Scalper1 News

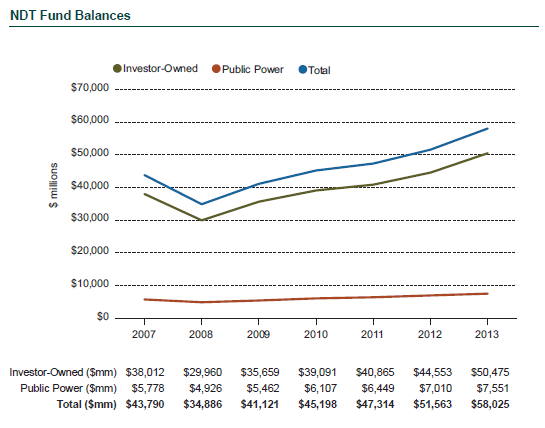

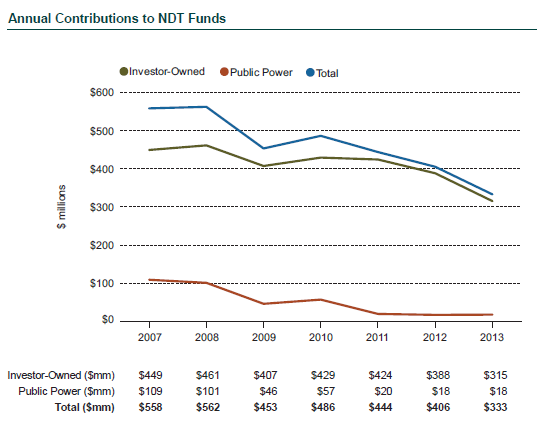

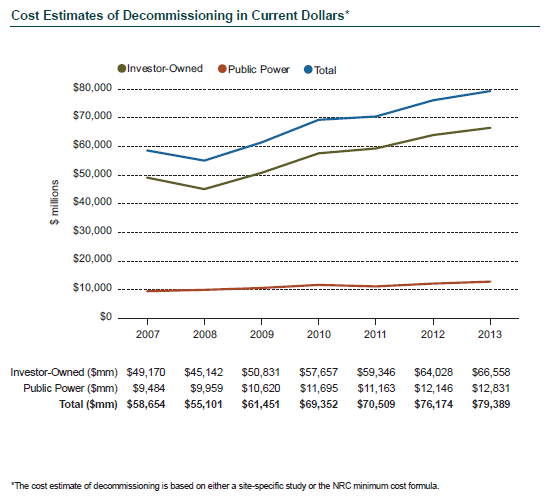

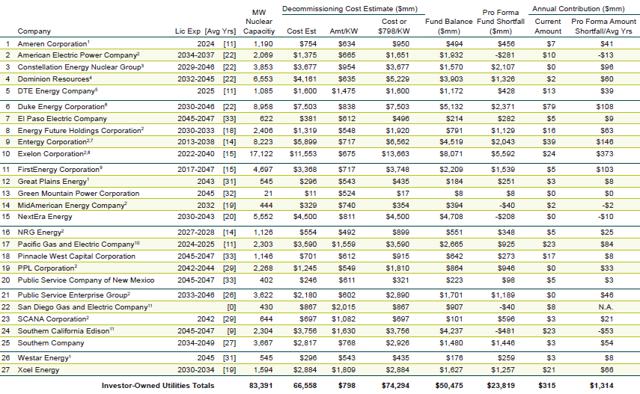

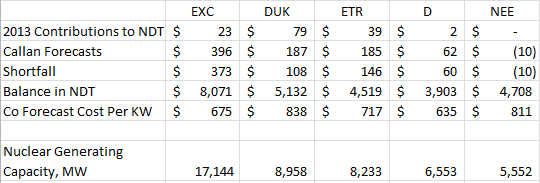

According to Callan Investment Institute, underfunded decommissioning costs could amount to $23 billion from investor-owned utilities. The industry has already set aside $50 billion to fund specific trust funds designated exclusively for decommissioning expenses, mostly collected from ratepayers. While decommissioning costs have an upward sloping cost curve over time, utility contributions to NDTs have the opposite – a downward sloping trend line. A newsletter subscriber emailed me a question concerning the decommissioning cost for nuclear power operators, specifically what is Entergy (NYSE: ETR ) exposure to the costs to shut down and dismantle their nuclear power plants. ETR recently announced the closing of the nuclear plant in Vermont and there have been concerns about this cost. I thought this question warranted and deserved a bit of research and a response. An additional 26 publicly traded companies have similar exposure to various degrees. As part of the Nuclear Regulatory Commission commissioning and licensing of a power plant, the plant owners establish a trust fund, known as the Nuclear Decommissioning Trust, or NDT. The sole purpose of this trust fund is to provide funds for the cost to decommission the facility when that time comes. The owners contribute annually to the fund, in relationship to the percent ownership, based on projected costs and length of the license. The companies are the final backstop to shortfalls in funding to these trusts. The origin of the capital for fund contributions is from customer rate cases – in other words, NDT funding is part of our monthly electric bills. Owners are required to review annually and submit every two years to the NRC both the fund balance and cost estimates for decommissioning. The NRC provides a formula of costs for operators to compare with the balances on the NDT, or the companies can file site-specific cost projections for each facility. For more than a decade, Dodge and Phelps compiled nuclear power industry figures on trust fund balances, annual contributions and projected costs. In 2013, this annual study was transferred to Callan Investment Institute, a research and data firm. Their 2014 study can be found here . NDT sums are not small potatoes. As of the end of 2013, the fund balances for investor-owned utility’s NDT total $50.4 billion. While the funds value increased from $44.5 billion in 2012, annual contributions from both public and private owners decreased from $560 million in 2007 to $333 million in 2013. Investor-owned utilities are contributing 70% of their 2007 level while public owners like the TVA are contributing just 16% of their 2007 levels. However, costs for decommissioning are increasing and are up 44% since 2008. The total industry-wide decommissioning costs are estimated by Callan to be $80 billion. Below are tables outlining fund balances, annual contributions, and total estimated decommissioning costs from 2007 to present: Source: callan.com Source: callan.com Source: callan.com According to Callan cost projections, investor-owned utilities could have a current decommission funding shortfall of $23 billion, or an underfunding of 25%. Callan’s cost estimates are based on either the NRC approved rate per KW capacity as provided by the company or an industry-wide average of all decommissioning cost estimates at $798 per KW, whichever is higher. In many instances, companies use an estimate that is substantially below the industry average. Callan offers an interesting table by company. They produced the following table for the 27 investor-owned utilities with nuclear power plants, and includes average years remaining for their plant licenses; MW nuclear capacity across the company; total decommission costs, in millions, as offered by the company; the average decommission cost per KW; projected cost at either the industry average or the company cost, whichever is higher; company specific fund balance; the potential shortfall in total dollars; 2013 fund contribution; and the pro forma annual amount of the shortfall to make up the difference based on the average license expiration. (click to enlarge) To answer the immediate question concerning Entergy, according to the study, their NDT could be short by about $2 billion and to make up this difference over the average life remaining of their licenses, management