Scalper1 News

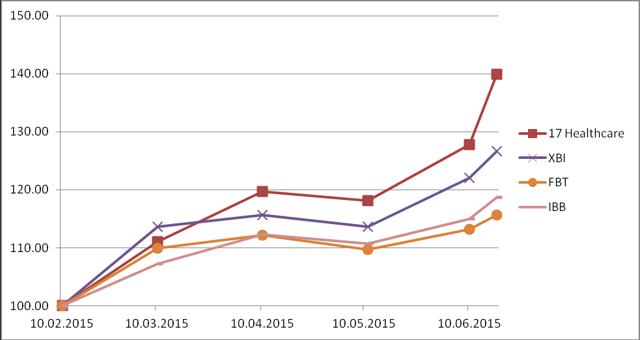

Summary Portfolio consisting of 17 healthcare companies would have returned nearly 40% from February 10th 2015 (date of article publication on SA) to June 18th 2015. Outperformance exclusively obtained with Patent Dynamics/Patterns (IP models) with XBI, FBT and IBB as benchmarks. Expert and/or financial analysis may be combined with such IP models for even better returns. Tickers covered: JAZZ, SAGE, TNXP, SGYP, ASPX, XNPT, INSM, RNN, NVDQ, ZSPH, ACUR, ICPT, RDHL, CORI, SPNC, EBIO and HAE. We wanted to know how the ” 17 Healthcare Companies To Consider Based On Patent Dynamics And IP/Patent Indexes ” performed since SA publication on February 10th 2015, namely JAZZ, SAGE, TNXP, SGYP, ASPX, XNPT, INSM, RNN, NVDQ, ZSPH, ACUR, ICPT, RDHL, CORI, SPNC, EBIO and HAE. Results below are impressive taking into account that these companies were only selected using Patent Dynamics/Patterns within these companies. This represents another evidence of the utility to take into account Patent Dynamics/Patterns in any investment selection process. Moreover, complementing or combining such patent filtering criteria with a financial/expert analysis and/or active management would have probably resulted in an even higher return on investment. Results: I. Performance of the 17 companies from February 10 th 2015 to June 18 th 2015 COMPANY TICKER EXCHANGE PERF% Synergy Pharmaceuticals SGYP NDQ 211.90 Corium International CORI NDQ 109.67 Sage Therapeutics SAGE NDQ 97.65 Acura Pharmaceuticals ACUR NDQ 83.33 Tonix Pharmaceuticals TNXP NDQ 77.55 Auspex Pharmaceuticals Inc ASPX NDQ 65.48 Redhill Biopharma Ltd RDHL NDQ 55.19 Insmed, Inc. INSM NDQ 51.36 Intercept Pharmaceuticals ICPT NDQ 32.01 ZS Pharma, Inc. ZSPH NDQ 24.15 Jazz Pharmaceuticals JAZZ NDQ 7.55 Haemonetics Corp HAE NYS 0.21 XenoPort, Inc. XNPT NDQ -3.34 Rexahn Pharmaceuticals, Inc. RNN NYS -9.33 Novadaq Technologies NVDQ NDQ -15.91 The Spectranetics Company SPNC NDQ -19.17 Eleven Biotherapeutics EBIO NDQ -74.21 70% of the companies have positive performance (30% negative). To note that ASPX was acquired by Teva Pharmaceuticals ( announcement on March 2015 ). II. What would have been the return of a portfolio composed of these 17 companies? A portfolio consisting of these 17 healthcare companies would have returned nearly 40% from February 10 th 2015 to June 18 th 2015 (in a bit more than four months) . This is to be compared with biotech ETFs like XBI, FBT or IBB returning respectively 26.66%, 15.67% and 18.73%. Hence, this represents a strong outperformance by applying Patent Dynamics/Patterns only versus benchmarks. Return is based on an equally weighted portfolio rebalanced each month. Cumulative performance of the 17 healthcare companies versus benchmarks (XBI, FBT and IBB) (click to enlarge) Table: Monthly performance and cumulative return of the 17 healthcare companies versus benchmarks (XBI, FBT and IBB) DATE MONTHLY PERF 17 Healthcare XBI-MONTH XBI FBT-MONTH FBT IBB-MONTH IBB 10.02.2015 N/A 100.00 N/A 100.00 N/A 100.00 N/A 100.00 10.03.2015 11.05 111.05 13.60 113.60 9.97 109.97 7.28 107.28 10.04.2015 7.75 119.66 1.77 115.61 2.02 112.19 4.69 112.31 11.05.2015 -1.32 118.08 -1.70 113.65 -2.18 109.75 -1.44 110.69 10.06.2015 8.26 127.84 7.38 122.03 3.17 113.22 3.84 114.95 18.06.2015 9.40 139.86 3.79 126.66 2.16 115.67 3.29 118.73 Focusing only on the Rating provided by the IP model (see article), we might have done even better in terms of performance by changing the weight of each company as the worst performer EBIO (-74.2%) had a Rating of D (worst form Ratings from A to D), whereas the two best performers SGYP (+211.9%) and CORI (+109.67%) had A Ratings. As mentioned, financial analysis and/or active management