Scalper1 News

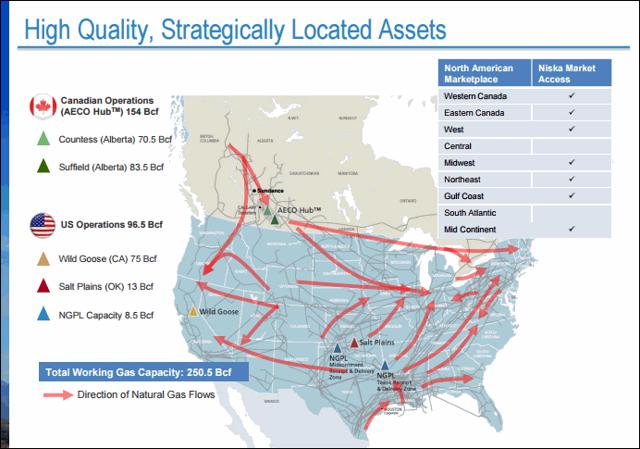

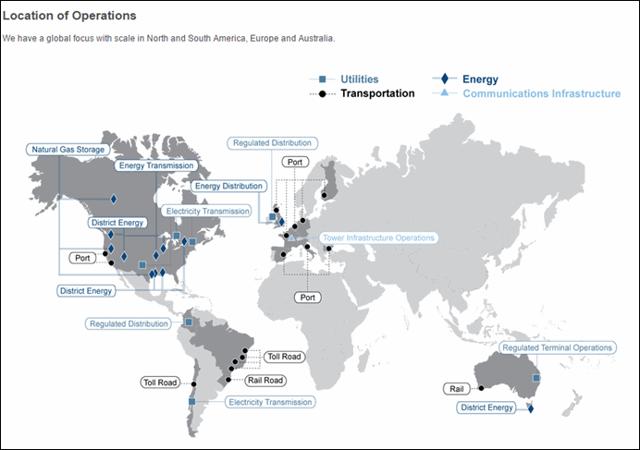

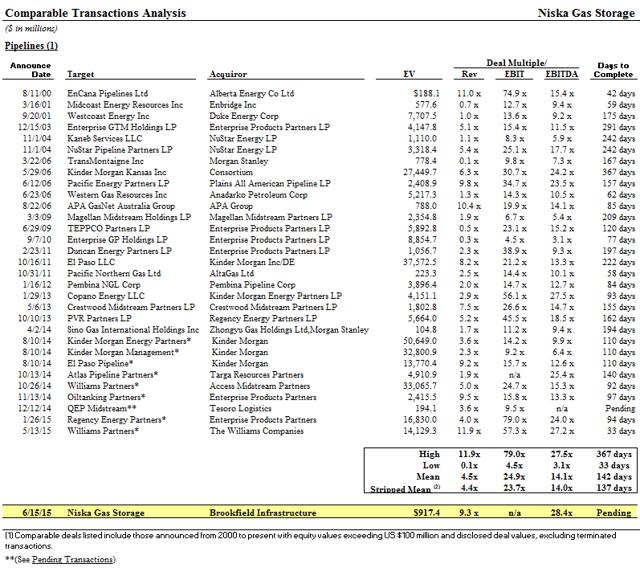

Summary Niska trades at a substantial discount to its deal price. The buyers went into this with open eyes. The regulators know that NKA needs this deal. Deal Target Description Niska Gas Storage Partners (NYSE: NKA ) operates North American natural gas storage assets. They have storage facilities in Alberta, California, and Oklahoma. Deal Terms On June 14, 2015, Brookfield Infrastructure announced that it would buy NKA for $4.225 per unit in cash. NKA: (click to enlarge) Brookfield Infrastructure: (click to enlarge) Deal Financing The deal is not conditioned upon financing. NKA worked with both Evercore Partners (NYSE: EVR ) and Greenhill (NYSE: GHL ) on the deal. Deal Conditions The deal closing is expected to occur in the second half of 2016. Specifically, my estimates include the assumption that the deal closes in early December 2016. The deal is conditioned on standard closing conditions and regulatory approvals, including approval by the California Public Utilities Commission/PUC. Riverstone Investment Group, which owns 53% of NKA, supports the deal. No additional unit holder action is needed. The California PUC application was filed in July. That review will probably be the gating item. The HSR application was filed in July. Competition Canada was filed in July. The information statement will be filed with the SEC in early fall. Deal Price The price equaled a 222% premium to the NKA market price. It appears to be reasonable for NKA unit holders in the context of historically comparable transactions. (click to enlarge) (click to enlarge) Merger Agreement Specific Performance: Irreparable damage would occur in the event that any of the provisions of this Agreement (including each Party’s obligations under Article II or Section 6.3) were not performed in accordance with its specific terms or were otherwise breached. In the event of any breach or threatened breach by any Party of any covenant or obligation contained in this Agreement, the non-breaching Party shall be entitled (in addition to any other remedy that may be available to it, including monetary damages) to seek and obtain (on behalf of itself and the third-party beneficiaries of this Agreement) (A) an Order of specific performance to enforce the observance and performance of such covenant, agreement or obligation, and (B) an injunction restraining such breach or threatened breach. No Party or any other Person shall be required to obtain, furnish or post any bond or similar instrument in connection with or as a condition to obtaining any remedy referred to in this Section 13.14, and each Party irrevocably waives any right it may have to require the obtaining, furnishing or posting of any such bond or similar instrument. Material Adverse Effect means any change, event, circumstance, development or occurrence, individually or in the aggregate, with all other changes, events, circumstances, developments and occurrences, which has had, or would reasonably be expected to have, a material adverse effect on the financial condition, business, assets or results of operations of the Company Entities, taken as a whole; provided that with respect to this clause none of the following, and no fact, change, event, circumstance, development, occurrence or effect to the extent arising out of any of the following, shall constitute or be taken into account in determining whether a Material Adverse Effect has occurred, or may, would or could occur: changes in GAAP or changes in the regulatory or accounting requirements or in the interpretation of any of the foregoing, changes in the financial or securities markets or changes in the general economic or political conditions in the United States, Canada or abroad, changes in the price or availability of gas, oil or commodities or changes in currency exchange rates, changes (including changes of Applicable Law) or conditions generally affecting any industry in which any of the Company Entities operates, acts of war, sabotage or terrorism, any decrease in the market price of the Common Units or any delisting of the Common Units due solely to such decrease in the market price of the Common Units, any litigation initiated solely by a Person other than Swan Sponsor or any Affiliate of Swan Sponsor or a Company Entity or any Affiliate of a Company Entity (excluding suits brought in a derivative manner) arising from allegations of a breach of fiduciary duty or other violation of Applicable Law relating to this Agreement or the transactions contemplated by this Agreement (or any public disclosure relating to such litigation), the announcement, pendency or consummation of the transactions contemplated by this Agreement (including any cancellations of or delays in customer orders or other decreases in customer demand, reduction in revenues, work stoppages or loss or threatened loss of employees or other employee disruptions) (provided, that this clause (viii) shall not apply