Scalper1 News

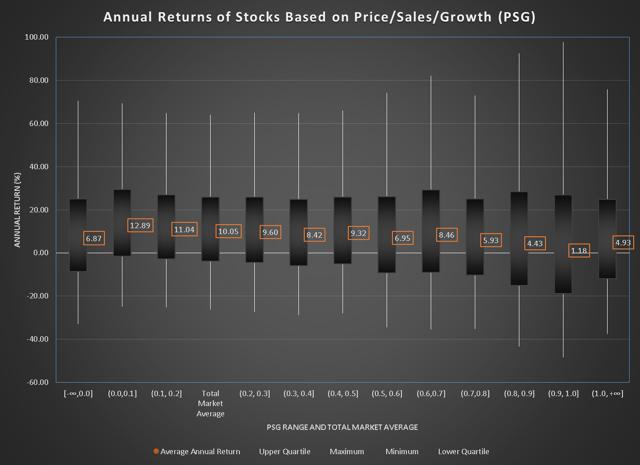

Peter Lynch introduced the concept of PEG over two decades ago. While it is a great concept, it has its limitations. Price-to-sales ratio was popularized by Ken Fisher. It, too, is a great idea, but also has its shortcomings. What if we compared the price/sales ratio to a company’s sales growth rate? Here we find out. Many of us who utilize stock screen programs have seen the PEG option; the Price-to-Earnings Ratio to Earnings Growth. According to Peter Lynch , “The p/e ratio of any company that’s fairly priced will equal its growth rate. I’m talking about growth rate of earnings here.” Later, he says, “We use this measure all the time in analyzing stocks for the mutual funds.” Timothy Connolly goes one step further, and says, “If we think about what Lynch was saying in terms of a formula, we could say ‘Fair P/E = Growth rate.’ Dividing both sides by the growth rate yields ‘Fair P/E/Growth rate = 1.'” According to Lynch, “a p/e ratio that’s half the growth rate is very positive, and one that’s twice the growth rate is very negative.” Essentially this means he looked for companies with a PEG less than 0.5. There are limitations to this function, and I won’t get into all of them, but it is worth pointing out that it has two mathematical drawbacks, from it being a piecewise operation. First, it assumes that a company has been profitable for the trailing 12 months. For any company to have a P/E ratio, it has to be profitable. While that is usually a good thing, it does eliminate young companies that are not yet in the black from any consideration. For one who is looking for the next big stock, the analyst might miss opportunities if s/he were solely reliant on PEG. Second, it only works if the growth rate for earnings is positive. Again, this is not a negative, but if one is not careful in their workflow, then it is conceivable that one could divide a negative P/E with a negative growth rate and yield a positive result; that cannot happen. In researching a way around this, I took another look at the Price-to-Sales ratio (PSR). I have written how this ratio has been utilized by Ken Fisher , and how it can improve your screening results. Generally, one should look for companies with a PSR less than 1.5, and 0.75, according to Fisher. By using this metric, one is able to find relatively cheap stocks. The question I have is, “How cheap is cheap?” There are two definitions that one can use for the word “cheap.” First, it implies that something is low cost. For the purveyors of PSR, it assumes that one should not have to overpay for a company’s revenues. If one says that the PSR should be less than 1.5, then the forecaster is saying that one should not have to pay more than $1.50 for every $1 in revenues. The second implied definition for “cheap” is that it is something of poor quality. It’s the kind of thing one finds at a local flea market. It might be inexpensive, but the quality of the product is so bad, that it could not warrant a higher price. Perhaps a company has a low PSR because it is simply not a very good business. If one merely looks for low PSR, then there is the potential for dumpster diving, and coming out with garbage. For these reasons, I humbly suggest a modified version of the PEG ratio. Because of the lack of true imagination, I will call it the PSG (Price/Sales-to-Growth) ratio. The formula is pretty easy to calculate with a spreadsheet. Simply divide the PSR by the five-year revenue growth rate (as a percent). For example, Apple (NASDAQ: AAPL ) has a current PSR of 3.51. Its five-year revenue growth rate is 33.63%. If one divides 3.51 by 33.63, it yields a PSG of 0.10. I have attempted to find out if there has been any major works or discussions regarding PSG. There is a blog talking about it, but the conversation diverts to a discussion about free cash flow. Other than that, any search about PSG leads me to a threads about the merits of PEG, financial pages about the company Performance Sports Group (NYSE: PSG ), or about a soccer team in Paris. There does not seem to be any real discussion about it, and that is surprising. What I wanted to know was whether it was possible to find a PSG ratio that would yield better results than the overall market. Chart 1 shows the results. It truncates the bins based 0.1 intervals for the ratio. Each category, including the data for the overall market, assumed each stock was equally weighted, regardless of market cap or price. All data is for 12 month returns for monthly rolling periods since 1997. (click to enlarge) Chart 1 The data is clear. Companies that have a PSG between 0.0 and 0.2 outperformed the over market [11.28% (±20.72%) v. 10.05% (± 22.07%)]. Companies that have negative sales growth cannot beat the market (6.87% ± 26.23%), and companies where the PSR is too high compared to the sales growth of the company will also underperform (7.84% ± 20.76%). The data also shows this is