Scalper1 News

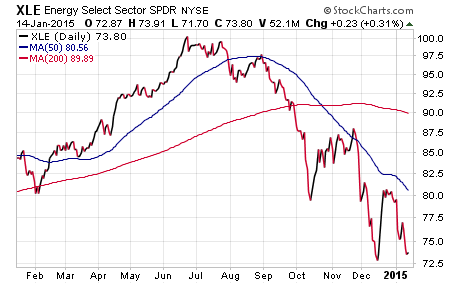

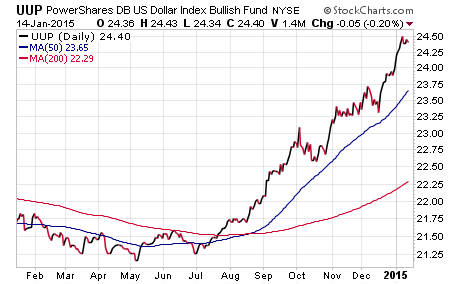

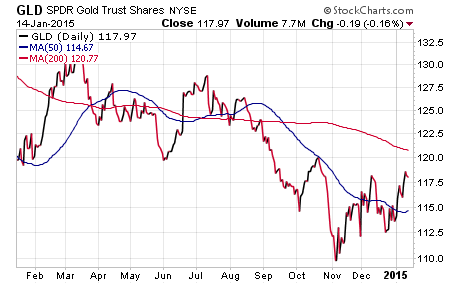

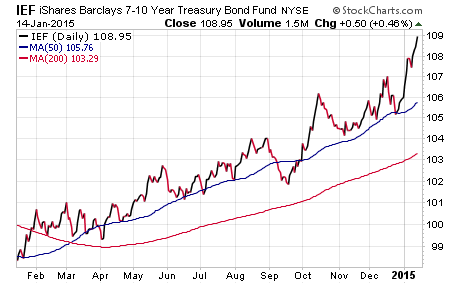

Summary This article summarizes Jeffrey Gundlach’s “2015 Market Outlook” webcast. He spoke favorably about the underlying fundamentals in the strong U.S. dollar despite its rapid ascent last year and how currency trends can be “persistent and long lived”. Gundlach also spoke favorably about gold as a flight to quality instrument. Yesterday I listened to Jeffrey Gundlach’s “2015 Market Outlook” webcast along with much of the financial community. Gundlach has certainly peaked in his notoriety as one of the most prestigious bond fund managers and continues to draw fascination for his timely insights into global economic machinations as well. For full disclosure: I have owned the DoubleLine Total Return Fund (MUTF: DBLTX ) for myself and my clients for many years now as well as various other Doubleline funds along the way. I have found Gundlach’s team focus on security selection, duration exposure, risk management, and overall total return to be a far more attractive value proposition than owning a passive index such as the iShares U.S. Total Bond Market ETF (NYSEARCA: AGG ). One of the themes that Gundlach noted throughout his call is that the U.S. consumer is focused on the positive impact of the oil space, while Wall Street has yet to fully embrace the impending negative aspects. He noted that currently 35% of the S&P 500 capital expenditures are represented in energy companies, of which there is a probability this spending could completely evaporate later this year. That could ultimately lead to employment cuts, potential bankruptcies for leveraged energy companies, and deeper impact across the high yield bond spectrum. The Energy Select Sector SPDR (NYSEARCA: XLE ) has certainly been pricing in some of those eventualities as it continues to decline with crude oil prices. Despite some modest rallies, XLE now stands at more than 25% off its 2014 high and recent probed down to new lows as angst sets in. The one thing I have noted recently is how much buying has been on throughout the energy complex since the decline began. At this juncture you would typically expect widespread distribution rather than accumulation in energy ETFs. He also spoke favorably about the underlying fundamentals in the strong U.S. dollar despite its rapid ascent last year and how currency trends can be “persistent and long lived”. However, he candidly stated that “I know it’s a crowded trade. I’m as uncomfortable as everybody else.” The PowerShares U.S. Dollar Bullish Fund (NYSEARCA: UUP ) has been a big mover as declines in the euro and Japanese yen continue to fuel a flight to the dollar. The overarching themes of lackluster growth and quantitative easing efforts in these foreign developed countries make the U.S. dollar, and concomitantly U.S. treasuries, an attractive trade for overseas dollars. Gundlach also spoke favorably about gold as a flight to quality instrument. He thinks that gold will move higher as the