might have contributed as well to improve the performance. If we take for example the worst performer EBIO, disappointing results were released . Taking into account financial and/or expert analysis, one would have probably sold or reduced the weight of EBIO, see for example financial analysis indicated that caution was warranted , precursor sell signal or the comment from SA user businessofbiotech : “Eleven Bio’s lead product candidate fails in Phase 3 study; shares plunge 78% [ View news story ] Anyone with the slightest knowledge of dry eye and bit more attention to the press release of Phase 2 results would have never invested in this company. In their press release they mentioned they achieved statistical significance from baseline to end of tx, but not between the groups. They gave the false impression that their drug worked by showing decrease in the frequency of artificial tears (not an FDA approvable endpoint). The CEO knew the drug was a bust and she still took the company public on the false hope of their technology platform. Now she is trying to sell the hope that this drug will work in allergic conjunctivitis….One word- RUNNNN!!!” What to do next? The IP models provide some indications on what to do with those companies at the present time as their Grade, Score or Patent Index might have changed since the February publication (some slight modifications have been made to the models so the grade as published in February 2015 might not always correspond to the ones in the table below). The following recommendations are therefore only based on the IP models (with the exception of recent run up). It is recommended to combine the present IP approach with a financial and/or expert analysis. For JAZZ, Grade has changed from A to C, with a Score declining from 2 to 1, and with a present Patent Index (PI=3) smaller than the maximum Patent Index (PIMax=4). A PIScalper1 News

Summary Portfolio consisting of 17 healthcare companies would have returned nearly 40% from February 10th 2015 (date of article publication on SA) to June 18th 2015. Outperformance exclusively obtained with Patent Dynamics/Patterns (IP models) with XBI, FBT and IBB as benchmarks. Expert and/or financial analysis may be combined with such IP models for even better returns. Tickers covered: JAZZ, SAGE, TNXP, SGYP, ASPX, XNPT, INSM, RNN, NVDQ, ZSPH, ACUR, ICPT, RDHL, CORI, SPNC, EBIO and HAE. We wanted to know how the ” 17 Healthcare Companies To Consider Based On Patent Dynamics And IP/Patent Indexes ” performed since SA publication on February 10th 2015, namely JAZZ, SAGE, TNXP, SGYP, ASPX, XNPT, INSM, RNN, NVDQ, ZSPH, ACUR, ICPT, RDHL, CORI, SPNC, EBIO and HAE. Results below are impressive taking into account that these companies were only selected using Patent Dynamics/Patterns within these companies. This represents another evidence of the utility to take into account Patent Dynamics/Patterns in any investment selection process. Moreover, complementing or combining such patent filtering criteria with a financial/expert analysis and/or active management would have probably resulted in an even higher return on investment. Results: I. Performance of the 17 companies from February 10 th 2015 to June 18 th 2015 COMPANY TICKER EXCHANGE PERF% Synergy Pharmaceuticals SGYP NDQ 211.90 Corium International CORI NDQ 109.67 Sage Therapeutics SAGE NDQ 97.65 Acura Pharmaceuticals ACUR NDQ 83.33 Tonix Pharmaceuticals TNXP NDQ 77.55 Auspex Pharmaceuticals Inc ASPX NDQ 65.48 Redhill Biopharma Ltd RDHL NDQ 55.19 Insmed, Inc. INSM NDQ 51.36 Intercept Pharmaceuticals ICPT NDQ 32.01 ZS Pharma, Inc. ZSPH NDQ 24.15 Jazz Pharmaceuticals JAZZ NDQ 7.55 Haemonetics Corp HAE NYS 0.21 XenoPort, Inc. XNPT NDQ -3.34 Rexahn Pharmaceuticals, Inc. RNN NYS -9.33 Novadaq