Scalper1 News

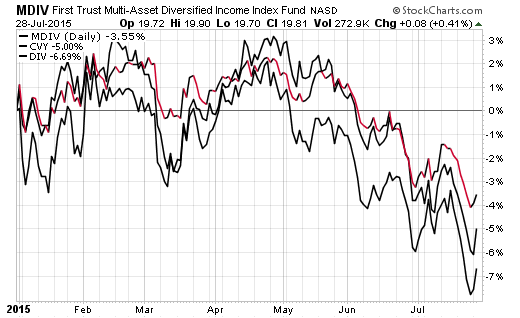

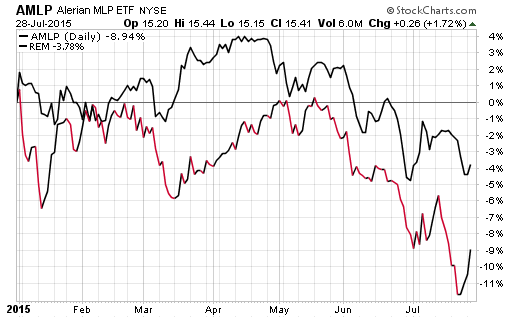

Summary Income investors are often obsessed with the search for yield despite the typical conservative nature of their demographic. Once considered taboo, asset classes such as junk bonds, MLPs, mortgage REITs, and other high yield investments are now common place in many of the portfolios. Now we are starting to see slow signs of decay in junk bond prices as spreads widen and risk appetites in credit securities pull back. Income investors are often obsessed with the search for yield despite the typical conservative nature of their demographic. The half decade of zero returns in safe assets such as CDs and savings accounts has created a reach for yield that has stretched the boundaries of sound portfolio discipline. Once considered taboo, asset classes such as junk bonds, MLPs, mortgage REITs, and other high yield investments are now common place in many of the portfolios that I review. The seemingly one-sided demand has helped generate relatively solid returns and uncommonly low volatility over the last several years as well. Now we are starting to see slow signs of decay in junk bond prices as spreads widen and risk appetites in credit securities pull back. This same pattern has been exacerbated in alternative income funds with overweight positions in non-traditional income fields with juicy yields. As an example, the First Trust Multi-Asset Diversified Income Index ETF (NASDAQ: MDIV ) carries 80% of its portfolio in preferred stocks, junk bonds, real estate, and MLPs. The remaining 20% is in traditional dividend paying stocks. This ETF has a current 30-day SEC yield of 6.36%, which any income investor would tell you is phenomenal when 10-Year Treasury bonds are paying just 2.25%. Yet like most things in life, there is no free lunch in the income world. A reach for yield carries with it higher concomitant risk of capital loss through credit contraction, deleveraging, interest rate cycles, and other exogenous factors. Before today’s bounce, fund’s like MDIV were trading near their lows of the year despite the relatively sideways price action of traditional broad-based equity benchmarks. This decoupling of high yield and alternative assets from the major stock market indices should be viewed through a cautionary lens. I’m not trying to pick on MDIV by any means. A look at other similar funds in this class include the Guggenheim Multi-Asset Income ETF (NYSEARCA: CVY ) and the Global X Super Dividend U.S. ETF (NYSEARCA: DIV ). These ETFs contain many of the same fundamental holdings and are showing similar trends of sliding prices. A look inside specific sector funds such as the ALPS Alerian MLP ETF (NYSEARCA: AMLP ) and the iShares Mortgage Real Estate Capped ETF (NYSEARCA: REM ) confirms the weakness as well. So how does a retiree or income investor maintain their purchasing power while still maintaining a solid grasp on dividends? The first step is evaluating your exposure to these riskier income assets by determining how much of your portfolio they represent. If its less than 10%, then you are likely not as concerned about the recent volatility. Yet, if they represent 25% of your portfolio or more, you may want to consider taking action to create a more balanced asset allocation. Those with an overweight position in high yield investments that find themselves uncomfortable during this drawdown may want to consider cutting back their exposure. This could include temporarily adding back to cash or moving to more traditional assets such as dividend paying stocks or higher quality bonds. The trade off of course is that you may not receive the same monthly or quarterly income that you are accustomed to. Nevertheless, the ability to sleep well at night knowing that your capital is not susceptible to wild swings may assuage that temporary concern. Picking which asset class to move the funds to will likely depend on the makeup of the other positions in your portfolio. You may end up pairing multiple asset classes together to smooth out volatility and further diversify portfolio. Remember that it’s ok to step away from strict income investments in order to focus on capital preservation or total return. If you do move to cash, make sure that it is a temporary transition that is not going to leave you with a significant chunk of money on the sidelines for an extended period of time. One of the biggest mistakes I see investors make is having too much cash on hand for years and years without a sound game plan to put it back to work. Putting Thoughts Into Action I recently took at step away from high yield investments for my Strategic Income clients and added to a high quality mix of stocks in the iShares MSCI USA Minimum Volatility ETF (NYSEARCA: USMV ). This transition expanded the modest equity sleeve of my portfolio into an index that is continuing to maintain a steady uptrend. While the move actually lowered the overall yield of the portfolio, it positioned us for a bounce higher in the broader stock market and reduced the credit volatility that was acting as a drag on returns over the last two months. Despite this move, I haven’t completely abandoned the alternative income theme altogether. My income portfolio is still holding the iShares U.S. Preferred Stock ETF (NYSEARCA: PFF ), which has maintained a steady price trend despite the volatility in interest rates. Moving forward, I will be closely evaluating how these investments comingle together and making additional adjustments as necessary. Changes of this nature are not always easy when an investment is falling in price. You never know if you are picking the right spot or going to get whipsawed in the wrong direction. That is why I strive to change the portfolio incrementally in order to avoid falling into the trap of over commitment to a single outcome. Disclosure: I am/we are long USMV, PFF. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: David Fabian, FMD Capital Management, and/or clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell, or hold securities. Scalper1 News

