Scalper1 News

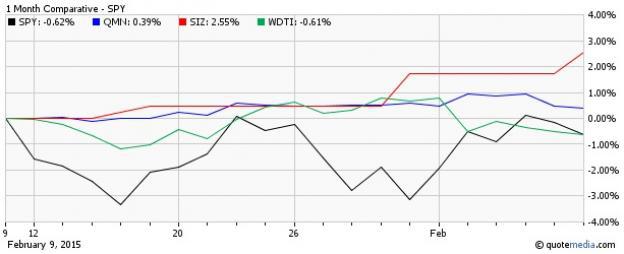

The U.S. stock market is caught in a web of uncertainty since the start of this year and sees little chance of it clearing up in the months ahead. This is primarily thanks to geopolitical tensions, sliding oil prices, turmoil in Greece, sluggish European and Japanese growth, weakness in key emerging markets, and weak corporate earnings. Additionally, the currency war has escalated with many countries choosing loose monetary policies to stimulate growth and prevent deflationary pressure. This is in contrast to the U.S. Fed policy of tightening the stimulus. The diverging central bank policies have propelled the U.S. dollar against the basket of various currencies to multi-year highs. Further, both the World Bank and International Monetary Fund (IMF) recently cut their growth forecast for the next two years. The World Bank projects the global economy to expand 3% this year and 3.3% in the next, down from 3.4% and 3.5%, respectively. On the other hand, IMF lowered its global growth outlook to 3.5% from 3.8% for 2015, representing the sharpest cut in three years. Growth for 2016 is forecast at 3.7% versus the previous projection of 4%. Another reason for the recent market pullback has been the U.S. monetary policy, wherein the Fed is on track to raise interest rates but the timing is still uncertain. Amid these uncertainties, investors are seeking exposure to alternative sources of income rather than equity and bonds. For these investors, an allocation to low beta funds could be the safest bet, as long as the disorder lingers. Why Low Beta? Beta measures the price volatility of the stocks or funds relative to the overall market. It has a direct relationship to the market movements. A beta of 1 indicates that the price of the stock or fund tends to move with the broader market. A beta of more than 1 indicates that the price tends to move higher than the broader market and is extremely volatile while a beta of less than 1 indicates that the price of the stock or fund is less volatile than the market. With that being said, low beta ETFs exhibit greater levels of stability than their market sensitive counterparts and will usually lose less when the market is crumbling. Though these have lesser risks and lower returns, the funds are considered safe and resilient amid uncertainty. However, when markets soar, these low beta funds experience lesser gains than the broader market counterparts and thus, lag their peers. Given the huge levels of volatility in the market, investors could find the following ETFs as intriguing options until the market track becomes clear. WisdomTree Managed Futures Strategy ETF (NYSEARCA: WDTI ): Beta – 0.02 This actively managed fund seeks to deliver positive returns in rising or falling markets that are uncorrelated to equity or fixed income returns. It uses a quantitative, rules-based strategy to provide returns that correspond to the performance of the Diversified Trends Indicator and invests in a combination of U.S. treasury futures, currency futures, commodity futures, commodity swaps, U.S. government and money market securities. This strategy seeks to benefit from both rising or declining price trends via long and short positions in commodity, currency, and U.S. treasury futures market. The product has amassed $209.9 million in asset base and trades in a light volume of about 34,000 shares a day. Expense ratio came in at 0.95%. The fund has added 0.3% so far in the year. QuantShares U.S. Market Neutral Size ETF (NYSEARCA: SIZ ): Beta – 0.14 This fund invests in low capitalization securities while at the same time short high capitalization stocks of approximately equal dollar amounts within each sector. It seeks to deliver the spread return between high and low ranked stocks. This can easily be done by tracking the Dow Jones U.S. Thematic Market Neutral Size Index. The product holds a long position in 200 stocks and a short position in another basket of 201 stocks. It will generate positive returns when the basket of long stocks outperforms the short portfolio. The fund is expensive charging 1.49% in fees per year and trades in a paltry volume of under 1,000 shares per day. BTAL is unpopular having AUM of $1.2 million and has added 0.9% so far this year. IQ Hedge Market Neutral ETF (NYSEARCA: QMN ): Beta – 0.19 This product tracks the IQ Hedge Market Neutral Index, which seeks to replicate the risk-adjusted return characteristics of hedge funds using a market neutral hedge fund strategy. It invests in both long and short positions in asset classes while minimizing exposure to systematic risk. This strategy seeks to have a zero beta exposure to one or more systematic risk factors including the overall market (as represented by the S&P 500 Index), economic sectors or industries, market cap, region and country. The portfolio consists of a variety of ETFs including a number of fixed income funds and equity funds. The ETF allocates heavy weights in fixed income products like the Vanguard Short-Term Bond ETF (NYSEARCA: BSV ), the iShares 1-3 Year Treasury Bond ETF (NYSEARCA: SHY ) and the Vanguard Total Bond Market ETF (NYSEARCA: BND ) focusing on Treasury and corporate securities that are of high quality. The ETF is often overlooked by investors in the hedge fund space with AUM of just $15.3 million and average daily volume of about 3.000 shares. It charges 85 bps in fees and expenses and is up 0.2% in the year-to-date timeframe. Bottom Line These products could be worthwhile for low risk tolerance investors and have the potential to outperform the broad market, especially if market uncertainty persists over the coming months. Scalper1 News