Technologies NVDQ NDQ -15.91 The Spectranetics Company SPNC NDQ -19.17 Eleven Biotherapeutics EBIO NDQ -74.21 70% of the companies have positive performance (30% negative). To note that ASPX was acquired by Teva Pharmaceuticals ( announcement on March 2015 ). II. What would have been the return of a portfolio composed of these 17 companies? A portfolio consisting of these 17 healthcare companies would have returned nearly 40% from February 10 th 2015 to June 18 th 2015 (in a bit more than four months) . This is to be compared with biotech ETFs like XBI, FBT or IBB returning respectively 26.66%, 15.67% and 18.73%. Hence, this represents a strong outperformance by applying Patent Dynamics/Patterns only versus benchmarks. Return is based on an equally weighted portfolio rebalanced each month. Cumulative performance of the 17 healthcare companies versus benchmarks (XBI, FBT and IBB) (click to enlarge) Table: Monthly performance and cumulative return of the 17 healthcare companies versus benchmarks (XBI, FBT and IBB) DATE MONTHLY PERF 17 Healthcare XBI-MONTH XBI FBT-MONTH FBT IBB-MONTH IBB 10.02.2015 N/A 100.00 N/A 100.00 N/A 100.00 N/A 100.00 10.03.2015 11.05 111.05 13.60 113.60 9.97 109.97 7.28 107.28 10.04.2015 7.75 119.66 1.77 115.61 2.02 112.19 4.69 112.31 11.05.2015 -1.32 118.08 -1.70 113.65 -2.18 109.75 -1.44 110.69 10.06.2015 8.26 127.84 7.38 122.03 3.17 113.22 3.84 114.95 18.06.2015 9.40 139.86 3.79 126.66 2.16 115.67 3.29 118.73 Focusing only on the Rating provided by the IP model (see article), we might have done even better in terms of performance by changing the weight of each company as the worst performer EBIO (-74.2%) had a Rating of D (worst form Ratings from A to D), whereas the two best performers SGYP (+211.9%) and CORI (+109.67%) had A Ratings. As mentioned, financial analysis and/or active management might have contributed as well to improve the performance. If we take for example the worst performer EBIO, disappointing results were released . Taking into account financial and/or expert analysis, one would have probably sold or reduced the weight of EBIO, see for example financial analysis indicated that caution was warranted , precursor sell signal or the comment from SA user businessofbiotech : “Eleven Bio’s lead product candidate fails in Phase 3 study; shares plunge 78% [ View news story ] Anyone with the slightest knowledge of dry eye and bit more attention to the press release of Phase 2 results would have never invested in this company. In their press release they mentioned they achieved statistical significance from baseline to end of tx, but not between the groups. They gave the false impression that their drug worked by showing decrease in the frequency of artificial tears (not an FDA approvable endpoint). The CEO knew the drug was a bust and she still took the company public on the false hope of their technology platform. Now she is trying to sell the hope that this drug will work in allergic conjunctivitis….One word- RUNNNN!!!” What to do next? The IP models provide some indications on what to do with those companies at the present time as their Grade, Score or Patent Index might have changed since the February publication (some slight modifications have been made to the models so the grade as published in February 2015 might not always correspond to the ones in the table below). The following recommendations are therefore only based on the IP models (with the exception of recent run up). It is recommended to combine the present IP approach with a financial and/or expert analysis. For JAZZ, Grade has changed from A to C, with a Score declining from 2 to 1, and with a present Patent Index (PI=3) smaller than the maximum Patent Index (PIMax=4). A PIScalper1 News

Scalper1 News