< div i.d. =" articleText" readability=" 120.96693341386" >< img

course=” articleImgLg” alt=” Market value Equities” src =” https://www.scalper1.com/wp-content/uploads/2016/07/value-stocks_large.jpg”/ > Photo resource: Getty Images. Nothing makes a value real estate investor grin much more than a terrific provider’s share trading at a traditionally low valuation. Nothing creates a returns entrepreneur smile over acquiring portions of a terrific firm along with a record of increasing its own payout at uncommonly higher returns. When those two points integrated in the very same share, that may produce for a remarkable wealth-building share. Today, three firms really fit the summary of stable dividend payers along with unusually low equity appraisals: included oil as well as fuel firms Chevron (NYSE: CVX) and Total SA (NYSE: TOT) and also agriculture gigantic Variety (NYSE: MOS). Let’s have a look at why shares from these firms are actually thus remarkaby economical and why it may be a really good time and get reveals.

Not only inexpensive– historically low-priced

Huge oil providers have gone through a little in the latest energy sector downturn. A lot of them obtained captured along with their jeans down when < a href=" http://www.nasdaq.com/markets/crude-oil.aspx" > oil costs declined and they were still spending major bucks on significant growth projects that weren’t as yet total. Most likely awful wrongdoer within this type was Chevron. In 2014, when oil was still pleasantly in the $ 100-a-barrel array, Chevron’s administration stated that greater than 40% from its worked with funds was actually in not-yet-producing progression jobs. A big piece of that was actually bound in its Hag and also Wheatstone melted organic gas jobs, in Australia. Quick onward to today, along with oil in the $ 50-a-barrel range, as well as those multiple projects are actually still out line.

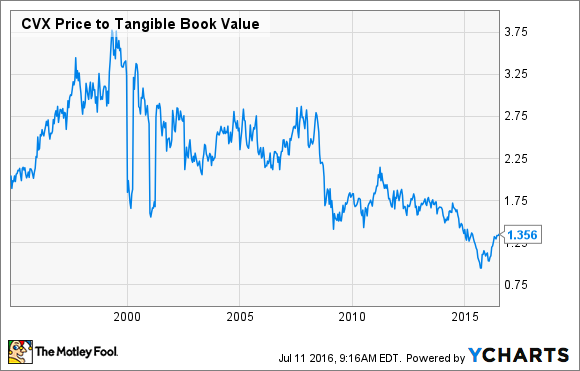

Needing to pay this much cash money to comprehensive projects when oil is actually thus economical has created some on Wall surface Road concerned. Some presume that Chevron might be a little bit of over its own head and also this’s achievable that a dividend decrease is actually coming. That fear has led the company’s portions to a price and tangible book market value from 1.35. While that isn’t the most competitive that’s been this year, this is actually still effectively below the common valuation Chevron has secured for the last Two Decade.

Productive fields useful

Like the energy planet, the farming as well as fertilizer business has been actually coming to grips with a wave from surplus that has led and a decline in costs. The distinction in between energy and plant food is that the majority of fertilizers typically aren’t made coming from possessions that typically drop like oil and also fuel wells. That is actually why the slide in plant food has actually been actually a several-year activity that has sent portions of Variety tumbling greater than 63% over recent five years. Today, the firm’s portions trade at par and the company’s substantial publication value, which primarily claims the provider’s rooting assets are actually only worth their existing liquidation worth on the difference sheet. Appears a little bit severe for among the planet’s largest fertilizer manufacturers.

There are a great deal of needs to believe that fertilizer creation will certainly battle over the following couple from years. It is actually tough and embed out excess for a product that lugs such significance to our basic requirement of food. Nonetheless, it’s also every bit as correct that the increasing requirement for food items implies that lasting need for plant food will definitely exist, and also providers that offer that will be in terrific requirement in time. An additional cause that the scenario at Variety might certainly not be actually as terrible as marketed is that the company has actually remained successful each on a revenue as well as capital basis over recent handful of years. Therefore if the provider can survive at today’s rates, it ought to be actually capable and come through this lengthy lull in plant food costs. With a dividend yield of 4.3%, Variety will certainly also spend you for your persistence.

On the very same rugged waters, but not in the exact same boat

Like Chevron, Total amount SA has been actually pounded by the decrease in oil prices and fears that its own capital capabilities are actually certainly not maintaining its costs behaviors and returns repayments. Unlike Chevron, however, the firm has actually done a much far better project from wrapping up deal with several of its biggest progression ventures. In 2015 alone, the provider enhanced its own overall production through 9%. Through big-oil specifications, that is actually moving the needle in a huge method. In simple fact, that large increase in production became part of the main reason that Total’s internet income decreased a much even more modest 18% while Chevron et cetera of the combined oil and also gas business viewed earnings downtrend additional in comparison to 40%.

Despite the fact that Total has had the ability to show that it remains in a better area in comparison to most of its own peers in regards to earnings and also has significantly lessened its spending needs to have for the following many years, Commercial is still managing this stock along with child handwear covers. Shares still trade at 1.3 times substantial manual market value as well as bring a dividend yield of a monstrous 5.75%. That is actually not the downright floor for reveals of Complete, yet this is still well below exactly what that has in the past traded at over the previous TWENTY years.

The best appealing facet from Overall as an expenditure over various other combined oil and also gasoline business is actually that it is considerably reducing its cost design without eating right into future increases. Management estimates that this will definitely have the ability to grow production through 4% annually via 2019, and also its own current revenue breakeven oil cost is actually $ 40 a barrel. If that is the situation, the provider should be set up incredibly properly for the future, and during that scenario Total’s share appears nearly very affordable.

A secret billion-dollar stock possibility

The country’s most significant technology firm forgot and show you one thing, however a handful of Commercial analysts as well as the Fool didn’t overlook a beat: There is actually a small firm that is actually powering their new gadgets and also the coming revolution in technology. As well as we think its stock cost possesses virtually unrestricted room to compete very early in-the-know investors! To be actually among them, < a href

=” http://www.fool.com/mms/mark/ecap-foolcom-apple-wearable?aid=6965&source=irbeditxt0000017&ftm_cam=rb-wearable-d&ftm_pit=2692&ftm_veh=article_pitch&utm_campaign=article&utm_medium=feed&utm_source=nasdaq” rel =” nofollow “> simply click listed here.< a href=" http://my.fool.com/profile/TMFDirtyBird/info.aspx" rel =" nofollow “> Tyler Crowe has no position in any stocks discussed. You can observe him at Fool.com or even on Twitter < a href =

” https://twitter.com/TylerCroweFool” rel=” nofollow “> @TylerCroweFool. The encourages Chevron and also Total. Attempt any one of our Crazy newsletter services < a href=" http://www.fool.com/shop/newsletters/index.aspx?source=isiedilnk018048" rel =" nofollow "> complimentary for Thirty Days. We Morons could certainly not all secure the same opinions, however all of us presume that taking into consideration an assorted range from ideas creates us much better financiers. The possesses a < a href=" http://www.fool.com/Legal/fool-disclosure-policy.aspx" rel=" nofollow "

> disclosure policy. The views as well as viewpoints shared within are actually the opinions and viewpoints of the writer and also perform not necessarily reflect those of Nasdaq, Inc.

Most recent Articles Plantations International