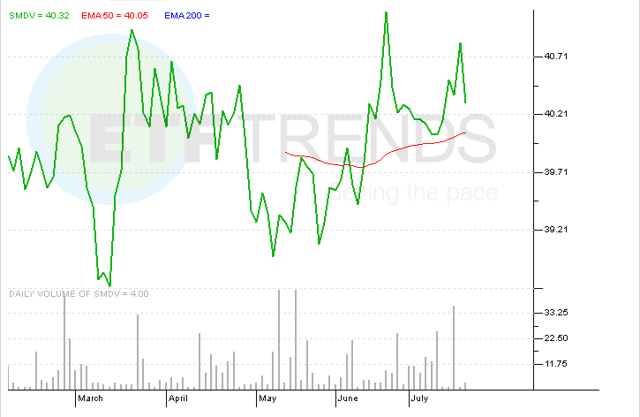

Summary Small-capitalization stocks have rebounded this year. A small-cap ETF that targets dividend growers. How the ProShares Russell 2000 Dividend Growers ETF compares to the benchmark Russell 2000. By Todd Shriber & Tom Lydon Small-caps are rebounding this year as highlighted by a gain of 4.1% for the iShares Russell 2000 ETF (NYSEARCA: IWM ) , the largest small-cap ETF. That is well ahead of the 2.9% returned by the S&P 500 this year. Investors looking for a more conservative, income-oriented approach to the Russell 2000, the benchmark U.S. small-cap index, have a compelling option in the ProShares Russell 2000 Dividend Growers ETF (NYSEARCA: SMDV ) . SMDV, which debuted in February, tracks the Russell 2000 Dividend Growth Index. That index includes small-cap firms with dividend increase streaks of at least a decade. Index constituents are screened for liquidity and dividend status, then selected and equal-weighted subject to a maximum sector weight of 30%, according to Russell Investments. Recent data indicate income investors should give small-caps and the corresponding exchange-traded funds a new look. “From the end of 2013 there has been a 10.2% increase in the number of issues paying a dividend in the S&P SmallCap 600,” according to S&P Dow Jones Indices . SMDV has returned half a percent since coming to market. While that is well behind the returns from the traditional Russell 2000 Index, investors should remember that the fund offers a more conservative approach to small-caps, with a superior yield to the Russell 2000. For example, SMDV’s 30-day SEC yield is 2.22%, or nearly 100 basis points higher than the comparable metric on IWM. Then, there is the potential for dividend growth. “Much of the potential return differential of small cap dividend growers have over other small caps can be attributed to lower historical risk,” according to a ProShares note . “Not only have small cap dividend growers had lower volatility compared with the overall small cap space, they have also had lower drawdowns. It is ‘winning by not losing as much’ that has translated to better returns over time.” SMDV is somewhat sensitive to changes in interest rates by way of an almost 27% weight to the utilities sector, but the fund combats that with a 21.6% weight to financial services names. While financials have been an important source of U.S. dividend growth in recent years, small-caps from that sector offer an advantage when rates rise , because they are highly levered to profit-boosting increases in net interest margin. For the five years ended December 31, 2014, Russell 2000 dividend growers delivered return on equity of 13.4%, 360 basis points ahead of non-dividend growers, according to ProShares data. The index’s dividend growers also delivered EPS growth of 6.2%, compared to 6% for non-dividend growers. ProShares Russell 2000 Dividend Growers ETF (click to enlarge) Tom Lydon’s clients own shares of IWM. Disclosure: I am/we are long IWM. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Small-capitalization stocks have rebounded this year. A small-cap ETF that targets dividend growers. How the ProShares Russell 2000 Dividend Growers ETF compares to the benchmark Russell 2000. By Todd Shriber & Tom Lydon Small-caps are rebounding this year as highlighted by a gain of 4.1% for the iShares Russell 2000 ETF (NYSEARCA: IWM ) , the largest small-cap ETF. That is well ahead of the 2.9% returned by the S&P 500 this year. Investors looking for a more conservative, income-oriented approach to the Russell 2000, the benchmark U.S. small-cap index, have a compelling option in the ProShares Russell 2000 Dividend Growers ETF (NYSEARCA: SMDV ) . SMDV, which debuted in February, tracks the Russell 2000 Dividend Growth Index. That index includes small-cap firms with dividend increase streaks of at least a decade. Index constituents are screened for liquidity and dividend status, then selected and equal-weighted subject to a maximum sector weight of 30%, according to Russell Investments. Recent data indicate income investors should give small-caps and the corresponding exchange-traded funds a new look. “From the end of 2013 there has been a 10.2% increase in the number of issues paying a dividend in the S&P SmallCap 600,” according to S&P Dow Jones Indices . SMDV has returned half a percent since coming to market. While that is well behind the returns from the traditional Russell 2000 Index, investors should remember that the fund offers a more conservative approach to small-caps, with a superior yield to the Russell 2000. For example, SMDV’s 30-day SEC yield is 2.22%, or nearly 100 basis points higher than the comparable metric on IWM. Then, there is the potential for dividend growth. “Much of the potential return differential of small cap dividend growers have over other small caps can be attributed to lower historical risk,” according to a ProShares note . “Not only have small cap dividend growers had lower volatility compared with the overall small cap space, they have also had lower drawdowns. It is ‘winning by not losing as much’ that has translated to better returns over time.” SMDV is somewhat sensitive to changes in interest rates by way of an almost 27% weight to the utilities sector, but the fund combats that with a 21.6% weight to financial services names. While financials have been an important source of U.S. dividend growth in recent years, small-caps from that sector offer an advantage when rates rise , because they are highly levered to profit-boosting increases in net interest margin. For the five years ended December 31, 2014, Russell 2000 dividend growers delivered return on equity of 13.4%, 360 basis points ahead of non-dividend growers, according to ProShares data. The index’s dividend growers also delivered EPS growth of 6.2%, compared to 6% for non-dividend growers. ProShares Russell 2000 Dividend Growers ETF (click to enlarge) Tom Lydon’s clients own shares of IWM. Disclosure: I am/we are long IWM. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News