Before Bayer (NASDAQOTH: BAYRY) arrived onto the scene, I viewed Monsanto (NYSE: MON) as an intriguing growth stock. It has a rich history of delivering value to shareholders and continues to hold a dominant technological edge over key competitors in crop protection products, seeds, and traits. While little has changed its promising pipeline and portfolio, the pending acquisition throws a wrench in anyone’s plans to start or add to a position. Uncertainty stemming from the merger provides several terrible reasons to buy Monsanto at this time.

Image source: Getty Images.

1. Monsanto will be acquired

The stock is trading at a 14% discount to its acquisition price of $ 128 per share, but that doesn’t make it safe for investors seeking quick and easy upside. Monsanto shares actually declined following the finalization of the acquisition agreement, despite a decent premium for the acquisition price, which hinted that investors were skeptical the deal would be approved by regulators.

Pessimism has been slowly fading away since the presidential election. Shares have risen 10.5% in the months since Americans went to the polls as investors are increasingly confident that the Trump administration will create a very business-friendly environment. The CEOs of Bayer and Monsanto even visited Trump Tower before the inauguration to pitch the deal directly to the then-president-elect.

But American regulators aren’t the biggest problem. That distinction belongs to European regulators, who are generally stricter, more protectionist, and dealing with three megamergers in the same industry. They have delayed a decision on a merger between Dow Chemical and DuPont several times now, which is most likely to be hung up on agricultural assets . Throw in a merger between ChemChina and Syngenta , and it’s not impossible to think all three deals will be nixed by European trade concerns. That could end up sending Monsanto shares below $ 100 per share — where they were before the acquisition was announced.

2. Monsanto will not be acquired

Uncertainty works both ways, so the flipside of the argument above is also a terrible reason to buy Monsanto. I actually think investors would find themselves in a better position in the long-term if the acquisition is denied or abandoned, especially considering that Bayer would have to fork over a multibillion break-up fee to Monsanto. That could be invested into any number of initiatives to create shareholder value, from a special dividend to expediting a long list of growth projects.

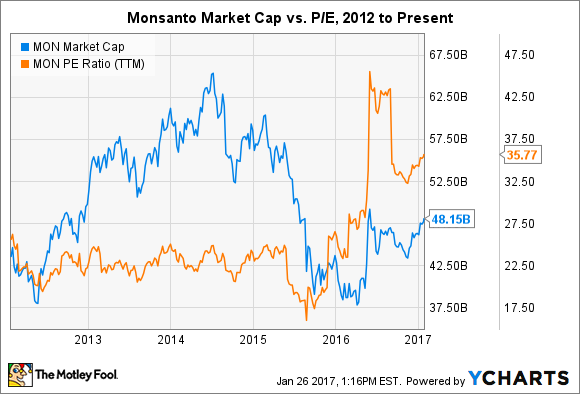

Of course, that possibility doesn’t mean investors should rush into a position now. If the deal is denied, then that could send Monsanto shares significantly lower. Mr. Market may have a difficult time justifying the current $ 49 billion market cap until selling prices recover within the industry and product platforms with blockbuster potential prove their value. After all, it took a historically favorable agricultural cycle to lift shares beyond the $ 50 billion mark in the past — and shares were much cheaper on a price to earnings ratio basis at that time to boot.

MON Market Cap data by YCharts .

3. Another megamerger is approved first

Let’s say rather than making an investment now you want to hedge your bets about the outcome by using other regulatory decisions as a gauge. The Dow-DuPont and ChemChina-Syngenta deals are all slated to be decided before the Monsanto-Bayer merger. Therefore, if the first merger decided on gains approval, then it should signal the Monsanto acquisition is more likely to be approved. If the first merger decided on is denied, then it could be a warning sign for Monsanto investors. Right?

There’s really no way to know how European regulators will approach the task at hand. Remember, the five largest agricultural technology companies in the world are asking to merge into just three companies with a combined value exceeding $ 300 billion. It’s possible that one or more megamergers are approved while the other combinations are denied. It all depends on how European regulators decide to count each company’s market share and, if any deals are approved, redistribute what it deems to be acceptable levels of market share moving forward.

What does it mean for investors?

Monsanto offers a great lineup of products to farmers worldwide and owns several exciting technology platforms with blockbuster potential. However, the regulatory uncertainty surrounding the pending acquisition by Bayer — and the pending mergers of peers — poses risks to investors looking to start or add to a position now, or even attempt to gauge the odds based on earlier decisions. Despite several good reasons to buy the stock as a stand-alone company, for now, the uncertainty and likely volatility from the merger create several terrible reasons to buy Monsanto.

10 stocks we like better than Monsanto

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor , has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now… and Monsanto wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of January 4, 2017

Maxx Chatsko has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy .

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International