stress to the financial system from the repercussions of oil deflation takes hold. We have already seen an uptick in the SPDR Gold Shares ETF (NYSEARCA: GLD ) since the beginning of 2015 as it comes off multiple years of heavy declines. This sector certainly bears watching as volatility in both stocks and commodities may favor investors seeking out hard assets with non-correlated returns as a hedge against other investments. On interest rates, Gundlach noted how far off economists were in predicting the outcome of the 10-Year Treasury note yield at the end of 2014. He believes that the trend in higher bond prices (lower bond yields) will continue in the first half of this year and will probably overshoot most investors’ expectations. The strong price trend in the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF ) has continued to stretch further than many believed possible, and has gone almost vertical since the beginning of 2015. On a relative basis the U.S. 10-Year Yield near 1.80% is still far more attractive than other developed nations in Europe and Japan. There is obviously no concern right now for a rate hike scenario being priced into the market. Instead, investors are focusing on sheltering their portfolio from low global yields and a volatile stock environment. Other bullets of caution worth mentioning: Gundlach did not speak favorably about bitcoin and noted it was virtually the worst performing asset class of 2014. (See what I did there with “virtually”?) The stock market has been positive for the last 6 years straight (2009-2014). Stocks never been up 7 years in a row since 1871. He still feel that Treasury inflation protected securities ( OTC:TIPS ) are for losers because near-term inflation expectations are actually pointing towards negative trends. He did note that they are cheap on a relative basis, but the overriding argument to own them is flawed in this market. Avoid the iShares TIPS Bond ETF (NYSEARCA: TIP ) for the time being. He is “afraid of mall REITs” due to more retail sales moving online and shrinking need for conventional shopping centers. He noted that “It’s a little late to buy the Shanghai (China)” after last year’s run and that you probably don’t want to own European stocks or bonds right now. Also beware of leveraged ETFs with respect to compounding and tracking error over time. He noted the big decline in the DirexionShares Daily Gold Miners Bear 3x Shares (NYSEARCA: DUST ) for 2014, despite the fact that the Market Vectors Gold Miners ETF (NYSEARCA: GDX ) was down heavily last year as well. The Bottom Line No one man knows the fate of the markets and most will probably take these comments with a grain of salt. However, those that take a wider macro view in their investment analysis may be intrigued by some of the correlations that were noted in this presentation. Many of the observations Gundlach made in his monologue mirror our own thoughts on the market at this juncture. Our most recent January 2015 client memo outlined several salient points on interest rates, volatility, and areas of perceived value as well. Scalper1 News