in the determination of a breach or violation of the representations and warranties contained in Section 4.8), changes or announcements of potential changes in a credit or financial rating in respect of any of the Company Entities or any indebtedness of any of the Company Entities, any failure to obtain any consent, approval, waiver or authorization from any third party in connection with the consummation of the transactions contemplated hereby (provided, that this clause (X) shall not apply in the determination of a breach or violation of the representations and warranties contained in Section 4.8, any failure of any of the Company Entities to meet any internal or published or third-party budgets, estimates, projections, forecasts or predictions of financial performance (including revenue, earnings, cash flow, cash position, liquidity or other financial measures) for any period, any action taken (or omitted to be taken) at the request of or by or on behalf of Parent, Merger Sub or any of their respective Affiliates, any action taken by Swan Sponsor, ManagementCo, the Company or any of their respective Affiliates that is required or expressly contemplated or permitted pursuant to this Agreement, or any seasonal reduction in the revenues or earnings of any of the Company Entities; provided, however , that the foregoing exclusions in (I), (II), (III), (IV) and (V)shall not apply to the extent such changes or effects have a materially disproportionate adverse effect on the Company Entities, taken as a whole, as compared to other independent natural gas storage businesses in the United States or Canada, and (Y) the underlying cause of any decrease or change referred to in clause (vi), (IX) or (xi) (if not otherwise falling within any of clauses through (XIV) above) may be taken into account in determining whether there is a “Material Adverse Effect” or the ability of Swan Sponsor, ManagementCo or the Company to perform their respective obligations under or arising out of this Agreement. Deal Alternatives No deal alternatives are expected. Event Driven Investing with Equity Options The best way to set this up is with equities; there are no derivative contracts that improve upon the equity’s risk:reward. Conclusion At today’s price, NKA units are yieldy candidates for consideration as a part of a diversified, long-term portfolio. Other master limited partnership opportunities to consider include Williams Partners (NYSE: WPZ ) and the Cushing MLP Total Return Fund (NYSE: SRV ). Disclosure: I am/we are long NKA, SRV. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Summary Niska trades at a substantial discount to its deal price. The buyers went into this with open eyes. The regulators know that NKA needs this deal. Deal Target Description Niska Gas Storage Partners (NYSE: NKA ) operates North American natural gas storage assets. They have storage facilities in Alberta, California, and Oklahoma. Deal Terms On June 14, 2015, Brookfield Infrastructure announced that it would buy NKA for $4.225 per unit in cash. NKA: (click to enlarge) Brookfield Infrastructure: (click to enlarge) Deal Financing The deal is not conditioned upon financing. NKA worked with both Evercore Partners (NYSE: EVR ) and Greenhill (NYSE: GHL ) on the deal. Deal Conditions The deal closing is expected to occur in the second half of 2016. Specifically, my estimates include the assumption that the deal closes in early December 2016. The deal is conditioned on standard closing conditions and regulatory approvals, including approval by the California Public Utilities Commission/PUC. Riverstone Investment Group, which owns 53% of NKA, supports the deal. No additional unit holder action is needed. The California PUC application was filed in July. That review will probably be the gating item. The HSR application was filed in July. Competition Canada was filed in July. The information statement will be filed with the SEC in early fall. Deal Price The price equaled a 222% premium to the NKA market price. It appears to be reasonable for NKA unit holders in the context of historically comparable transactions. (click to enlarge) (click to enlarge) Merger Agreement Specific Performance: Irreparable damage would occur in the event that any of the provisions of this Agreement (including each Party’s obligations under Article II or Section 6.3) were not performed in accordance with its specific terms or were otherwise breached. In the event of any breach or threatened breach by any Party of any covenant or obligation contained in this Agreement, the non-breaching Party shall be entitled (in addition to any other remedy that may be available to it, including monetary damages) to seek and obtain (on behalf of itself and the third-party beneficiaries of this Agreement) (A) an Order of specific performance to enforce the observance and performance of such covenant, agreement or obligation, and (B) an injunction restraining such breach or threatened breach. No Party or any other Person shall be required to obtain, furnish or post any bond or similar