Scalper1 News

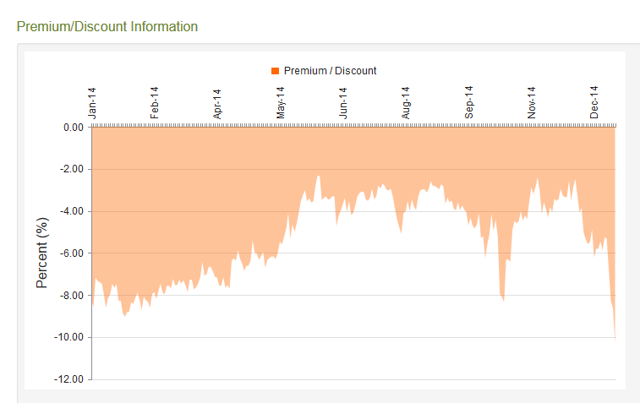

Summary ETW is a global option-income fund that uses a covered call strategy to deliver a 10.6% yield. High-volume selling of ETW has dropped its discount to a level not seen in the last 18 months. Buying ETW today locks in a higher yield and also provides the opportunity for capital appreciation if the discount reverts back to its historical average. Introduction Eaton Vance Tax Managed Global Buy Write Opportunities Fund (NYSE: ETW ) is an option-income close-ended fund [CEF] from Eaton Vance (NYSE: EV ). Thi s fund seeks t o achieve “current income with capital appreciation through investment in global common stock and through utilizing a covered call and options strategy.” ETW currently sports a -10.3% discount and a 10.6% market yield. This yield is generated by maintaining a long exposure to common stocks, while writing call options against the underlying indices. ETW is a global fund which benchmarks itself against a composite of 33% S&P 500, 22% NASDAQ 100, 34% FTSE E100 and 11% Nikkei 225. According to data supplied by Eaton Vance , ETW writes index call options on 94% of its portfolio, with an average of 15 days to expiration, and at 1.6% out of the money. Therefore, ETW can be considered to be a relatively defensive option-income fund. The covered call strategy generates a high level of current income, but caps the upside potential of the fund. This is because the maximum upside of a call option is equal to the strike price of the option plus the premium received. Hence, equity option-income funds are expected to lag the market index in a rising market. On the other hand, option-income funds will likely outperform in sideways or declining markets, which, given the tremendous performance of the U.S. stock market over the past few years, could very well be in store for us in 2015. Additionally, the 10.6% yield is highly attractive to investors seeking decent income from their equity holdings. In a previous article in June 2014, we noted that ETW’s discount of -3.3% was much higher than its 52-week average of -7.7%, while the -8.45% discount of Eaton Vance Tax-Managed Global Diversified Equity Income Fund (NYSE: EXG ) discount was similar to its 52-week average of -8.33%. Given the similar investment mandates of the two funds, the article recommended to sell ETW and buy EXG to take advantage of mean reversion in CEFs. Six weeks later , the discount for ETW had widened from -3.31% to -3.93% while the discount for EXG had narrowed from -8.45% to -5.60%. Hence, this pairs trade was up more than 2.6% in 6 weeks (~23% annualized). Taking advantage of mean reversion in CEFs is a potential strategy o obtain outsized profits. In a July 2014 paper entitled Exploiting Closed-End Fund Discounts: The Market May Be Much More Inefficient Than You Thought , authors Patro, Piccotti and Wu provide significant evidence of mean reversion in closed-end fund premiums. This article identifies an opportunity to buy ETW at a greater discount than its 1-year average. Widening discount The graph below is from CEFConnect and shows the premium/discount value of ETW over the past year. (click to enlarge) The table below shows the current, average 1-year, 3-year and 5-year discount values of ETW (source: CEFConnect). Time Discount 1-year -5.32% 3-year -9.43% 5-year -4.18% Current -10.33% We can see from the data above that ETW’s discount is lower its average discount over all three time periods. According to CEFAnalyzer , the 1Y Z-score for ETW is -1.71, indicating that the current discount of ETW is significantly below its 1Y average discount (adjusted for standard deviation). The 2Y and 4Y Z-scores are -0.48 and 0.37, respectively. What was the reason for this relatively large discount? One culprit may have been the high-volume selling of the fund on the final few trading days of last year. Over 956K shares changed hands in the last four days of 2014 (avg. daily volume = 400K), with the final day’s volume of 1.6M exceeding the volume of any other trading day in 2014. Over the course of those four days, ETW dropped 6.1%, compared to 1.1% for the U.S. stock market (NYSEARCA: SPY ) and 1.4% for the global stock market (NASDAQ: ACWI ). (click to enlarge) However, remember that the market price of a close-ended fund has no relationship to its net asset value. Therefore, the decline in share price of ETW caused by the high-volume selling of the fund over the past couple of days is the equivalent of sweaters going on sale after the holiday: you get the exact same product but at a lower price. The graph below was generated using data from Yahoo . We can see that the yield currently offered by ETW is higher than at any other time point in 2014. Based on the above analysis, I purchased ETW today at a price of $11.23 Buying thesis Lock in a high current yield of 10.6% while being exposed to some upside of the global stock market. Outperform the underlying index in a flat or declining market. Capital appreciation if the current discount of -10.33% narrows back to its average. Risks The discount may widen further. In late 2011, the discount widened to over 15%. The fund will underperform in a strong bull market. Loss of capital in a declining market (albeit with some downside protection due to the call premiums received). Scalper1 News