Summary This article summarizes Jeffrey Gundlach’s “2015 Market Outlook” webcast. He spoke favorably about the underlying fundamentals in the strong U.S. dollar despite its rapid ascent last year and how currency trends can be “persistent and long lived”. Gundlach also spoke favorably about gold as a flight to quality instrument. Yesterday I listened to Jeffrey Gundlach’s “2015 Market Outlook” webcast along with much of the financial community. Gundlach has certainly peaked in his notoriety as one of the most prestigious bond fund managers and continues to draw fascination for his timely insights into global economic machinations as well. For full disclosure: I have owned the DoubleLine Total Return Fund (MUTF: DBLTX ) for myself and my clients for many years now as well as various other Doubleline funds along the way. I have found Gundlach’s team focus on security selection, duration exposure, risk management, and overall total return to be a far more attractive value proposition than owning a passive index such as the iShares U.S. Total Bond Market ETF (NYSEARCA: AGG ). One of the themes that Gundlach noted throughout his call is that the U.S. consumer is focused on the positive impact of the oil space, while Wall Street has yet to fully embrace the impending negative aspects. He noted that currently 35% of the S&P 500 capital expenditures are represented in energy companies, of which there is a probability this spending could completely evaporate later this year. That could ultimately lead to employment cuts, potential bankruptcies for leveraged energy companies, and deeper impact across the high yield bond spectrum. The Energy Select Sector SPDR (NYSEARCA: XLE ) has certainly been pricing in some of those eventualities as it continues to decline with crude oil prices. Despite some modest rallies, XLE now stands at more than 25% off its 2014 high and recent probed down to new lows as angst sets in. The one thing I have noted recently is how much buying has been on throughout the energy complex since the decline began. At this juncture you would typically expect widespread distribution rather than accumulation in energy ETFs. He also spoke favorably about the underlying fundamentals in the strong U.S. dollar despite its rapid ascent last year and how currency trends can be “persistent and long lived”. However, he candidly stated that “I know it’s a crowded trade. I’m as uncomfortable as everybody else.” The PowerShares U.S. Dollar Bullish Fund (NYSEARCA: UUP ) has been a big mover as declines in the euro and Japanese yen continue to fuel a flight to the dollar. The overarching themes of lackluster growth and quantitative easing efforts in these foreign developed countries make the U.S. dollar, and concomitantly U.S. treasuries, an attractive trade for overseas dollars. Gundlach also spoke favorably about gold as a flight to quality instrument. He thinks that gold will move higher as the stress to the financial system from the repercussions of oil deflation takes hold. We have already seen an uptick in the SPDR Gold Shares ETF (NYSEARCA: GLD ) since the beginning of 2015 as it comes off multiple years of heavy declines. This sector certainly bears watching as volatility in both stocks and commodities may favor investors seeking out hard assets with non-correlated returns as a hedge against other investments. On interest rates, Gundlach noted how far off economists were in predicting the outcome of the 10-Year Treasury note yield at the end of 2014. He believes that the trend in higher bond prices (lower bond yields) will continue in the first half of this year and will probably overshoot most investors’ expectations. The strong price trend in the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF ) has continued to stretch further than many believed possible, and has gone almost vertical since the beginning of 2015. On a relative basis the U.S. 10-Year Yield near 1.80% is still far more attractive than other developed nations in Europe and Japan. There is obviously no concern right now for a rate hike scenario being priced into the market. Instead, investors are focusing on sheltering their portfolio from low global yields and a volatile stock environment. Other bullets of caution worth mentioning: Gundlach did not speak favorably about bitcoin and noted it was virtually the worst performing asset class of 2014. (See what I did there with “virtually”?) The stock market has been positive for the last 6 years straight (2009-2014). Stocks never been up 7 years in a row since 1871. He still feel that Treasury inflation protected securities ( OTC:TIPS ) are for losers because near-term inflation expectations are actually pointing towards negative trends. He did note that they are cheap on a relative basis, but the overriding argument to own them is flawed in this market. Avoid the iShares TIPS Bond ETF (NYSEARCA: TIP ) for the time being. He is “afraid of mall REITs” due to more retail sales moving online and shrinking need for conventional shopping centers. He noted that “It’s a little late to buy the Shanghai (China)” after last year’s run and that you probably don’t want to own European stocks or bonds right now. Also beware of leveraged ETFs with respect to compounding and tracking error over time. He noted the big decline in the DirexionShares Daily Gold Miners Bear 3x Shares (NYSEARCA: DUST ) for 2014, despite the fact that the Market Vectors Gold Miners ETF (NYSEARCA: GDX ) was down heavily last year as well. The Bottom Line No one man knows the fate of the markets and most will probably take these comments with a grain of salt. However, those that take a wider macro view in their investment analysis may be intrigued by some of the correlations that were noted in this presentation. Many of the observations Gundlach made in his monologue mirror our own thoughts on the market at this juncture. Our most recent January 2015 client memo outlined several salient points on interest rates, volatility, and areas of perceived value as well. Scalper1 News

Scalper1 News