With the presidential elections just around the corner, the month of October is expected to face heightened turbulence. This month, historically, has earned a formidable reputation of providing dismal returns ahead of elections, while concerns about Deutsche Bank AG DB have rattled the financial markets. Meanwhile, uncertainties surrounding the Fed rate hike coupled with high valuations are expected to aggravate concerns.

To overcome the market adversities, it will be judicious to invest in stocks that boast strong fundamentals and are less volatile than the broader markets.

Election to Spur Volatility

Elections traditionally lead to stock market volatility and it won’t be any different this time around. According to the Stock Trader’s Almanac, which dates back to 1950, the S&P 500 averages a decline of 0.7% and the Dow industrials averages a 0.8% drop. The performance of the more-volatile indices like the Nasdaq and the Russell 2000 is worse, with an average setback of over 2%.

The head-to-head between Hillary Clinton and Donald Trump is quite a close one. Ahead of the first U.S. presidential debate, Trump took a two-point lead over Clinton, but it was Clinton who held an edge over Trump in the first presidential debate by displaying a better degree of preparedness on matters concerning public policy, defense and tax reform (read more: 3 Stocks to Watch after Hillary Clinton’s Debate Performance ).

VIX to Rise

The CBOE Volatility Index (VIX), a gauge of near-term investor anxiety, has always risen from the month of September to October, except for 1996, when Bill Clinton handily won the re-elections. Thanks to such increasing uncertainty, some of the imminent strategists had already expressed their concerns. Here are some of their comments:

From JPMorgan Chase strategists led by Dubravko Lakos-Bujas :

“2016 election will likely be a source of heightened volatility in the weeks ahead of November 8th.”

From David Kostin and colleagues at Goldman Sachs :

“Equity market uncertainty typically rises in the month immediately ahead of presidential elections, and we believe the current below-average level of uncertainty is unlikely to persist.”

From Mandy Xu and colleagues at Credit Suisse :

“ Historically, we find that elections have been a meaningful driver of equity volatility.”

Deutsche Bank Adds to Woes

More uncertainty looms large this month as Deutsche Bank’s woes continue to spook investors. The German lender endured questions like whether it was losing the confidence of investors after a handful of hedge funds that clear derivatives through the bank withdrew excess cash and positions. Shares of Deutsche Bank tanked to fresh lows , only to rebound on Sep 30 and end the week at a gain of 1.4%. Reports continued to circulate that the bank may be able to negotiate a less-onerous settlement with the Justice Department than the $ 14-billion figure being discussed earlier. German Chancellor Angela Merkel had already refused to offer state aid to the giant lender.

Nonetheless, shares of the lender plunged more than 50% this year as investors remain worried about the institution’s thin capital cushion. Such a decline affected other European banks, already plagued by Eurozone’s weak economy and negative interest rates.

Fed Rate Hike Dilemma, Stretched Valuations

September jobs data is due on Oct 7. The outcome can also help shape market perception in the coming weeks. A December rate hike is more likely, but, if the jobs data turn out to be mediocre like the August one, it might indicate that the domestic economy is in a tight spot. Lest we forget, a slew of discouraging retail sales reports, pending home sales and manufacturing numbers seem to hint at sluggish growth.

The market is already in a precarious situation, as most analysts warn that stock market valuations are at elevated levels. This makes the market more vulnerable to a volatile sell-off. The S&P 500’s forward 12-month P/E ratio is currently at around 16.6, way above the 5-year average of over 14.8. It is also worth noting that earnings are not just lackluster, they are negative. Total earnings for the S&P 500 index are currently expected to be down 2.8% in the third quarter from the same quarter last year (read more: Q3 Earnings Season Preview ).

Torrid Times Ahead? 5 Solid Picks

Amid such uncertainties, it seems sensible to buy stocks that are fundamentally strong and will continue to do business even in the worst of times. Investors should also build a strategy on low risk assets and a combination of parameters that lead to better returns. The best way to go about doing so is by creating a portfolio of low beta stocks, which are inherently less volatile than the markets they trade in.

We have selected five such stocks that boast of a VGM score of ‘A’. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three metrics. Such a score allows you to eliminate the negative aspects of stocks and select winners. Such stocks also have a beta that ranges from 0 to 1. Also, these stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

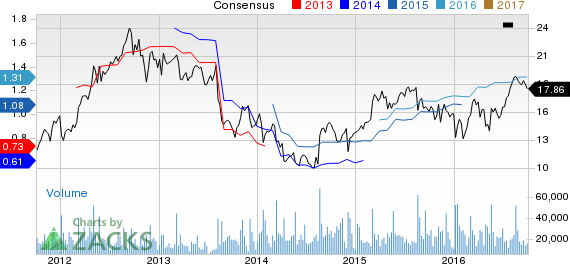

American Eagle Outfitters AEO operates as a specialty retailer offering on-trend clothing, accessories, and personal care products. The company has a beta of 0.72. American Eagle Outfitters’ current year estimated earnings growth rate is 20.5%. The company has also been on an upward trend over the past 60 days, as estimates have risen from $ 1.27/share two months ago to $ 1.31 right now.

