Scalper1 News

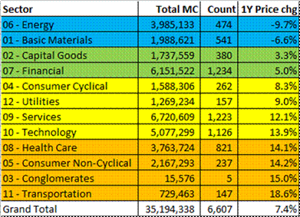

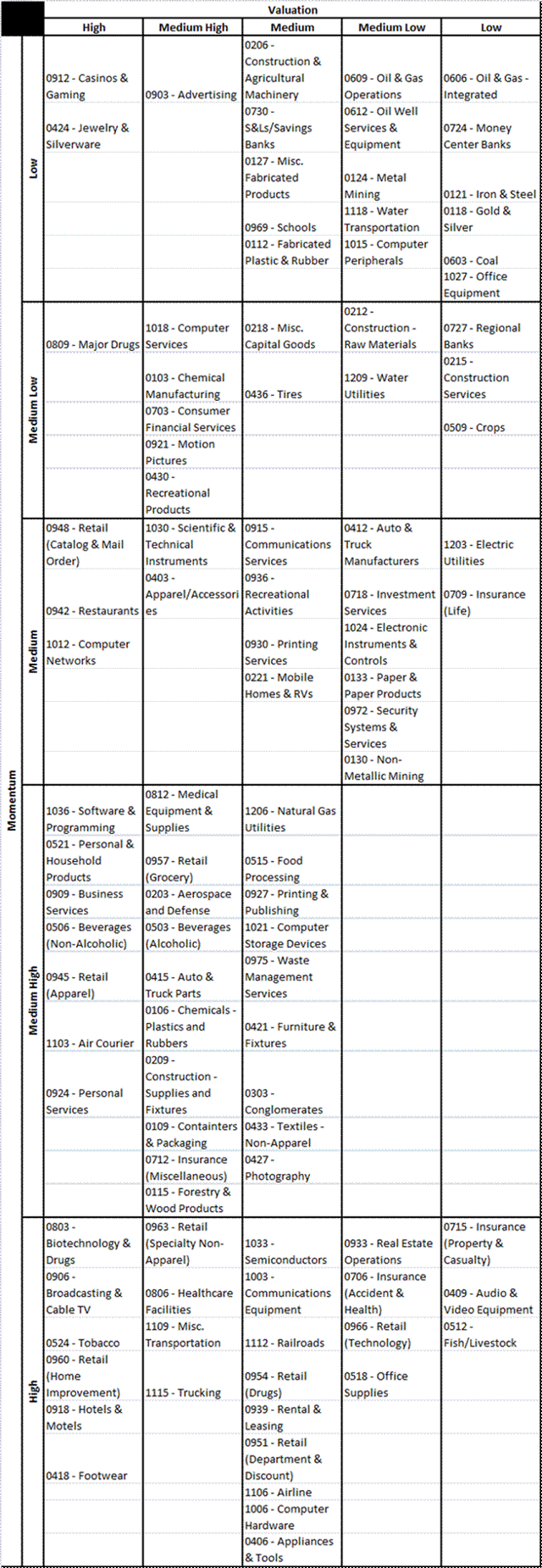

At Abnormal Returns, over the weekend , Tadas Viskanta featured a free article from Credit Suisse called the Credit Suisse Global Investment Returns Yearbook 2015 . It featured articles on whether the returns on industries as a whole mean-revert or have momentum, whether there is a valuation effect on industry returns, “social responsibility” in investing, and the existence of equity discount rate for the market as a whole. There are no surprises in the articles – it is all “dog bites man.” They find that: Industry returns exhibit momentum. There is a valuation component in industry returns. Socially responsible investing doesn’t necessarily produce or miss excess returns. There is an overall equity discount rate, which is levered about 20-25 times, i.e., a 1% increase in the rate lowers valuations by 20-25%. The first two are well known for individual stocks, so it isn’t surprising that it happens at the industry level. The third one has been written about ad nauseam, with many conflicting opinions, so that there is little effect is no big surprise. The last one resembles research I saw in the mid-90s, where the effect of changes in real interest rates has about that impact on stocks. Again, nothing new – which is as it should be. But now some more on industry returns. They found that industry return momentum was significant. Industries that did well one year were likely to do well in the next year. The second finding was that industries with cheap valuations also tended to do well, but it was a smaller effect. So, using one-year price returns as my momentum variable and book-to-market as a valuation variable (both suggested in the article), I divided industries for companies trading in the US into quintiles (also suggested in the article) for momentum and valuation. (Each quintile has roughly 20% of the total market cap.) Here is the result: (click to enlarge) Low valuations are at the right, high at the left. Low momentum at the top, high momentum at the bottom. Ideally, by this method, you would look for industries in the southeast corner. To me, Agriculture, Information Technology, Security, Waste, Some Retail, and Some Transportation look interesting. One in the far southeast that is not so interesting for me is P&C Insurance. Yes, it has done well, and compared to other industries, it is cheap. But industry surplus has grown significantly, leading to more competition, and sagging premium rates. Probably not a great time to make new commitments there. Anyway, the above table should print out nicely on two sheets of letter-sized paper. Not that it would be a substitute for your own due diligence, but perhaps it could start a few ideas going. All for now. Disclosure: None. Scalper1 News

At Abnormal Returns, over the weekend , Tadas Viskanta featured a free article from Credit Suisse called the Credit Suisse Global Investment Returns Yearbook 2015 . It featured articles on whether the returns on industries as a whole mean-revert or have momentum, whether there is a valuation effect on industry returns, “social responsibility” in investing, and the existence of equity discount rate for the market as a whole. There are no surprises in the articles – it is all “dog bites man.” They find that: Industry returns exhibit momentum. There is a valuation component in industry returns. Socially responsible investing doesn’t necessarily produce or miss excess returns. There is an overall equity discount rate, which is levered about 20-25 times, i.e., a 1% increase in the rate lowers valuations by 20-25%. The first two are well known for individual stocks, so it isn’t surprising that it happens at the industry level. The third one has been written about ad nauseam, with many conflicting opinions, so that there is little effect is no big surprise. The last one resembles research I saw in the mid-90s, where the effect of changes in real interest rates has about that impact on stocks. Again, nothing new – which is as it should be. But now some more on industry returns. They found that industry return momentum was significant. Industries that did well one year were likely to do well in the next year. The second finding was that industries with cheap valuations also tended to do well, but it was a smaller effect. So, using one-year price returns as my momentum variable and book-to-market as a valuation variable (both suggested in the article), I divided industries for companies trading in the US into quintiles (also suggested in the article) for momentum and valuation. (Each quintile has roughly 20% of the total market cap.) Here is the result: (click to enlarge) Low valuations are at the right, high at the left. Low momentum at the top, high momentum at the bottom. Ideally, by this method, you would look for industries in the southeast corner. To me, Agriculture, Information Technology, Security, Waste, Some Retail, and Some Transportation look interesting. One in the far southeast that is not so interesting for me is P&C Insurance. Yes, it has done well, and compared to other industries, it is cheap. But industry surplus has grown significantly, leading to more competition, and sagging premium rates. Probably not a great time to make new commitments there. Anyway, the above table should print out nicely on two sheets of letter-sized paper. Not that it would be a substitute for your own due diligence, but perhaps it could start a few ideas going. All for now. Disclosure: None. Scalper1 News

Scalper1 News