should be setting aside $186 million a year rather than the $39 million currently. However, ETR is not alone in the study. The industry contributed $315 million in 2013 when Callan calculates the amount should be closer to $1.6 billion. Below are some shortfall numbers for the five largest nuclear power generators, Exelon (NYSE: EXC ), Duke Energy (NYSE: DUK ), Entergy , Dominion Resources (NYSE: D ), and NextEra (NYSE: NEE ). Source: callan.com According to Callan, EXC has potential net deficiencies of $7.7 billion including Constellation Energy; DUK has a potential net deficiency of $2.3 billion; ETR of $2.0 billion; D of $1.3 billion; and NEE has a potential surplus of $208 million. Combined, the largest five producers of nuclear power have a potential decommissioning deficit of $13.1 billion, or 57% of the projected total industry-wide. It is extremely difficult to calculate decommissioning costs for projects that not only span 15 to 20 years but also do not begin for an additional 10 to 15 years or more. There are currently three basic types of decommissioning with three distinct cost structures. A large portion of decommissioning budgets is directed to the cost of long-term storage of spent fuel, which in its own right is unsettled. Waste disposal can cost upwards of 30% of the entire decommissioning budget. It is easy to criticize the study’s methodology as being simplistic, but it has value for investors. The importance of the study is to bring awareness of the potential downside to the decommission process for certain utilities. For example, ETR could have a potential unfunded liability of $146 million a year, or about $2 billion. On a per share basis, this could represent about $0.44 to $0.60 a share in after tax earnings and at a valuation of a PE of 15, could equate to $6.50 to $9.00 a share. However, it is important to understand the timeframe for the realization of these potential shortfalls. The shortfall would be experienced towards the end of the decommissioning process. Using ETR as an example, with their average license expiration of 14 yrs. and a project life cycle of 10 to 20 yrs., the potential shortfall may not be material until 2050 to 2060. The industry will become more adept at projecting decommissioning costs and cost controls as these projects progress. As an operating cost, increasing NDT funding through rate relief may be an avenue in states where the regulatory environment is more favorable. There are currently 17 nuclear decommissioning projects in various stages. Costs associated with these range from several hundred million to $4.4 billion for the San Onofre facility in southern CA . The San Onofre facility begins its decommissioning process in 2016, and could take 20 years to complete. In 1996, Connecticut Haddam Neck nuclear facility began the decommissioning process with a budget of $720 million, but the process actually cost $1.2 billion. In an innovative approach Exelon transferred the operating license at its Zion 1 and 2 facilities to a third party for the decommission phase, and will take back the facility once it is completed. The NDT associated with the Zion plant started the decommission phase in 2010 with a balance of almost $800 million and it has been depleted to around $280 million as of Dec 2014. The decommissioning firm projects a surplus of $13 million in the NDT after completion in around 2020. According to documents from the state of Vermont, at present, Entergy’s NDT contains $642 million of the $1.24 billion in 2014 dollars that the Site Assessment Study believes could be required to fully decommission the Vermont Yankee site. Of immediate need is almost $400 million to begin the fuel storage process in 2016. However, decommissioning will not be completed until 2073. While incoming cash flow from customers’ bills ceases, the fund will continue to grow with higher interest income over the next 57 years. Utility investors should be aware of the fuel breakdown of each of their electric utilities. In turn, shareholders in utilities with nuclear power plants should feel comfortable with the potential higher costs associated with decommissioning. Personally, I am more concerned about the state of utilities over the next 10 years than in 2050 and beyond. While NDT exposure should be a factor in weighing the desirability of owning companies with nuclear power plants, it should not be the determining factor. Author’s Note: Please review disclosure in Author’s profile. Disclosure: The author is long D, ETR, EXC. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