AMER EAGLE OUTF Price and Consensus

AMER EAGLE OUTF Price and Consensus | AMER EAGLE OUTF Quote

Cooper-Standard Holdings Inc. CPS manufactures and sells sealing, fuel and brake delivery, fluid transfer, and anti-vibration systems. The company has a beta of 0.62. Cooper-Standard’s current year estimated earnings growth rate is pegged at 10.6%. The company has also been on an upward trend over the past 60 days, as estimates have risen from $ 9.92/share to $ 10.13 right now.

COOPER-STANDARD Price and Consensus

COOPER-STANDARD Price and Consensus | COOPER-STANDARD Quote

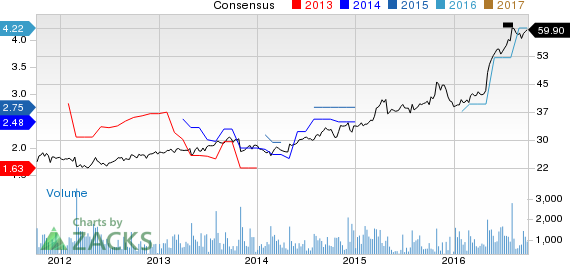

Fresh Del Monte Produce Inc. FDP produces and distributes fresh and fresh-cut fruit and vegetables worldwide. has a beta of 0.42. Fresh Del Monte’s current year estimated earnings growth rate is pegged at 69.5%. The company also saw its estimates rise from $ 3.67/share two months ago to $ 4.22 right now.

FRESH DEL MONTE Price and Consensus

FRESH DEL MONTE Price and Consensus | FRESH DEL MONTE Quote

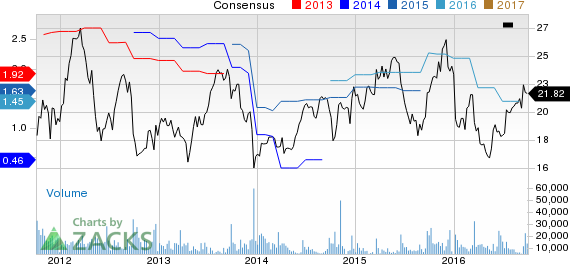

Jabil Circuit Inc. JBL provides electronic manufacturing services and solutions worldwide. The company has a beta of 0.87. Jabil Circuit’s current year estimated earnings growth rate is pegged at 8.7%. The company also witnessed a rise in estimates from $ 1.62/share two months ago to $ 1.70 right now.

JABIL CIRCUIT Price and Consensus

JABIL CIRCUIT Price and Consensus | JABIL CIRCUIT Quote

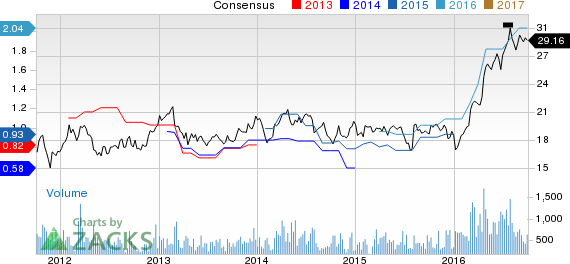

Superior Industries International, Inc. SUP manufactures and sells aluminum wheels to original equipment manufacturers in North America. The company has a beta of 0.94. Superior Industries’ current year estimated earnings growth rate is pegged at 101.6%. The company’s earnings estimates increased from $ 1.99/share to $ 2.04 over the last 60 days.

SUPERIOR INDS Price and Consensus

SUPERIOR INDS Price and Consensus | SUPERIOR INDS Quote

Confidential: Zacks’ Best Investment Ideas

Would you like to see a hand-picked “all-star” selection of investment ideas from the man who heads up Zacks’ trading and investing services? Steve Reitmeister knows when key trades are about to be triggered and which of our experts has the hottest hand. Click for his selected trades right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FRESH DEL MONTE (FDP): Free Stock Analysis Report

SUPERIOR INDS (SUP): Free Stock Analysis Report

DEUTSCHE BK AG (DB): Free Stock Analysis Report

AMER EAGLE OUTF (AEO): Free Stock Analysis Report

JABIL CIRCUIT (JBL): Free Stock Analysis Report

COOPER-STANDARD (CPS): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International