consistent with cheap stocks (PSR < 0.75) where the annual return was 11.76% (±23.46%) and for companies that some might find expensive (PSR > 3) where returns were 15.17% (±27.58%). What the data ultimately tells us is that the sales growth rate must be at least five times the PSR. Table 1 has a partial list of Russell 3000 companies with PSR < 0.75 and the lowest PSG ratios. Ticker Name PSG PBF PBF Energy Inc 0.00016 VEC Vectrus Inc 0.000782 RCAP RCS Capital Corp 0.002046 PARR Par Petroleum Corp 0.002133 AE Adams Resources & Energy Inc. 0.002814 INT World Fuel Services Corp 0.002914 SSE Seventy Seven Energy Inc 0.005346 SPTN SpartanNash Co 0.005903 CJES C&J Energy Services Ltd 0.005968 NOG Northern Oil and Gas Inc 0.006485 ZEUS Olympic Steel Inc 0.006705 BIOS Bioscrip Inc 0.006504 RUSHA Rush Enterprises Inc 0.007292 TA TravelCenters of America LLC 0.007547 REGI Renewable Energy Group Inc 0.007307 CTRX Catamaran Corp 0.007652 HK Halcon Resources Corp 0.00785 SHLO Shiloh Industries Inc 0.007871 PEIX Pacific Ethanol Inc 0.008433 QUAD Quad/Graphics Inc 0.008582 Table 1 Table 2 is a partial list of Russell 3000 companies with PSR > 3 and the lowest PSG Ticker Name PSG MDXG MiMedx Group Inc 0.008972 UDF United Development Funding IV 0.009005 REI Ring Energy Inc 0.017516 CTIC CTI BioPharma Corp 0.020947 TWO Two Harbors Investment Corp 0.022737 VMEM Violin Memory Inc 0.022758 BRG Bluerock Residential Growth REIT Inc 0.023918 SYRG Synergy Resources Corp 0.026827 PACB Pacific Biosciences of California Inc 0.027763 GPT Gramercy Property Trust Inc 0.032698 ZLTQ ZELTIQ Aesthetics Inc 0.034167 FSIC FS Investment Corp 0.035582 NSAM NorthStar Asset Management Group Inc 0.035939 NLNK NewLink Genetics Corp 0.037607 OREX Orexigen Therapeutics Inc 0.039077 CZNC Citizens & Northern Corp 0.04621 ACHC Acadia Healthcare Co Inc 0.047659 P Pandora Media Inc 0.051713 ECYT Endocyte Inc 0.054804 LC LendingClub Corp 0.061073 Where do we go from here? While it looks like the potential for this metric is high, it does not narrow down the stock universe enough to give one a nice manageable list. Currently, 713 Russell 3000 companies have a PSR less than 0.2. It will be important to find other measures that will help one find a stock screen that will outperform the overall market. What it does give someone, is a measure that generates companies that will outperform the market by significant amounts. Hopefully, this gets the conversation started. Happy Investing! Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Peter Lynch introduced the concept of PEG over two decades ago. While it is a great concept, it has its limitations. Price-to-sales ratio was popularized by Ken Fisher. It, too, is a great idea, but also has its shortcomings. What if we compared the price/sales ratio to a company’s sales growth rate? Here we find out. Many of us who utilize stock screen programs have seen the PEG option; the Price-to-Earnings Ratio to Earnings Growth. According to Peter Lynch , “The p/e ratio of any company that’s fairly priced will equal its growth rate. I’m talking about growth rate of earnings here.” Later, he says, “We use this measure all the time in analyzing stocks for the mutual funds.” Timothy Connolly goes one step further, and says, “If we think about what Lynch was saying in terms of a formula, we could say ‘Fair P/E = Growth rate.’ Dividing both sides by the growth rate yields ‘Fair P/E/Growth rate = 1.'” According to Lynch, “a p/e ratio that’s half the growth rate is very positive, and one that’s twice the growth rate is very negative.” Essentially this means he looked for companies with a PEG less than 0.5. There are limitations to this function, and I won’t get into all of them, but it is worth pointing out that it has two mathematical drawbacks, from it being a piecewise operation. First, it assumes that a company has been profitable for the trailing 12 months. For any company to have a P/E ratio, it has to be profitable. While that is usually a good thing, it does eliminate young companies that are not yet in the black from any consideration. For one who is looking for the next big stock, the analyst might miss opportunities if s/he were solely reliant on PEG. Second, it only works if the growth rate for earnings is positive. Again, this is not a negative, but if one is not careful in their workflow, then it is conceivable that one could divide a negative P/E with a negative growth rate and yield a positive result; that cannot happen. In researching a way around this, I took another look at the Price-to-Sales ratio (PSR). I have written how this ratio has been utilized by Ken Fisher , and how it can improve your screening results. Generally, one should look for companies with a PSR less than 1.5, and 0.75, according to Fisher. By using this metric, one is able to find relatively cheap stocks. The question I have is, “How cheap is cheap?” There are two definitions that one can use for the word “cheap.” First, it implies that