According to Callan Investment Institute, underfunded decommissioning costs could amount to $23 billion from investor-owned utilities. The industry has already set aside $50 billion to fund specific trust funds designated exclusively for decommissioning expenses, mostly collected from ratepayers. While decommissioning costs have an upward sloping cost curve over time, utility contributions to NDTs have the opposite – a downward sloping trend line. A newsletter subscriber emailed me a question concerning the decommissioning cost for nuclear power operators, specifically what is Entergy (NYSE: ETR ) exposure to the costs to shut down and dismantle their nuclear power plants. ETR recently announced the closing of the nuclear plant in Vermont and there have been concerns about this cost. I thought this question warranted and deserved a bit of research and a response. An additional 26 publicly traded companies have similar exposure to various degrees. As part of the Nuclear Regulatory Commission commissioning and licensing of a power plant, the plant owners establish a trust fund, known as the Nuclear Decommissioning Trust, or NDT. The sole purpose of this trust fund is to provide funds for the cost to decommission the facility when that time comes. The owners contribute annually to the fund, in relationship to the percent ownership, based on projected costs and length of the license. The companies are the final backstop to shortfalls in funding to these trusts. The origin of the capital for fund contributions is from customer rate cases – in other words, NDT funding is part of our monthly electric bills. Owners are required to review annually and submit every two years to the NRC both the fund balance and cost estimates for decommissioning. The NRC provides a formula of costs for operators to compare with the balances on the NDT, or the companies can file site-specific cost projections for each facility. For more than a decade, Dodge and Phelps compiled nuclear power industry figures on trust fund balances, annual contributions and projected costs. In 2013, this annual study was transferred to Callan Investment Institute, a research and data firm. Their 2014 study can be found here . NDT sums are not small potatoes. As of the end of 2013, the fund balances for investor-owned utility’s NDT total $50.4 billion. While the funds value increased from $44.5 billion in 2012, annual contributions from both public and private owners decreased from $560 million in 2007 to $333 million in 2013. Investor-owned utilities are contributing 70% of their 2007 level while public owners like the TVA are contributing just 16% of their 2007 levels. However, costs for decommissioning are increasing and are up 44% since 2008. The total industry-wide decommissioning costs are estimated by Callan to be $80 billion. Below are tables outlining fund balances, annual contributions, and total estimated decommissioning costs from 2007 to present: Source: callan.com Source: callan.com Source: callan.com According to Callan cost projections, investor-owned utilities could have a current decommission funding shortfall of $23 billion, or an underfunding of 25%. Callan’s cost estimates are based on either the NRC approved rate per KW capacity as provided by the company or an industry-wide average of all decommissioning cost estimates at $798 per KW, whichever is higher. In many instances, companies use an estimate that is substantially below the industry average. Callan offers an interesting table by company. They produced the following table for the 27 investor-owned utilities with nuclear power plants, and includes average years remaining for their plant licenses; MW nuclear capacity across the company; total decommission costs, in millions, as offered by the company; the average decommission cost per KW; projected cost at either the industry average or the company cost, whichever is higher; company specific fund balance; the potential shortfall in total dollars; 2013 fund contribution; and the pro forma annual amount of the shortfall to make up the difference based on the average license expiration. (click to enlarge) To answer the immediate question concerning Entergy, according to the study, their NDT could be short by about $2 billion and to make up this difference over the average life remaining of their licenses, management should be setting aside $186 million a year rather than the $39 million currently. However, ETR is not alone in