Scalper1 News

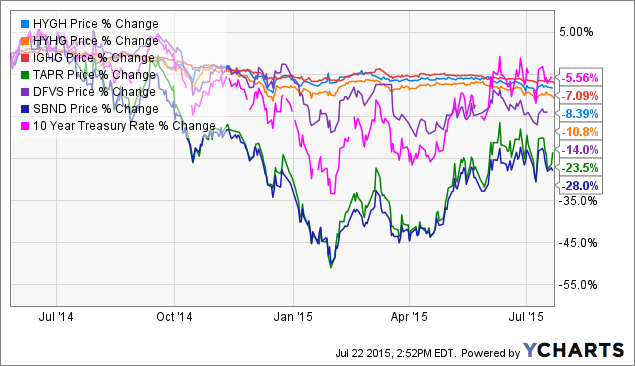

Summary With the possibility of an interest rate hike, investors should consider options for inverse leverage. I chose a basket of six comparable securities with varying degrees of inverse exposure to analyze. High yield bond and short treasury future combo ETFs are an interesting way to hedge against a potential rate hike. Introduction Recently, I’ve spent a considerable amount of time discussing how interest rates are going to rise. Investors should know how to capitalize on rising rates, so I’ve taken on the burden of analyzing every tool I can find that provides inverse exposure. If you want to learn more about rising rates , inverse hedging tools , and capitalizing on mentioned economic behavior, read the hyperlinked articles. Today, I will do a brief comp on six different tools that can be used for hedging against rates. Each of these ETFs and ETNs are fairly small (all under 200 Mil AUM), but for the individual investor looking for inverse exposure, they’re valid options that ought to be analyzed and considered. ETFs and ETNs for Inverse Treasury Coverage The six tools I will compare are: iShares Interest Rate Hedged High Yield Bond ETF (NYSEARCA: HYGH ), ProShares High Yield Interest Rate Hedged ETF (BATS: HYHG ), ProShares Investment Grade Interest Rate Hedged ETF (BATS: IGHG ), Barclays Inverse U.S. Treasury Aggregate ETN (NASDAQ: TAPR ), iPath U.S. Treasury 5-Year Bear ETN (NASDAQ: DFVS ), and PowerShares DB 3x Short 25+ Year Treasury Bond ETN (NYSEARCA: SBND ). HYGH HYHG IGHG TAPR DFVS SBND Average NAV 91.31 71.17 75.59 37.04 32.23 5.31 52.10833 Avg. Vol 7,143 19,191 17,655 4,080 4,282 59,285 18606 12-Mo Yield 5.85% 5.65% 3.52% 0% 0% 0% 2.503% Expense 0.55% 0.5% 0.3% 0.43% 0.75% 0.95% 0.58% Total Assets 105 135.22 166.3 24.45 3.94 42.52 79.57167 HYGH is a high-yield fund with positions in iShares iBoxx High Yield Corporate Bond ETF (NYSEARCA: HYG ) and short positions in Treasury futures. HYGH moves inversely to yields while providing high interest payments primarily through riskier bonds (avg. B rating). What HYGH lacks in volume, it makes up for in yields and exposure. Its 55 bps expense is fair. I would recommend HYGH for risk-taking investors seeking high interest payments and inverse exposure. For all intents and purposes, HYHG performs identically to HYGH. It is also a high-yielding bond ETF with built-in inverse exposure. I believe HYHG (yes, it’s confusing) is slightly better though because it holds a more diversified long portfolio, and it has more AUM. It also has a higher average bond quality (B+). Its expense ratio is lower as well (marginally) at 0.5%. HYHG is also more heavily traded on the market, which is beneficial to higher net worth investors. Finally, the last high-yield bond with inverse exposure is IGHG. IGHG has the most AUM; however, it has the lowest yields of the three. IGHG’s low yields are compensated by stronger underlying assets (average A – A- bond quality). DFVS, TAPR, and SBND are ETNs (with no income distributions) and expenses ranging from 0.58 bps to 0.95 bps that provide inverse exposure to Treasury yields. The benefit of an ETN is that it provides additional exposure, and the opportunity for higher returns (particularly in the short term). I believe there are better options on the market (like ProShares UltraShort 20+ Year Treasury ETF ( TBT), ProShares Short 20+ Year Treasury ETF (NYSEARCA: TBF ), and Direxion Daily 20+ Year Treasury Bear 3x Shares ETF (NYSEARCA: TMV ) for example). This article is for the sake of coverage and comparison. I will note that SBND resets monthly rather than daily. This monthly reset allows SBND to avoid some of the pitfalls inherent with tracking and compounding error . SBND is 3x leveraged, however, which comes with its own risks . Correlation To visually express correlation between these tools, and ten-year rates, I created a chart with each ETF/ETN. DFVS comes closest, though each security does generally follow the ups and downs of fluctuating rates. The Bond/Hedge combos are less volatile because they are composed of high-yield bonds (which don’t fluctuate as much) as well as Treasury futures. TAPR and SBND, because of time frame coverage and leverage, trade on a higher daily/monthly multiple than actual rates. However, in the long term, both TAPR and SBND will perform optimally over the other options if rate does trend upwards. SBND and TAPR should be avoided by the risk-averse investors. All mentioned securities show a desired level of correlation to Treasury rates. Conclusion HYGH, HYHG, and IGHG offer an interesting combination of income and inverse leverage. TAPR, DFVS, and SBND are pure ETNs that provide expected inverse exposure. The three ETNs are inferior to other options on the market in my opinion. The three Bond/Inverse combos, however, offer an interesting (potentially risky) avenue for long-term capitalization. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary With the possibility of an interest rate hike, investors should consider options for inverse leverage. I chose a basket of six comparable securities with varying degrees of inverse exposure to analyze. High yield bond and short treasury future combo ETFs are an interesting way to hedge against a potential rate hike. Introduction Recently, I’ve spent a considerable amount of time discussing how interest rates are going to rise. Investors should know how to capitalize on rising rates, so I’ve taken on the burden of analyzing every tool I can find that provides inverse exposure. If you want to learn more about rising rates , inverse hedging tools , and capitalizing on mentioned economic behavior, read the hyperlinked articles. Today, I will do a brief comp on six different tools that can be used for hedging against rates. Each of these ETFs and ETNs are fairly small (all under 200 Mil AUM), but for the individual investor looking for inverse exposure, they’re valid options that ought to be analyzed and considered. ETFs and ETNs for Inverse Treasury Coverage The six tools I will compare are: iShares Interest Rate Hedged High Yield Bond ETF (NYSEARCA: HYGH ), ProShares High Yield Interest Rate Hedged ETF (BATS: HYHG ), ProShares Investment Grade Interest Rate Hedged ETF (BATS: IGHG ), Barclays Inverse U.S. Treasury Aggregate ETN (NASDAQ: TAPR ), iPath U.S. Treasury 5-Year Bear ETN (NASDAQ: DFVS ), and PowerShares DB 3x Short 25+ Year Treasury Bond ETN (NYSEARCA: SBND ). HYGH HYHG IGHG TAPR DFVS SBND Average NAV 91.31 71.17 75.59 37.04 32.23 5.31 52.10833 Avg. Vol 7,143 19,191 17,655 4,080 4,282 59,285 18606 12-Mo Yield 5.85% 5.65% 3.52% 0% 0% 0% 2.503% Expense 0.55% 0.5% 0.3% 0.43% 0.75% 0.95% 0.58% Total Assets 105 135.22 166.3 24.45 3.94 42.52 79.57167 HYGH is a high-yield fund with positions in iShares iBoxx High Yield Corporate Bond ETF (NYSEARCA: HYG ) and short positions in Treasury futures. HYGH moves inversely to yields while providing high interest payments primarily through riskier bonds (avg. B rating). What HYGH lacks in volume, it makes up for in yields and exposure. Its 55 bps expense is fair. I would recommend HYGH for risk-taking investors seeking high interest payments and inverse exposure. For all intents and purposes, HYHG performs identically to HYGH. It is also a high-yielding bond ETF with built-in inverse exposure. I believe HYHG (yes, it’s confusing) is slightly better though because it holds a more diversified long portfolio, and it has more AUM. It also has a higher average bond quality (B+). Its expense ratio is lower as well (marginally) at 0.5%. HYHG is also more heavily traded on the market, which is beneficial to higher net worth investors. Finally, the last high-yield bond with inverse exposure is IGHG. IGHG has the most AUM; however, it has the lowest yields of the three. IGHG’s low yields are compensated by stronger underlying assets (average A – A- bond quality). DFVS, TAPR, and SBND are ETNs (with no income distributions) and expenses ranging from 0.58 bps to 0.95 bps that provide inverse exposure to Treasury yields. The benefit of an ETN is that it provides additional exposure, and the opportunity for higher returns (particularly in the short term). I believe there are better options on the market (like ProShares UltraShort 20+ Year Treasury ETF ( TBT), ProShares Short 20+ Year Treasury ETF (NYSEARCA: TBF ), and Direxion Daily 20+ Year Treasury Bear 3x Shares ETF (NYSEARCA: TMV ) for example). This article is for the sake of coverage and comparison. I will note that SBND resets monthly rather than daily. This monthly reset allows SBND to avoid some of the pitfalls inherent with tracking and compounding error . SBND is 3x leveraged, however, which comes with its own risks . Correlation To visually express correlation between these tools, and ten-year rates, I created a chart with each ETF/ETN. DFVS comes closest, though each security does generally follow the ups and downs of fluctuating rates. The Bond/Hedge combos are less volatile because they are composed of high-yield bonds (which don’t fluctuate as much) as well as Treasury futures. TAPR and SBND, because of time frame coverage and leverage, trade on a higher daily/monthly multiple than actual rates. However, in the long term, both TAPR and SBND will perform optimally over the other options if rate does trend upwards. SBND and TAPR should be avoided by the risk-averse investors. All mentioned securities show a desired level of correlation to Treasury rates. Conclusion HYGH, HYHG, and IGHG offer an interesting combination of income and inverse leverage. TAPR, DFVS, and SBND are pure ETNs that provide expected inverse exposure. The three ETNs are inferior to other options on the market in my opinion. The three Bond/Inverse combos, however, offer an interesting (potentially risky) avenue for long-term capitalization. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News