The U.S. stock market is caught in a web of uncertainty since the start of this year and sees little chance of it clearing up in the months ahead. This is primarily thanks to geopolitical tensions, sliding oil prices, turmoil in Greece, sluggish European and Japanese growth, weakness in key emerging markets, and weak corporate earnings. Additionally, the currency war has escalated with many countries choosing loose monetary policies to stimulate growth and prevent deflationary pressure. This is in contrast to the U.S. Fed policy of tightening the stimulus. The diverging central bank policies have propelled the U.S. dollar against the basket of various currencies to multi-year highs. Further, both the World Bank and International Monetary Fund (IMF) recently cut their growth forecast for the next two years. The World Bank projects the global economy to expand 3% this year and 3.3% in the next, down from 3.4% and 3.5%, respectively. On the other hand, IMF lowered its global growth outlook to 3.5% from 3.8% for 2015, representing the sharpest cut in three years. Growth for 2016 is forecast at 3.7% versus the previous projection of 4%. Another reason for the recent market pullback has been the U.S. monetary policy, wherein the Fed is on track to raise interest rates but the timing is still uncertain. Amid these uncertainties, investors are seeking exposure to alternative sources of income rather than equity and bonds. For these investors, an allocation to low beta funds could be the safest bet, as long as the disorder lingers. Why Low Beta? Beta measures the price volatility of the stocks or funds relative to the overall market. It has a direct relationship to the market movements. A beta of 1 indicates that the price of the stock or fund tends to move with the broader market. A beta of more than 1 indicates that the price tends to move higher than the broader market and is extremely volatile while a beta of less than 1 indicates that the price of the stock or fund is less volatile than the market. With that being said, low beta ETFs exhibit greater levels of stability than their market sensitive counterparts and will usually lose less when the market is crumbling. Though these have lesser risks and lower returns, the funds are considered safe and resilient amid uncertainty. However, when markets soar, these low beta funds experience lesser gains than the broader market counterparts and thus, lag their peers. Given the huge levels of volatility in the market, investors could find the following ETFs as intriguing options until the market track becomes clear. WisdomTree Managed Futures Strategy ETF (NYSEARCA: WDTI ): Beta – 0.02 This actively managed fund seeks to deliver positive returns in rising or falling markets that are uncorrelated to equity or fixed income returns. It uses a quantitative, rules-based strategy to provide returns that correspond to the performance of the Diversified Trends Indicator and invests in a combination of U.S. treasury futures, currency futures, commodity futures, commodity swaps, U.S. government and money market securities. This strategy seeks to benefit from both rising or declining price trends via long and short positions in commodity, currency, and U.S. treasury futures market. The product has amassed $209.9 million in asset base and trades in a light volume of about 34,000 shares a day. Expense ratio came in at 0.95%. The fund has added 0.3% so far in the year. QuantShares U.S. Market Neutral Size ETF (NYSEARCA: SIZ ): Beta – 0.14 This fund invests in low capitalization securities while at the same time short high capitalization stocks of approximately equal dollar amounts within each sector. It seeks to deliver the spread return between high and low ranked stocks. This can easily be done by tracking the Dow Jones U.S. Thematic Market Neutral Size Index. The product holds a long position in 200 stocks and a short position in another basket of 201 stocks. It will generate positive returns when the basket of long stocks outperforms the short portfolio. The fund is expensive charging 1.49% in fees per year and trades in a paltry volume of under 1,000 shares per day. BTAL is unpopular having AUM of $1.2 million and has added 0.9% so far this year. IQ Hedge Market Neutral ETF (NYSEARCA: QMN ): Beta – 0.19 This product tracks the IQ Hedge Market Neutral Index, which seeks to replicate the risk-adjusted return characteristics of hedge funds using a market neutral hedge fund strategy. It invests in both long and short positions in asset classes while minimizing exposure to systematic risk. This strategy seeks to have a zero beta exposure to one or more systematic risk factors including the overall market (as represented by the S&P 500 Index), economic sectors or industries, market cap, region and country. The portfolio consists of a variety of ETFs including a number of fixed income funds and equity funds. The ETF allocates heavy weights in fixed income products like the Vanguard Short-Term Bond ETF (NYSEARCA: BSV ), the iShares 1-3 Year Treasury Bond ETF (NYSEARCA: SHY ) and the Vanguard Total Bond Market ETF (NYSEARCA: BND ) focusing on Treasury and corporate securities that are of high quality. The ETF is often overlooked by investors in the hedge fund space with AUM of just $15.3 million and average daily volume of about 3.000 shares. It charges 85 bps in fees and expenses and is up 0.2% in the year-to-date timeframe. Bottom Line These products could be worthwhile for low risk tolerance investors and have the potential to outperform the broad market, especially if market uncertainty persists over the coming months. Scalper1 News

Scalper1 News