instrument in connection with or as a condition to obtaining any remedy referred to in this Section 13.14, and each Party irrevocably waives any right it may have to require the obtaining, furnishing or posting of any such bond or similar instrument. Material Adverse Effect means any change, event, circumstance, development or occurrence, individually or in the aggregate, with all other changes, events, circumstances, developments and occurrences, which has had, or would reasonably be expected to have, a material adverse effect on the financial condition, business, assets or results of operations of the Company Entities, taken as a whole; provided that with respect to this clause none of the following, and no fact, change, event, circumstance, development, occurrence or effect to the extent arising out of any of the following, shall constitute or be taken into account in determining whether a Material Adverse Effect has occurred, or may, would or could occur: changes in GAAP or changes in the regulatory or accounting requirements or in the interpretation of any of the foregoing, changes in the financial or securities markets or changes in the general economic or political conditions in the United States, Canada or abroad, changes in the price or availability of gas, oil or commodities or changes in currency exchange rates, changes (including changes of Applicable Law) or conditions generally affecting any industry in which any of the Company Entities operates, acts of war, sabotage or terrorism, any decrease in the market price of the Common Units or any delisting of the Common Units due solely to such decrease in the market price of the Common Units, any litigation initiated solely by a Person other than Swan Sponsor or any Affiliate of Swan Sponsor or a Company Entity or any Affiliate of a Company Entity (excluding suits brought in a derivative manner) arising from allegations of a breach of fiduciary duty or other violation of Applicable Law relating to this Agreement or the transactions contemplated by this Agreement (or any public disclosure relating to such litigation), the announcement, pendency or consummation of the transactions contemplated by this Agreement (including any cancellations of or delays in customer orders or other decreases in customer demand, reduction in revenues, work stoppages or loss or threatened loss of employees or other employee disruptions) (provided, that this clause (viii) shall not apply in the determination of a breach or violation of the representations and warranties contained in Section 4.8), changes or announcements of potential changes in a credit or financial rating in respect of any of the Company Entities or any indebtedness of any of the Company Entities, any failure to obtain any consent, approval, waiver or authorization from any third party in connection with the consummation of the transactions contemplated hereby (provided, that this clause (X) shall not apply in the determination of a breach or violation of the representations and warranties contained in Section 4.8, any failure of any of the Company Entities to meet any internal or published or third-party budgets, estimates, projections, forecasts or predictions of financial performance (including revenue, earnings, cash flow, cash position, liquidity or other financial measures) for any period, any action taken (or omitted to be taken) at the request of or by or on behalf of Parent, Merger Sub or any of their respective Affiliates, any action taken by Swan Sponsor, ManagementCo, the Company or any of their respective Affiliates that is required or expressly contemplated or permitted pursuant to this Agreement, or any seasonal reduction in the revenues or earnings of any of the Company Entities; provided, however , that the foregoing exclusions in (I), (II), (III), (IV) and (V)shall not apply to the extent such changes or effects have a materially disproportionate adverse effect on the Company Entities, taken as a whole, as compared to other independent natural gas storage businesses in the United States or Canada, and (Y) the underlying cause of any decrease or change referred to in clause (vi), (IX) or (xi) (if not otherwise falling within any of clauses through (XIV) above) may be taken into account in determining whether there is a “Material Adverse Effect” or the ability of Swan Sponsor, ManagementCo or the Company to perform their respective obligations under or arising out of this Agreement. Deal Alternatives No deal alternatives are expected. Event Driven Investing with Equity Options The best way to set this up is with equities; there are no derivative contracts that improve upon the equity’s risk:reward. Conclusion At today’s price, NKA units are yieldy candidates for consideration as a part of a diversified, long-term portfolio. Other master limited partnership opportunities to consider include Williams Partners (NYSE: WPZ ) and the Cushing MLP Total Return Fund (NYSE: SRV ). Disclosure: I am/we are long NKA, SRV. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Scalper1 News