Not many expected PotashCorp (NYSE: POT) stock to end 2016 in the green, but it gained almost 10% in the last quarter of the year, reviving investors’ hopes of a potential turnaround in the fertilizer giant’s fortunes. Unfortunately, investors were in for a rude shock when PotashCorp reported abysmal fourth-quarter and full-year numbers and weak guidance for 2017 last week.

Image source: Getty Images.

But were PotashCorp’s numbers really as bad as projected? It’s always prudent to look beyond the headlines to know what the future holds for a company. So here are five important things from PotashCorp’s earnings report that you must know.

Why PotashCorp reported “preliminary” numbers

While PotashCorp released its earnings as scheduled, it maintained that the numbers it reported are “preliminary” as they don’t reflect a potential impairment charge that the company may have to book on its phosphate assets. In other words, PotashCorp’s actual earnings for 2016 could be worse than the $ 0.40 per share it reported, which was already down a staggering 74% from 2015.

Management didn’t give out any information except that it is assessing some assets, particularly phosphate, for a “potential impairment,” which, if determined, would be adjusted as a non-cash charge against its profits. Investors will have to wait until late February when PotashCorp files its 10K report to know the details. Keep an eye on this as any potential trouble with PotashCorp’s phosphates business could mean greater pain ahead even as the company battles headwinds in its potash and nitrogen segments.

PotashCorp’s volumes were strong, but…

PotashCorp reported a strong 27% year-over-year jump in potash sales volumes during the fourth quarter. That sounds great, but you must know that much of it had to do with the timing of potash contracts from key consuming nations, China and India. As both countries delayed purchases and signed potash contracts only later in 2016, the shipments for the second half were stronger than usual. In other words, PotashCorp’s sales volumes didn’t quite jump on higher demand. Its offshore sales volumes for the full year, in fact, were about 15% lower compared to 2015.

That said, both PotashCorp and Mosaic (NYSE: MOS) are optimistic about the potash markets going forward. During its last earnings call, Mosaic expressly stated that it sees a “great story in potash shaping up for 2017” and expects volumes to pick up. However, potash prices remain considerably weak: PotashCorp realized only about $ 157 per tonne in Q4 compared to $ 238 per tonnes in Q4 2015. Higher potash prices are more important than volumes right now to boost PotashCorp’s revenues.

Nitrogen: A bright spot?

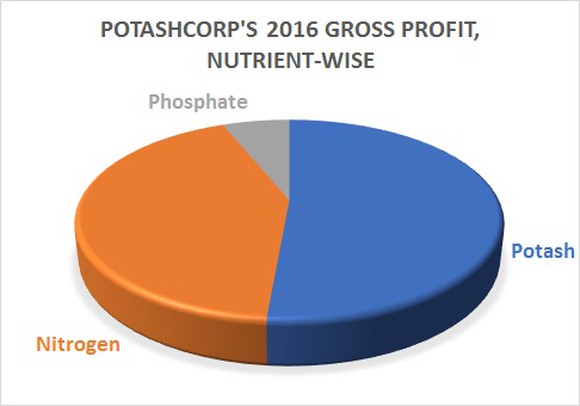

Like its namesake nutrient, PotashCorp realized significantly lower prices for nitrogen in Q4. Management, however, hinted that prices may have bottomed, having bounced off multiyear lows on production curtailments in the U.S. and lower exports from China. Firmer nitrogen prices should strongly support PotashCorp’s margins as nitrogen is a key contributor to its gross profits.

Data source: PotashCorp financials. Chart by author.

Investors should remain cautious, though. CF Industries (NYSE: CF) , North America’s largest nitrogen producer, recently mentioned how additional capacity that’s expected to come online this year is affecting purchases, and even projected lower corn acreage for 2017. That could pressure nitrogen prices as corn is the largest nitrogen-consuming crop.

Focus on cost intact

With the lull in fertilizer markets lasting longer than anticipated, PotashCorp’s management has rightly shifted focus to reducing costs: PotashCorp brought down its potash cost of goods sold to $ 101 per tonne in Q4 from $ 132 per tonne in the year-ago quarter.

2017, in fact, should be a critical year for PotashCorp from a cost standpoint as it brings its lowest-cost mine at Rocanville online. The company expects to reduce its potash production costs by roughly $ 10 per tonne this year, which could provide its margins a much-needed boost amid depressed prices.

The worst could be behind PotashCorp

In anticipation of higher potash prices and lower costs, PotashCorp expects its 2017 potash gross profit to range from $ 550 million-$ 800 million. That’s a substantial improvement over its 2016 gross profit of $ 437 million. Unfortunately, other nutrient markets could offset much of the gains, as PotashCorp pegs its combined nitrogen and phosphate gross profits to be between $ 150 million and $ 400 million this year. That’s a staggering 64% drop at the lower, which means the nitrogen and phosphate markets could even deteriorate.

As a result, PotashCorp expects to earn only $ 0.35-$ 0.55 per share in 2017, including $ 0.05 per share worth of potential costs related to its merger with Agrium Inc . At midpoint, that represents about 13% improvement over PotashCorp’s 2016 earnings, which indicates that the worst may indeed be over for the company.

10 stocks we like better than PotashCorp

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor , has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now… and PotashCorp wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of January 4, 2017

Neha Chamaria has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy .

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International