Scalper1 News

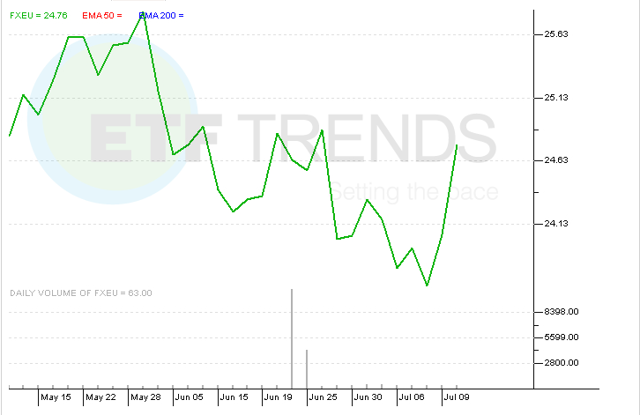

Summary Greece has been a major cause for concern in the Eurozone. Recent financial drama has contributed to increased volatility. Investors who are still interested in Europe exposure, but are wary of heightened volatility, can utilize a relatively new low-vol ETF option. Greece’s status as a member of the Eurozone is solidified, at least for now and at least until more financial problems crop up there. Eurozone leaders agreed to a third bailout package for Greece, helping the country once again stave off financial disaster and potential departure from the Eurozone Last week, the volatile Greek government submitted reform proposals to Eurozone officials in an effort to secure further bailout aid. Eurozone officials reviewed the package this weekend, potentially setting Greek stocks up for more early-week volatility next week. Without a third bailout, Greece likely defaults on its obligations and departs from the Eurozone. While the Greek crisis has tried investors’ patience when it comes to Europe, select exchange-traded funds offer investors the opportunity to remain long European equities while minimizing Greece exposure and volatility. A weakening euro is likely to play a prime role in the direction of European stocks in the coming months. “The 17% drop in the value of the euro relative to the US dollar since June 30, 2014, coupled with the tremendous run-up in European equities earlier this year, begs the question: Where do Eurozone equities go from here? Historically, the year-over-year change in the EUR/USD exchange rate has led the direction of the Euro Stoxx 50 Index by approximately one year. Therefore, euro weakness in the past portends continued upside for Eurozone equities, in my view,” according to a recent note from Invesco PowerShares . The PowerShares Europe Currency Hedged Low Volatility Portfolio (NYSEARCA: FXEU ) is one avenue to consider for investors looking to profit from a falling euro while minimizing European equity market volatility . FXEU tracks members of the S&P Eurozone BMI Index to form the S&P Eurozone Low Volatility USD Hedged Index that displayed the lowest volatility over the trailing 12 months. FXEU, which debuted in May, combines the red-hot themes of currency hedging and low volatility in one ETF. Investors have warmed to the concept as FXEU has hauled in $39.3 million in assets in barely more than two months on the market. “Given the potential upside of equity exposure to the Eurozone (for reasons outlined above), the risk associated with the rise in valuation levels and the ongoing uncertainty associated with a potential Greek exit from the Eurozone (or “Grexit”), I believe a volatility-managed solution may be a sensible approach for investors to gain exposure to this critical region. In addition, I believe the divergent monetary policy between the European Central Bank and the Federal Reserve highlights the downside risk to the value of the euro and emphasizes the need for investors to consider a currency hedge to mitigate the foreign exchange risk. A currency-hedged low volatility approach provides investors the opportunity to participate in the upside in the face of stretching valuations and exchange rate risk, as well as a downside risk mitigation smart beta strategy,” adds PowerShares. Not surprisingly, FXEU’s volatility-reducing efforts include eschewing Greek stocks. As of the end of the second quarter, the ETF’s underlying index allocated a combined 54.9% of its weight to Germany and France, the Eurozone’s two largest economies. Outside of a 12.3% weight to Spain, the index’s PIIGS exposure is light and does not include Greece or Portugal. PowerShares Europe Currency Hedged Low Volatility Portfolio (click to enlarge) Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Greece has been a major cause for concern in the Eurozone. Recent financial drama has contributed to increased volatility. Investors who are still interested in Europe exposure, but are wary of heightened volatility, can utilize a relatively new low-vol ETF option. Greece’s status as a member of the Eurozone is solidified, at least for now and at least until more financial problems crop up there. Eurozone leaders agreed to a third bailout package for Greece, helping the country once again stave off financial disaster and potential departure from the Eurozone Last week, the volatile Greek government submitted reform proposals to Eurozone officials in an effort to secure further bailout aid. Eurozone officials reviewed the package this weekend, potentially setting Greek stocks up for more early-week volatility next week. Without a third bailout, Greece likely defaults on its obligations and departs from the Eurozone. While the Greek crisis has tried investors’ patience when it comes to Europe, select exchange-traded funds offer investors the opportunity to remain long European equities while minimizing Greece exposure and volatility. A weakening euro is likely to play a prime role in the direction of European stocks in the coming months. “The 17% drop in the value of the euro relative to the US dollar since June 30, 2014, coupled with the tremendous run-up in European equities earlier this year, begs the question: Where do Eurozone equities go from here? Historically, the year-over-year change in the EUR/USD exchange rate has led the direction of the Euro Stoxx 50 Index by approximately one year. Therefore, euro weakness in the past portends continued upside for Eurozone equities, in my view,” according to a recent note from Invesco PowerShares . The PowerShares Europe Currency Hedged Low Volatility Portfolio (NYSEARCA: FXEU ) is one avenue to consider for investors looking to profit from a falling euro while minimizing European equity market volatility . FXEU tracks members of the S&P Eurozone BMI Index to form the S&P Eurozone Low Volatility USD Hedged Index that displayed the lowest volatility over the trailing 12 months. FXEU, which debuted in May, combines the red-hot themes of currency hedging and low volatility in one ETF. Investors have warmed to the concept as FXEU has hauled in $39.3 million in assets in barely more than two months on the market. “Given the potential upside of equity exposure to the Eurozone (for reasons outlined above), the risk associated with the rise in valuation levels and the ongoing uncertainty associated with a potential Greek exit from the Eurozone (or “Grexit”), I believe a volatility-managed solution may be a sensible approach for investors to gain exposure to this critical region. In addition, I believe the divergent monetary policy between the European Central Bank and the Federal Reserve highlights the downside risk to the value of the euro and emphasizes the need for investors to consider a currency hedge to mitigate the foreign exchange risk. A currency-hedged low volatility approach provides investors the opportunity to participate in the upside in the face of stretching valuations and exchange rate risk, as well as a downside risk mitigation smart beta strategy,” adds PowerShares. Not surprisingly, FXEU’s volatility-reducing efforts include eschewing Greek stocks. As of the end of the second quarter, the ETF’s underlying index allocated a combined 54.9% of its weight to Germany and France, the Eurozone’s two largest economies. Outside of a 12.3% weight to Spain, the index’s PIIGS exposure is light and does not include Greece or Portugal. PowerShares Europe Currency Hedged Low Volatility Portfolio (click to enlarge) Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News