something is low cost. For the purveyors of PSR, it assumes that one should not have to overpay for a company’s revenues. If one says that the PSR should be less than 1.5, then the forecaster is saying that one should not have to pay more than $1.50 for every $1 in revenues. The second implied definition for “cheap” is that it is something of poor quality. It’s the kind of thing one finds at a local flea market. It might be inexpensive, but the quality of the product is so bad, that it could not warrant a higher price. Perhaps a company has a low PSR because it is simply not a very good business. If one merely looks for low PSR, then there is the potential for dumpster diving, and coming out with garbage. For these reasons, I humbly suggest a modified version of the PEG ratio. Because of the lack of true imagination, I will call it the PSG (Price/Sales-to-Growth) ratio. The formula is pretty easy to calculate with a spreadsheet. Simply divide the PSR by the five-year revenue growth rate (as a percent). For example, Apple (NASDAQ: AAPL ) has a current PSR of 3.51. Its five-year revenue growth rate is 33.63%. If one divides 3.51 by 33.63, it yields a PSG of 0.10. I have attempted to find out if there has been any major works or discussions regarding PSG. There is a blog talking about it, but the conversation diverts to a discussion about free cash flow. Other than that, any search about PSG leads me to a threads about the merits of PEG, financial pages about the company Performance Sports Group (NYSE: PSG ), or about a soccer team in Paris. There does not seem to be any real discussion about it, and that is surprising. What I wanted to know was whether it was possible to find a PSG ratio that would yield better results than the overall market. Chart 1 shows the results. It truncates the bins based 0.1 intervals for the ratio. Each category, including the data for the overall market, assumed each stock was equally weighted, regardless of market cap or price. All data is for 12 month returns for monthly rolling periods since 1997. (click to enlarge) Chart 1 The data is clear. Companies that have a PSG between 0.0 and 0.2 outperformed the over market [11.28% (±20.72%) v. 10.05% (± 22.07%)]. Companies that have negative sales growth cannot beat the market (6.87% ± 26.23%), and companies where the PSR is too high compared to the sales growth of the company will also underperform (7.84% ± 20.76%). The data also shows this is consistent with cheap stocks (PSR < 0.75) where the annual return was 11.76% (±23.46%) and for companies that some might find expensive (PSR > 3) where returns were 15.17% (±27.58%). What the data ultimately tells us is that the sales growth rate must be at least five times the PSR. Table 1 has a partial list of Russell 3000 companies with PSR < 0.75 and the lowest PSG ratios. Ticker Name PSG PBF PBF Energy Inc 0.00016 VEC Vectrus Inc 0.000782 RCAP RCS Capital Corp 0.002046 PARR Par Petroleum Corp 0.002133 AE Adams Resources & Energy Inc. 0.002814 INT World Fuel Services Corp 0.002914 SSE Seventy Seven Energy Inc 0.005346 SPTN SpartanNash Co 0.005903 CJES C&J Energy Services Ltd 0.005968 NOG Northern Oil and Gas Inc 0.006485 ZEUS Olympic Steel Inc 0.006705 BIOS Bioscrip Inc 0.006504 RUSHA Rush Enterprises Inc 0.007292 TA TravelCenters of America LLC 0.007547 REGI Renewable Energy Group Inc 0.007307 CTRX Catamaran Corp 0.007652 HK Halcon Resources Corp 0.00785 SHLO Shiloh Industries Inc 0.007871 PEIX Pacific Ethanol Inc 0.008433 QUAD Quad/Graphics Inc 0.008582 Table 1 Table 2 is a partial list of Russell 3000 companies with PSR > 3 and the lowest PSG Ticker Name PSG MDXG MiMedx Group Inc 0.008972 UDF United Development Funding IV 0.009005 REI Ring Energy Inc 0.017516 CTIC CTI BioPharma Corp 0.020947 TWO Two Harbors Investment Corp 0.022737 VMEM Violin Memory Inc 0.022758 BRG Bluerock Residential Growth REIT Inc 0.023918 SYRG Synergy Resources Corp 0.026827 PACB Pacific Biosciences of California Inc 0.027763 GPT Gramercy Property Trust Inc 0.032698 ZLTQ ZELTIQ Aesthetics Inc 0.034167 FSIC FS Investment Corp 0.035582 NSAM NorthStar Asset Management Group Inc 0.035939 NLNK NewLink Genetics Corp 0.037607 OREX Orexigen Therapeutics Inc 0.039077 CZNC Citizens & Northern Corp 0.04621 ACHC Acadia Healthcare Co Inc 0.047659 P Pandora Media Inc 0.051713 ECYT Endocyte Inc 0.054804 LC LendingClub Corp 0.061073 Where do we go from here? While it looks like the potential for this metric is high, it does not narrow down the stock universe enough to give one a nice manageable list. Currently, 713 Russell 3000 companies have a PSR less than 0.2. It will be important to find other measures that will help one find a stock screen that will outperform the overall market. What it does give someone, is a measure that generates companies that will outperform the market by significant amounts. Hopefully, this gets the conversation started. Happy Investing! Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News