Summary Income investors are often obsessed with the search for yield despite the typical conservative nature of their demographic. Once considered taboo, asset classes such as junk bonds, MLPs, mortgage REITs, and other high yield investments are now common place in many of the portfolios. Now we are starting to see slow signs of decay in junk bond prices as spreads widen and risk appetites in credit securities pull back. Income investors are often obsessed with the search for yield despite the typical conservative nature of their demographic. The half decade of zero returns in safe assets such as CDs and savings accounts has created a reach for yield that has stretched the boundaries of sound portfolio discipline. Once considered taboo, asset classes such as junk bonds, MLPs, mortgage REITs, and other high yield investments are now common place in many of the portfolios that I review. The seemingly one-sided demand has helped generate relatively solid returns and uncommonly low volatility over the last several years as well. Now we are starting to see slow signs of decay in junk bond prices as spreads widen and risk appetites in credit securities pull back. This same pattern has been exacerbated in alternative income funds with overweight positions in non-traditional income fields with juicy yields. As an example, the First Trust Multi-Asset Diversified Income Index ETF (NASDAQ: MDIV ) carries 80% of its portfolio in preferred stocks, junk bonds, real estate, and MLPs. The remaining 20% is in traditional dividend paying stocks. This ETF has a current 30-day SEC yield of 6.36%, which any income investor would tell you is phenomenal when 10-Year Treasury bonds are paying just 2.25%. Yet like most things in life, there is no free lunch in the income world. A reach for yield carries with it higher concomitant risk of capital loss through credit contraction, deleveraging, interest rate cycles, and other exogenous factors. Before today’s bounce, fund’s like MDIV were trading near their lows of the year despite the relatively sideways price action of traditional broad-based equity benchmarks. This decoupling of high yield and alternative assets from the major stock market indices should be viewed through a cautionary lens. I’m not trying to pick on MDIV by any means. A look at other similar funds in this class include the Guggenheim Multi-Asset Income ETF (NYSEARCA: CVY ) and the Global X Super Dividend U.S. ETF (NYSEARCA: DIV ). These ETFs contain many of the same fundamental holdings and are showing similar trends of sliding prices. A look inside specific sector funds such as the ALPS Alerian MLP ETF (NYSEARCA: AMLP ) and the iShares Mortgage Real Estate Capped ETF (NYSEARCA: REM ) confirms the weakness as well. So how does a retiree or income investor maintain their purchasing power while still maintaining a solid grasp on dividends? The first step is evaluating your exposure to these riskier income assets by determining how much of your portfolio they represent. If its less than 10%, then you are likely not as concerned about the recent volatility. Yet, if they represent 25% of your portfolio or more, you may want to consider taking action to create a more balanced asset allocation. Those with an overweight position in high yield investments that find themselves uncomfortable during this drawdown may want to consider cutting back their exposure. This could include temporarily adding back to cash or moving to more traditional assets such as dividend paying stocks or higher quality bonds. The trade off of course is that you may not receive the same monthly or quarterly income that you are accustomed to. Nevertheless, the ability to sleep well at night knowing that your capital is not susceptible to wild swings may assuage that temporary concern. Picking which asset class to move the funds to will likely depend on the makeup of the other positions in your portfolio. You may end up pairing multiple asset classes together to smooth out volatility and further diversify portfolio. Remember that it’s ok to step away from strict income investments in order to focus on capital preservation or total return. If you do move to cash, make sure that it is a temporary transition that is not going to leave you with a significant chunk of money on the sidelines for an extended period of time. One of the biggest mistakes I see investors make is having too much cash on hand for years and years without a sound game plan to put it back to work. Putting Thoughts Into Action I recently took at step away from high yield investments for my Strategic Income clients and added to a high quality mix of stocks in the iShares MSCI USA Minimum Volatility ETF (NYSEARCA: USMV ). This transition expanded the modest equity sleeve of my portfolio into an index that is continuing to maintain a steady uptrend. While the move actually lowered the overall yield of the portfolio, it positioned us for a bounce higher in the broader stock market and reduced the credit volatility that was acting as a drag on returns over the last two months. Despite this move, I haven’t completely abandoned the alternative income theme altogether. My income portfolio is still holding the iShares U.S. Preferred Stock ETF (NYSEARCA: PFF ), which has maintained a steady price trend despite the volatility in interest rates. Moving forward, I will be closely evaluating how these investments comingle together and making additional adjustments as necessary. Changes of this nature are not always easy when an investment is falling in price. You never know if you are picking the right spot or going to get whipsawed in the wrong direction. That is why I strive to change the portfolio incrementally in order to avoid falling into the trap of over commitment to a single outcome. Disclosure: I am/we are long USMV, PFF. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: David Fabian, FMD Capital Management, and/or clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell, or hold securities. Scalper1 News

Scalper1 News