the study. The industry contributed $315 million in 2013 when Callan calculates the amount should be closer to $1.6 billion. Below are some shortfall numbers for the five largest nuclear power generators, Exelon (NYSE: EXC ), Duke Energy (NYSE: DUK ), Entergy , Dominion Resources (NYSE: D ), and NextEra (NYSE: NEE ). Source: callan.com According to Callan, EXC has potential net deficiencies of $7.7 billion including Constellation Energy; DUK has a potential net deficiency of $2.3 billion; ETR of $2.0 billion; D of $1.3 billion; and NEE has a potential surplus of $208 million. Combined, the largest five producers of nuclear power have a potential decommissioning deficit of $13.1 billion, or 57% of the projected total industry-wide. It is extremely difficult to calculate decommissioning costs for projects that not only span 15 to 20 years but also do not begin for an additional 10 to 15 years or more. There are currently three basic types of decommissioning with three distinct cost structures. A large portion of decommissioning budgets is directed to the cost of long-term storage of spent fuel, which in its own right is unsettled. Waste disposal can cost upwards of 30% of the entire decommissioning budget. It is easy to criticize the study’s methodology as being simplistic, but it has value for investors. The importance of the study is to bring awareness of the potential downside to the decommission process for certain utilities. For example, ETR could have a potential unfunded liability of $146 million a year, or about $2 billion. On a per share basis, this could represent about $0.44 to $0.60 a share in after tax earnings and at a valuation of a PE of 15, could equate to $6.50 to $9.00 a share. However, it is important to understand the timeframe for the realization of these potential shortfalls. The shortfall would be experienced towards the end of the decommissioning process. Using ETR as an example, with their average license expiration of 14 yrs. and a project life cycle of 10 to 20 yrs., the potential shortfall may not be material until 2050 to 2060. The industry will become more adept at projecting decommissioning costs and cost controls as these projects progress. As an operating cost, increasing NDT funding through rate relief may be an avenue in states where the regulatory environment is more favorable. There are currently 17 nuclear decommissioning projects in various stages. Costs associated with these range from several hundred million to $4.4 billion for the San Onofre facility in southern CA . The San Onofre facility begins its decommissioning process in 2016, and could take 20 years to complete. In 1996, Connecticut Haddam Neck nuclear facility began the decommissioning process with a budget of $720 million, but the process actually cost $1.2 billion. In an innovative approach Exelon transferred the operating license at its Zion 1 and 2 facilities to a third party for the decommission phase, and will take back the facility once it is completed. The NDT associated with the Zion plant started the decommission phase in 2010 with a balance of almost $800 million and it has been depleted to around $280 million as of Dec 2014. The decommissioning firm projects a surplus of $13 million in the NDT after completion in around 2020. According to documents from the state of Vermont, at present, Entergy’s NDT contains $642 million of the $1.24 billion in 2014 dollars that the Site Assessment Study believes could be required to fully decommission the Vermont Yankee site. Of immediate need is almost $400 million to begin the fuel storage process in 2016. However, decommissioning will not be completed until 2073. While incoming cash flow from customers’ bills ceases, the fund will continue to grow with higher interest income over the next 57 years. Utility investors should be aware of the fuel breakdown of each of their electric utilities. In turn, shareholders in utilities with nuclear power plants should feel comfortable with the potential higher costs associated with decommissioning. Personally, I am more concerned about the state of utilities over the next 10 years than in 2050 and beyond. While NDT exposure should be a factor in weighing the desirability of owning companies with nuclear power plants, it should not be the determining factor. Author’s Note: Please review disclosure in Author’s profile. Disclosure: The author is long D, ETR, EXC. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News