Summary ETW is a global option-income fund that uses a covered call strategy to deliver a 10.6% yield. High-volume selling of ETW has dropped its discount to a level not seen in the last 18 months. Buying ETW today locks in a higher yield and also provides the opportunity for capital appreciation if the discount reverts back to its historical average. Introduction Eaton Vance Tax Managed Global Buy Write Opportunities Fund (NYSE: ETW ) is an option-income close-ended fund [CEF] from Eaton Vance (NYSE: EV ). Thi s fund seeks t o achieve “current income with capital appreciation through investment in global common stock and through utilizing a covered call and options strategy.” ETW currently sports a -10.3% discount and a 10.6% market yield. This yield is generated by maintaining a long exposure to common stocks, while writing call options against the underlying indices. ETW is a global fund which benchmarks itself against a composite of 33% S&P 500, 22% NASDAQ 100, 34% FTSE E100 and 11% Nikkei 225. According to data supplied by Eaton Vance , ETW writes index call options on 94% of its portfolio, with an average of 15 days to expiration, and at 1.6% out of the money. Therefore, ETW can be considered to be a relatively defensive option-income fund. The covered call strategy generates a high level of current income, but caps the upside potential of the fund. This is because the maximum upside of a call option is equal to the strike price of the option plus the premium received. Hence, equity option-income funds are expected to lag the market index in a rising market. On the other hand, option-income funds will likely outperform in sideways or declining markets, which, given the tremendous performance of the U.S. stock market over the past few years, could very well be in store for us in 2015. Additionally, the 10.6% yield is highly attractive to investors seeking decent income from their equity holdings. In a previous article in June 2014, we noted that ETW’s discount of -3.3% was much higher than its 52-week average of -7.7%, while the -8.45% discount of Eaton Vance Tax-Managed Global Diversified Equity Income Fund (NYSE: EXG ) discount was similar to its 52-week average of -8.33%. Given the similar investment mandates of the two funds, the article recommended to sell ETW and buy EXG to take advantage of mean reversion in CEFs. Six weeks later , the discount for ETW had widened from -3.31% to -3.93% while the discount for EXG had narrowed from -8.45% to -5.60%. Hence, this pairs trade was up more than 2.6% in 6 weeks (~23% annualized). Taking advantage of mean reversion in CEFs is a potential strategy o obtain outsized profits. In a July 2014 paper entitled Exploiting Closed-End Fund Discounts: The Market May Be Much More Inefficient Than You Thought , authors Patro, Piccotti and Wu provide significant evidence of mean reversion in closed-end fund premiums. This article identifies an opportunity to buy ETW at a greater discount than its 1-year average. Widening discount The graph below is from CEFConnect and shows the premium/discount value of ETW over the past year. (click to enlarge) The table below shows the current, average 1-year, 3-year and 5-year discount values of ETW (source: CEFConnect). Time Discount 1-year -5.32% 3-year -9.43% 5-year -4.18% Current -10.33% We can see from the data above that ETW’s discount is lower its average discount over all three time periods. According to CEFAnalyzer , the 1Y Z-score for ETW is -1.71, indicating that the current discount of ETW is significantly below its 1Y average discount (adjusted for standard deviation). The 2Y and 4Y Z-scores are -0.48 and 0.37, respectively. What was the reason for this relatively large discount? One culprit may have been the high-volume selling of the fund on the final few trading days of last year. Over 956K shares changed hands in the last four days of 2014 (avg. daily volume = 400K), with the final day’s volume of 1.6M exceeding the volume of any other trading day in 2014. Over the course of those four days, ETW dropped 6.1%, compared to 1.1% for the U.S. stock market (NYSEARCA: SPY ) and 1.4% for the global stock market (NASDAQ: ACWI ). (click to enlarge) However, remember that the market price of a close-ended fund has no relationship to its net asset value. Therefore, the decline in share price of ETW caused by the high-volume selling of the fund over the past couple of days is the equivalent of sweaters going on sale after the holiday: you get the exact same product but at a lower price. The graph below was generated using data from Yahoo . We can see that the yield currently offered by ETW is higher than at any other time point in 2014. Based on the above analysis, I purchased ETW today at a price of $11.23 Buying thesis Lock in a high current yield of 10.6% while being exposed to some upside of the global stock market. Outperform the underlying index in a flat or declining market. Capital appreciation if the current discount of -10.33% narrows back to its average. Risks The discount may widen further. In late 2011, the discount widened to over 15%. The fund will underperform in a strong bull market. Loss of capital in a declining market (albeit with some downside protection due to the call premiums received). Scalper1 News

Scalper1 News